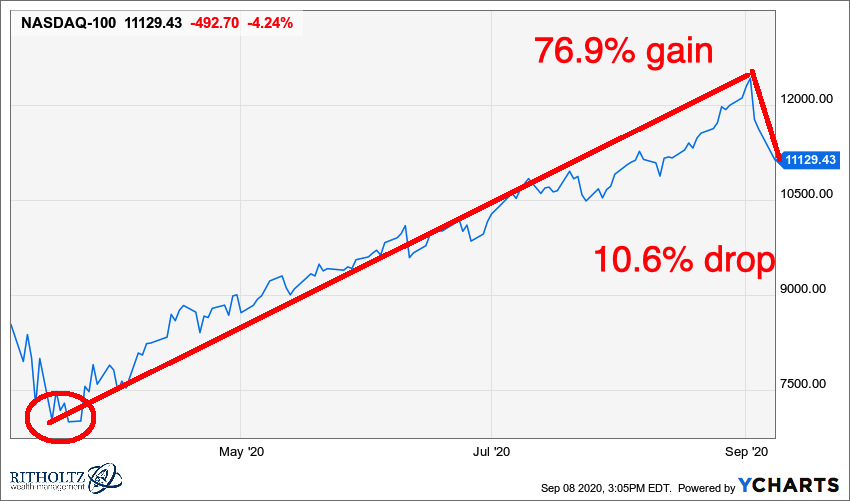

Source: YCharts (my annotation)

Above is the chart I discussed on BTV yesterday; it shows the Nasdaq 100 from the March lows of 7020 to the peak 12,420.5 then correction that began last week to 11,068. I chose the NDX because that is where much of the action has been, primarily in the FAANMG stocks.

We could have used a chart of the S&P500 — up 60.1%, down 6.95% (2237 to 3580 to 3332) — as similar, but a touch less dramatic.

Regardless, the chatter leading up to this and then following is utterly fascinating:

• March Sell off was a generational reset.

• Markets looking past economic distress to a vaccine early 2021.

• Robin Hood has been driving FAANMG stocks and market higher!

• No, it is a 1999 like Tech Bubble and a crash is inevitable.

• Its an election referendum: [insert preferred candidate here] is why markets are rallying!

• But wait, Valuation has gotten too high, and a correction must occur!

• Its Softbank’s derivatives driving markets lower.

And so on.

Each of these narratives is an attempt to explain prior market action. None came forward prior to the moves (OK, this one did, but I may be biased).

Take a little Narrative Fallacy, add a cup of Hindsight Bias, throw in how much we hate randomness and you have a recipe for the creation of a more comfortable alternative universe.

How much do people really hate “Randomness”? It disrupts their belief system in good and bad, in Karma; It leads people to suspect that maybe some people do not get what they deserve through the work of cosmic justice system managed by a benevolent God. Tragedies happen, great luck occurs, it all seems to be without any sort of understandable, rational framework for how luck is distributed in the universe.

But he truth is that randomness affects all of us: It is a theme that comes up again and again with MiB guests — many of whom discuss the outsized role that good fortune and random luck have played in their lives. It certainly impacts markets and stocks in their day to day random walks; the paradox of skill in sports makes competition at the highest level that much more dependent upon an unlucky bounce. Just ask Novak Djokovic about randomness.

Consider how random events impacted the 2016 election. What makes a product go viral and become a giant hit in business seem on occasion to be completely serendipitous, and those outcomes can change the course of history.

We create narratives to explain the inexplicable. We much prefer a comforting story to an uncomfortable truth. We seem these narrative in the explanations of the rally and the correction.

Look for them in the explanatory narratives you see today.