Source: Irrelevant Investor

The second quarter and with it, the first half are now behind us. At the midpoint of the year, a lot of people have been scratching their heads, confused about their results in how they have been dealing with the markets.

If you are unhappy with your portfolio in 2020, perhaps you might wish to ask yourself 5 questions as we begin the second half of the year:

1. What is my plan? Not just an inkling or what you might feel or an instinct, but a written plan that explains to your future self (or others) what you are doing, thinking and why. Without a plan, you are just spitballing, bouncing from one short term stimulus to the next, a slave to FinTV and random commentary.

Your plan includes an assessment of your current financial circumstances, your expected future income, your future spending (liabilities) plans, tax and estate liabilities, and your savings requirements. Planning allows you to better understand these and actively manage them. Preparation is key — leave the improv to the comedians.

2. What are my Goals? Why are you putting capital at risk? Is it to speculate, for fun, or for capital appreciation? Are you saving for a specific item — house, college, retirement, philanthropy, impact? Is it for a perpetual capital pool that has a purpose? Without answering these questions, how can you modulate how much risk to assume, what sort of duration your investments should be, and what sort of future liabilities you want to manage.

3. How do I know when I am wrong? Regardless of your positions, what is your objective measure that informs you that something you did was in error? If you do not have any sort of metric that easily determines if a position or allocation or even a belief is in error, then how can you ever course correct?

Most of us hate to admit error. Everybody is wrong all time, and refusing to acknowledge that lacks all humility. Being wrong present a wonderful opportunity for learning, growth and improvement. Don’t hide your errors but embrace them.

4. How am I managing my emotions? What are you doing about thew regular flow of endorphins and adrenaline that course through your veins? How are you managing your fight or flight response? Have you figured out a way to offset the daily onslaught of negative news, brilliant bears and others who might push your emotional hot buttons?

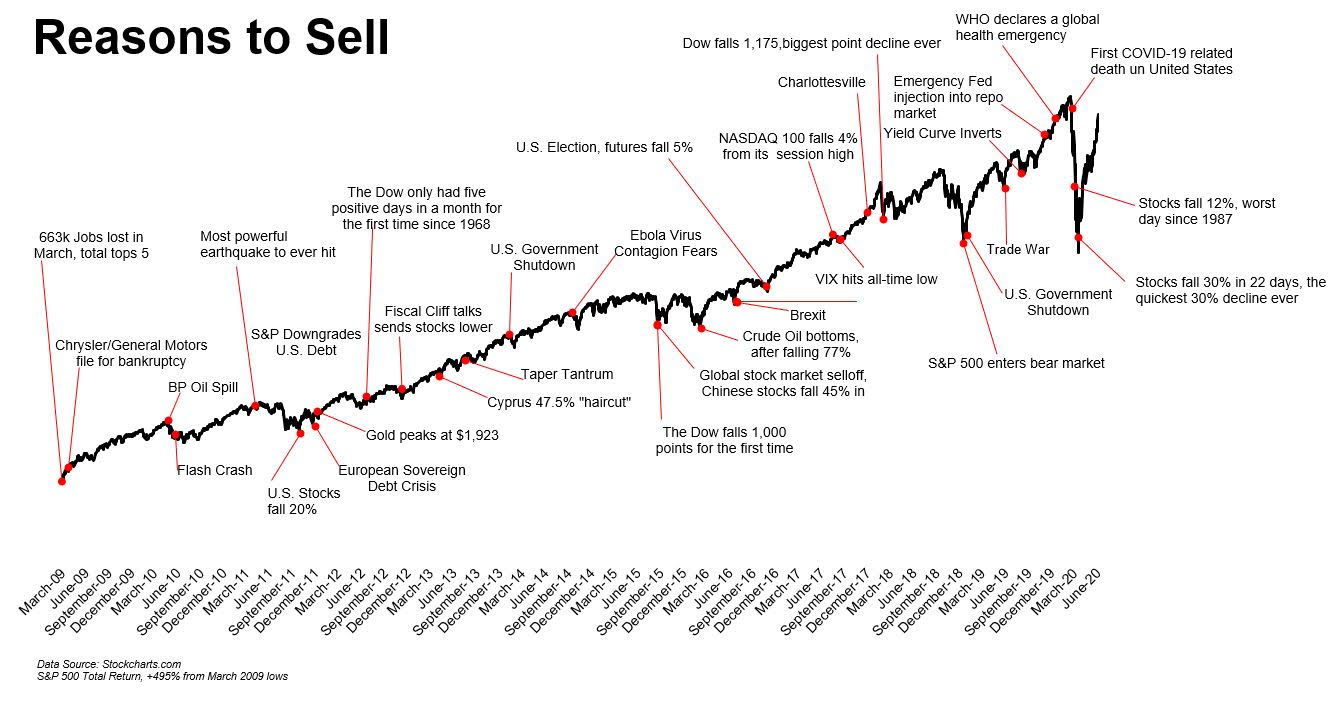

Despite this all being well understood for decades, it is still an issue for many people. Fear is not what should drive your asset allocations; emotions should be a valid part of your “Buy/Sell” decisions (See chart above). But it is human nature that these will influence you on a regular basis and at the worst possible times! Have an approach that manages this well.

5. What changes am I willing to make? Now for the hard part: If what you are doing is not working, then doing the same thing over and over again won’t fix anything. How much of what you believe has been proven false and must be discarded? What are you watching/reading/listening to that is counter-productive? What steps have you failed to undertake that are pressing and much be addressed? What are you willing to do to make repairs?

Change is never easy, and is especially difficult when money — and ego — is involved. But when in a situation that is not (or has not) been working, it is the only way to improve your results.

I am fond of the idea that even if you don’t have all of the answers, having good questions will go a long way in helping you get to the answers you need.

Previously:

Don’t Panic! (with apologies to Douglas Adams) (March 9, 2020)

Ray Dalio on The Fine Art of Failure (December 11, 2017)

Nobody Knows Nuthin’ (May 5, 2016)