To hear an audio spoken word version of this post, click here.

Debates between various schools of economic thought keep playing out in the public policy sphere. We saw this in 2008-09 within economics, as debates raged about how best to respond to the financial crisis. During that era, the dichotomy between Saltwater and Freshwater economists came to the fore. We have continued to see these debates within that framework.

These abstract theoretical debates matter to academics, but are much less meaningful to investors and policy makers. The more relevant question to them is simply which school gets it right or wrong. Consider several recent stimulus debates:

• The 2008-09 GFC rescue consisted of mostly monetary stimulus. Critics pointed out the added liquidity distorted market incentives as it worked to the advantage of the wealthy: Stocks, bonds and real estate all rose in price. The bottom half of the country only benefitted indirectly, as income and wealth inequality notably worsened.

• The Tax Cuts and Jobs Act of 2017 was a multi trillion dollars, pro-cyclical stimulus mostly accrued to the benefit of Corporate America and the top 10% of individuals; it was roundly criticized for neglecting the least well off.

• The 2020 CARES Act was a 2 trillion dollar rescue plan that fell in large part to the middle and lower parts of the economic strata — the exact group the TCAJA missed. It provided emergency aid to those whose places of employment were closed due to pandemic lockdown, and staved off an even worse economy.

• The CARES Act 2 was a $900 billion relief package passed by Congress on Dec. 21, 2020. It made up much of the aid that expired in December or earlier, and was expected to cover the gap until a new aid package could be passed by the incoming Biden admin.

• The 2021 CARES Act is a proposed 1.9 trillion dollar rescue plan for the unemployed, small businesses, to facilitate re-opening schools, roll out mass vaccinations against Covid19, and provide fiscal support for states and cities. It is currently being countered by a $600 billion dollar plan.

Back to the question of which school gets it right or wrong: I cannot help but notice that many of the same economists who have in the past been wrong about stimulus post GFC (and more recently been wrong about Inflation) seem to be re-upping the same errors about stimulus during the Covid era. As a reminder, consider this collection of economists helped to ensure the 2008-09 recovery was terrible by fighting against a massive government rescue.

If you want to blame a specific school of thought for why the post-financial crisis recovery was so weak, start with the group who opposed a trillion dollar fiscal response to the GFC.

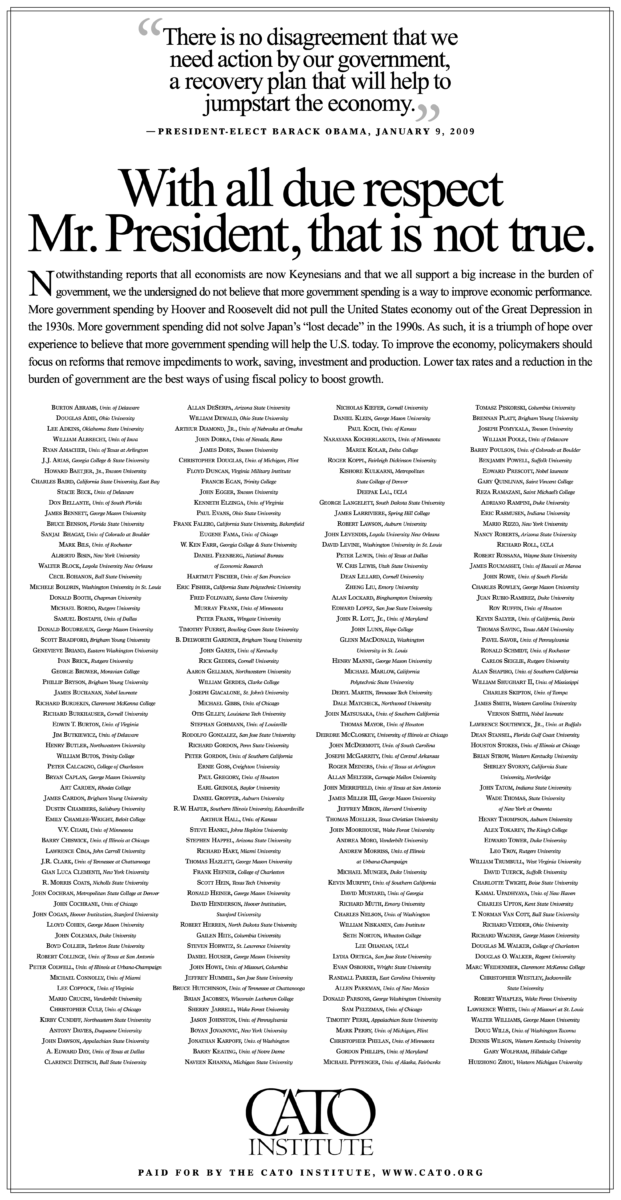

The Anti-Stimulus, Anti-Rescue crew have not learned anything from their prior mistakes. Not everyone who signed onto the full page advertisement taken on in the New York Times on January 9th, 2009 remain n the anti-stimulus camp. But there is a substantial overlap between those on the list below who opposed a more robust response to the GFC and a current group opposed a more robust response to the pandemic.

Some people never learn seem to learn from their prior errors…

Here is the CATO Institute’s full page NYT ad from January 9, 2009:

Click to Download Cato PDF