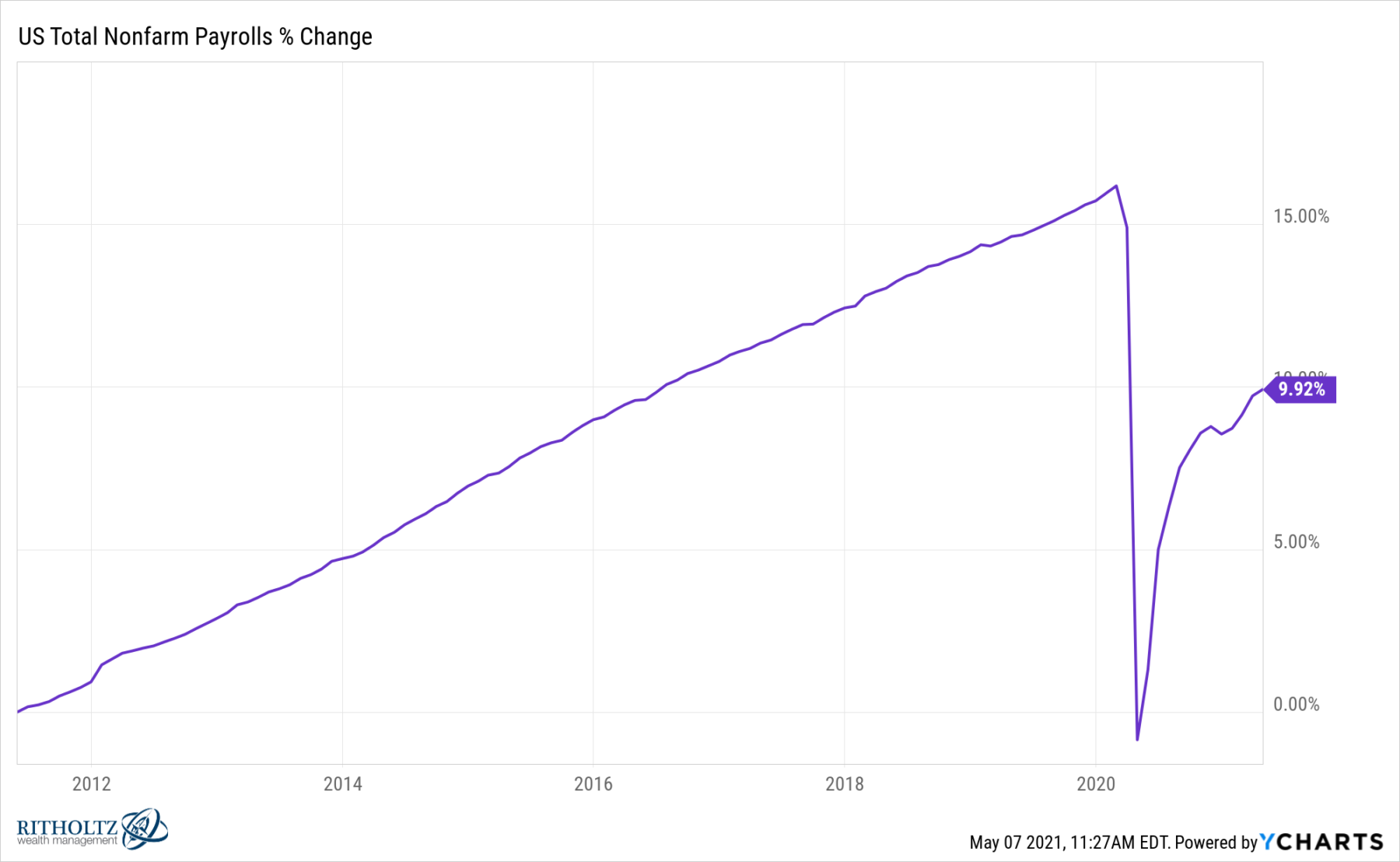

Today’s exercise in “confirming my priors“ is the big downside surprise in NFP – BLS reported a net 266,000 jobs in April, far below expectations of a million plus. The prior two months were also revised down by 78,000.

Here is the thing: This is well within a range of non-farm payroll report “misses” – it’s a noisy series that encompasses a broad statistical range of potential outcomes, with lots of room for modeling error. Add to that the difficulties associated with assembling data during a dynamic period of change, in the early stage of an economic recovery from a pandemic-driven, work for home but now re-opening circumstances.

The result is a recipe for a NFP wildly off from estimates; or more accurately, an especially challenging month to for those whose jobs requires them to make wild ass estimates of government data reports.

Speaking of my priors, here are a few intriguing reminders via this report:

• This strengthens the Biden infrastructure proposal ( I have been support every infrastructure bill from the last decade.) it is hard to go home and say you voted against the bill when payrolls come in ¾ million jobs light.

• If you need to hire you must increase wages; if you want to hire (but cannot increase wages), you better offer a compelling workplace or prepare for unfilled positions and higher than normal turnover.

• Employers are not competing against unemployment insurance, they are COMPETING AGAINST EACH OTHER FOR TALENT. How so many are missing this is perplexing. This is how the market operates; prices rise when demand goes up. That I need to even remind sone of this is proof how badly damaging ideological blinders are to fundamental economic analysis.

• Inflation gets put off for a while (again). Look for the “Just you wait” crowd of those who have been wrong about inflation for two decades now. They didn’t see it in the 2000s when it was right in front of them, but they imagine they are seeing it now when it is not there (yet). I’ll have more on this next week.

• “All models are wrong, but some are useful.” I have been using this George Box quote years, and it seems some people are resistant. Wall Street economic models are only loosely correlated to BLS models, which themselves are only loosely correlated to reality.

• Many models are “noisy” and NFP is an especially noisy data series. There is an enormous range of potential outcomes due to errors in collection.

• NFP is perhaps the most overrated economic indicator there is – in part because of the above noise issue.

• Your recency bias overemphasizing THIS report needs to be kept in check. As do your anecdotes — even cumulatively, they do not add up to data

• “Nobody knows anything.” William Goldman’s infamous aphorism has been a guiding principle for me when it comes to the dumb predictions made about the future, even when they are made by (otherwise) smart people.

There is more for sure, but that is a good start to a wildly below consensus NFP report.

Previously:

Forecasting & Prediction Discussions

NFP Day: The Most Over-Analyzed, Over-Emphasized, Least-Understood Data Point (February 4th, 2011)

THE MOST IMPORTANT EVER NFP blah blah blah (June 7, 2013)

Why did God invent economists? (August 17, 2013)

What Kinds of Errors Are You Making (and what are you doing to fix them?) (December 13, 2013)

Why Are Investors Always Surprised (by Surprises)? (January 15, 2016)

Nobody Knows Nuthin’ (May 5, 2016)

Forecasting? Wall Street is Wising Up (December 15, 2017)

What Models Don’t Know (May 6, 2020)