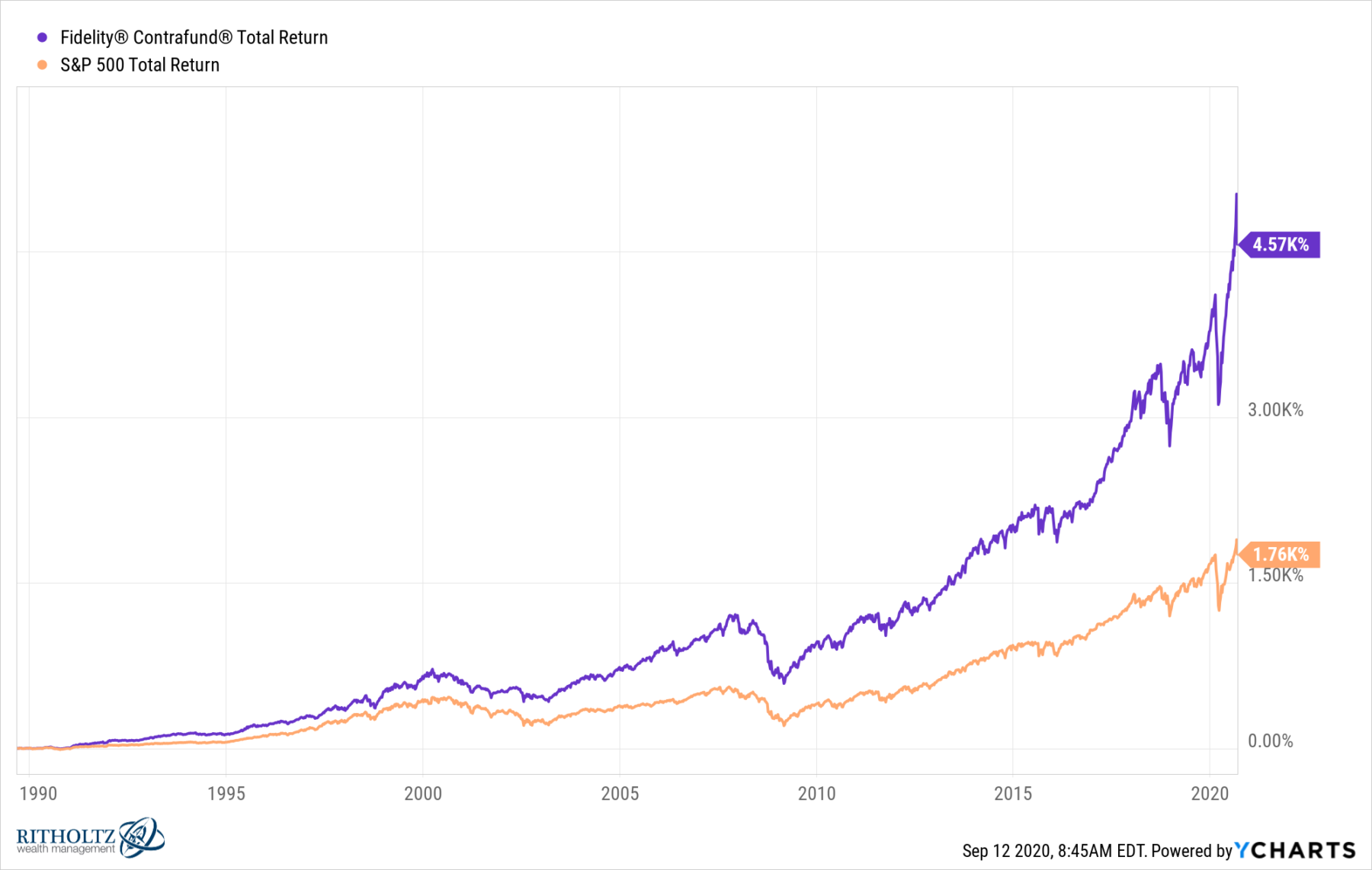

This week, we speak with Fidelity‘s Will Danoff, who manages the firm’s storied Contrafund.The large-cap growth fund has $139 billion in assets under management.

This week, we speak with Fidelity‘s Will Danoff, who manages the firm’s storied Contrafund.The large-cap growth fund has $139 billion in assets under management.

During Danoff’s 30-year tenure, the Fidelity Contrafund has outperformed the S&P 500 in 100% of rolling 10-year time periods; it has outperformed the S&P 500 Index by an average of 3.21 percentage points per year over those three decades.

Example: He tells the 2,003 story of a presentation by AskJeeves’ new CEO discussing natural language search. The plan was to raise market share from 1% to 5%; they also explained why Google was “crushing everybody” with a 55-60% market share (40% web +15% AOL search). Danoff asked what Google was doing so well, and the CEO of Ask Jeeves explained why Google’s algorithm was so vastly superior to the rest of the industry, and why GOOG was likely to gain more market share. Danoff went back to his office, did more research into Google, and ended up a big buyer during the August 2004 IPO of Google, adding even more in the years afterward.

Danoff explains why “Fidelity is a great place to manage money;” He has worked with Peter Lynch, Joel Tillinghast, Jeffrey Vinik, Ned Johnson, Gerald Tsai, and many others.

A list of his favorite books are here; A transcript of our conversation is available here.

You can stream and download our full conversation, including the podcast extras on iTunes, Spotify, Overcast, Google, Bloomberg, and Stitcher. All of our earlier podcasts on your favorite pod hosts can be found here.

Be sure to check out our Masters in Business next week with Doug DeMuro, one of the most popular online car reviewers. His YouTube channel has 3.7 million subscribers; his videos have been streamed 1.1 billion times, with each video averaging 2 million views. He conceived/co-founded the auction site Cars & Bids. He is he author of two books: “Plays With Cars,” and “Bumper to Bumper.”

Will Danoff’s Favorite Books

City of Thieves by David Benioff

Churchill: Walking with Destiny by Andrew Roberts