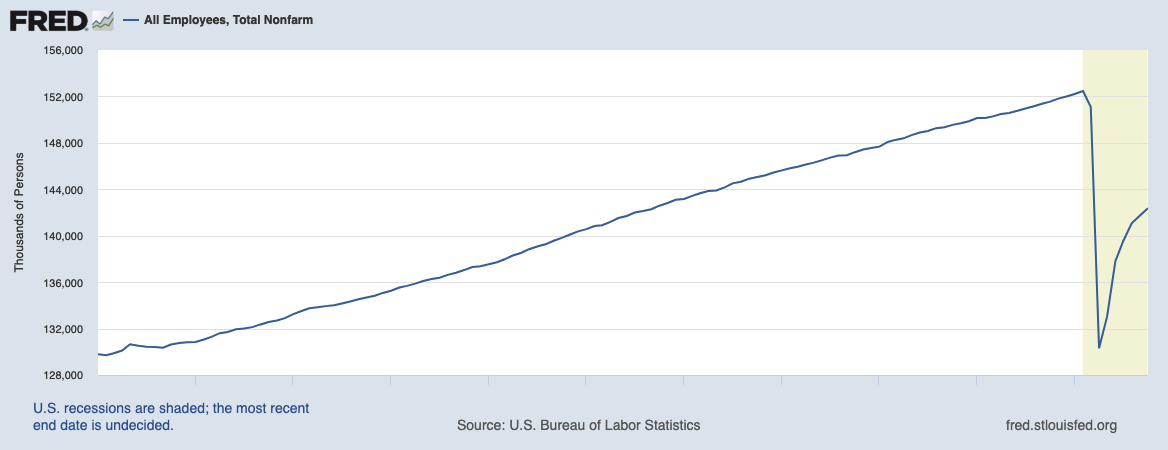

Total Nonfarm Employees: Where does each admin begin or end?

Source: FRED

A quick note this AM about an important issue I believe gets lost in the overheated rhetoric.

We put way too much emphasis on what I see as the wrong areas: We overemphasize partisanship, get lost in tribalism, live in the here & now while ignoring long term. If behavioral finance was a Star Wars film, we might observe “The cognitive dissonance is strong in this one.”

But it is not just the weak minded, its all of us. We are easily excited, and in that state of emotion, we forget very basic realities: The US economy is huge, the global economy is immense, and our individual ability to effect those is tiny. Even our collective ability to move the needle is at best modest. I tried to address this in my very first column for the Washington Post a decade ago: Why politics and investing don’t mix.

For those of you who have imagined a major economic shift with this outcome — or similarly imagined that shift in 2016 — I have some disappointing news for you. Very little has changed economically. The economy was in a pretty good shape when Trump came into office, and continued along its prior path – right up until the pandemic.

I love showing people a variety of economic data – GDP, employment, wages, retail sales, unemployment – for the period from 2010 to 2020, but with the dates stripped out. Then I ask them “Show me where the Obama admin ends and the Trump admin begins.”

Look at that Employment chart above — can you identify where the change in admins occurred? A shift in tax policy? No, you cannot.

Try it with each of these:

No one can do it. It is impossible to see where the Obama Economy ends and the Trump Economy begins. I expect the same to be true of the Biden Economy.

Well, maybe with one small difference: The President-elect will pay much more attention to the scientists and doctors and the CDC. That’s is a positive to resume the prior trend, because the economy and the markets will not be able to return to normal until the pandemic is brought to heel.

This is both the genius of capitalism and a source of frustration for many people who want to see significant change.

Previously:

Why politics and investing don’t mix (February 6, 2011) WaPo

How Externalities Affect Systems (August 14, 2020)

End of the Secular Bull? Not So Fast (April 3, 2020)