Earlier this month, I asked How Much is the Rule of Law Worth to Markets?

It’s a challenge to quantify that query long-term, and while I suspect it is worth trillions of dollars, we really do not know for sure.

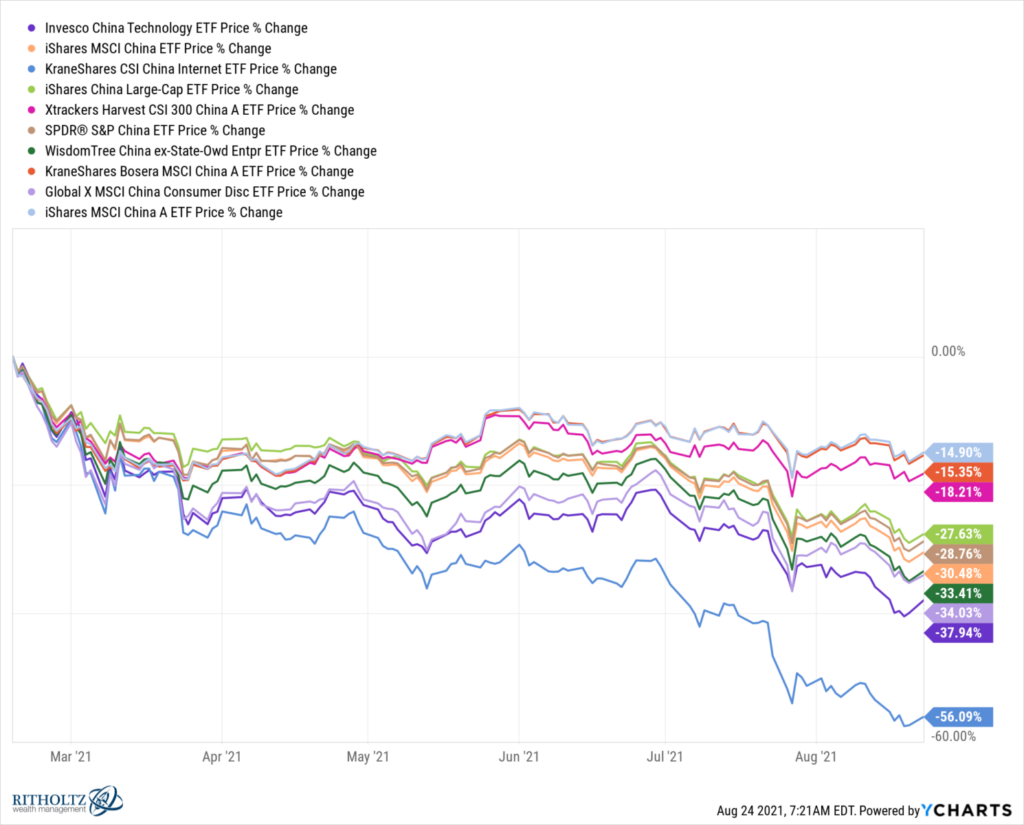

What we can see is the results this year in various China-focused tech funds. I used ETF database’s list of 10 ETFs: MCHI, KWEB, FXI, ASHR, GXC, CQQQ, CXSE, KBA, CHIQ, CNYA. Since February 15th, the best of these is off 15%; the worst is down by more than 55% (my apologies for the use of the technical term “Whackage“).

Over the same period, the S&P 500 index is up 13.84%.

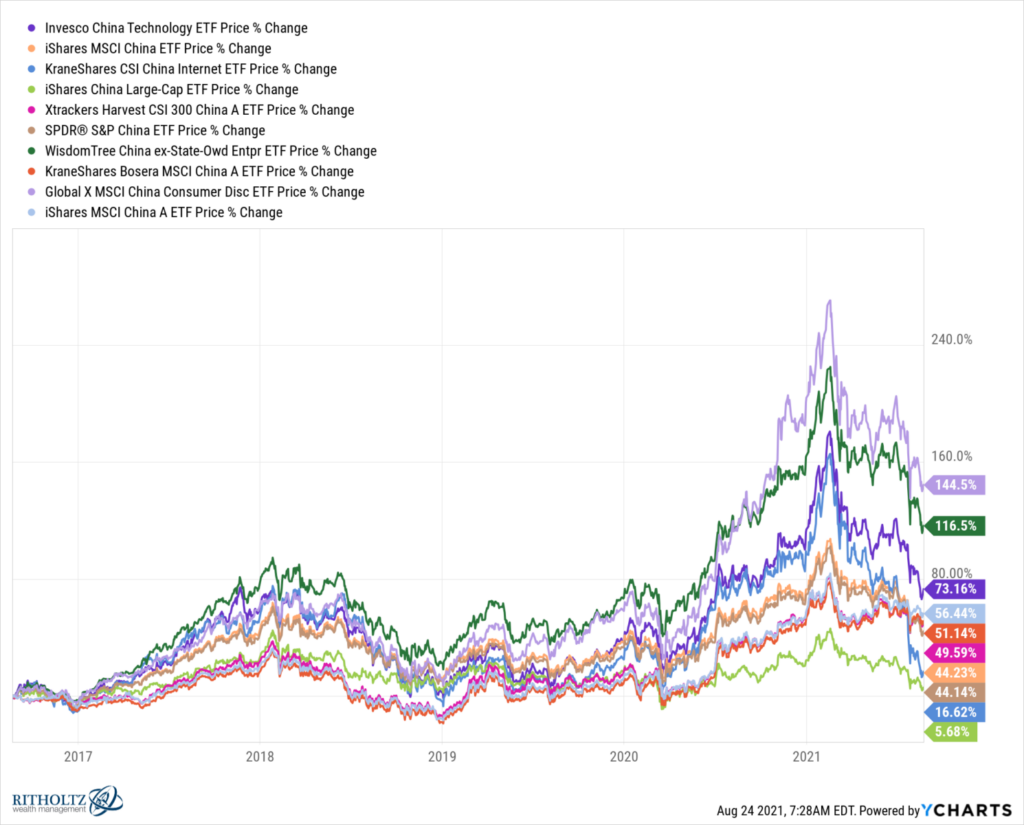

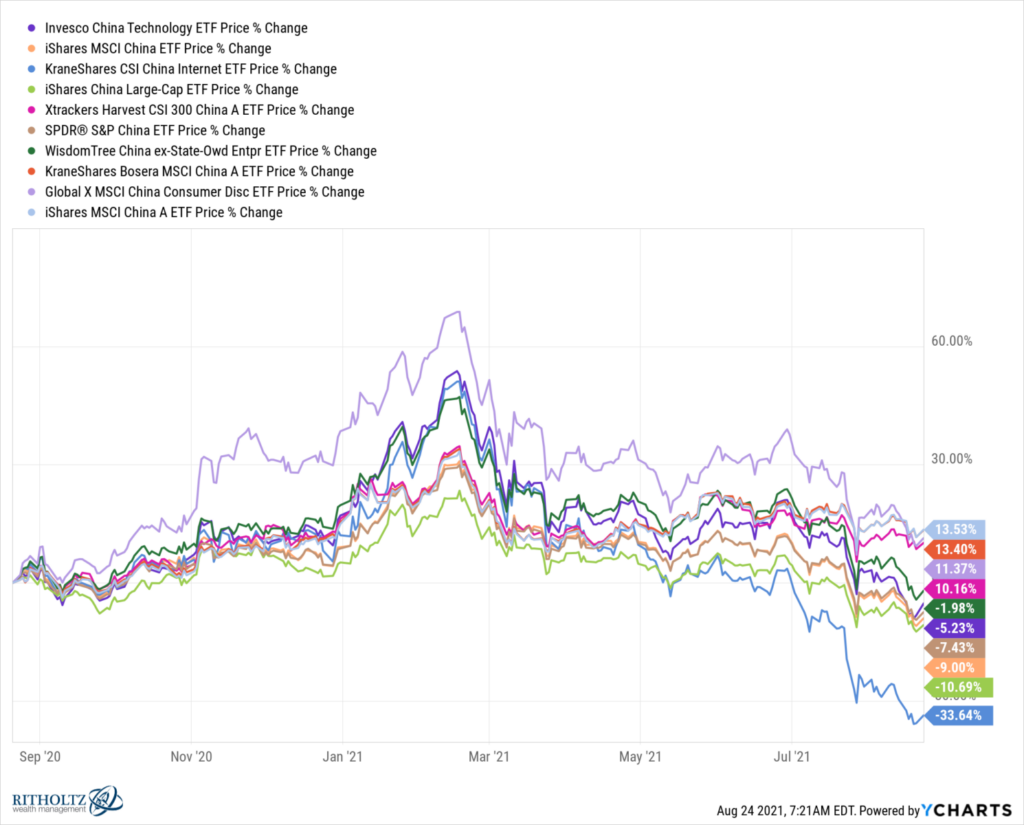

I frequently criticize lows to highs charts, so for the sake of context, consider longer-term charts, such as the 12-month and 5-year, after the jump. (All graphs courtesy of YCharts)

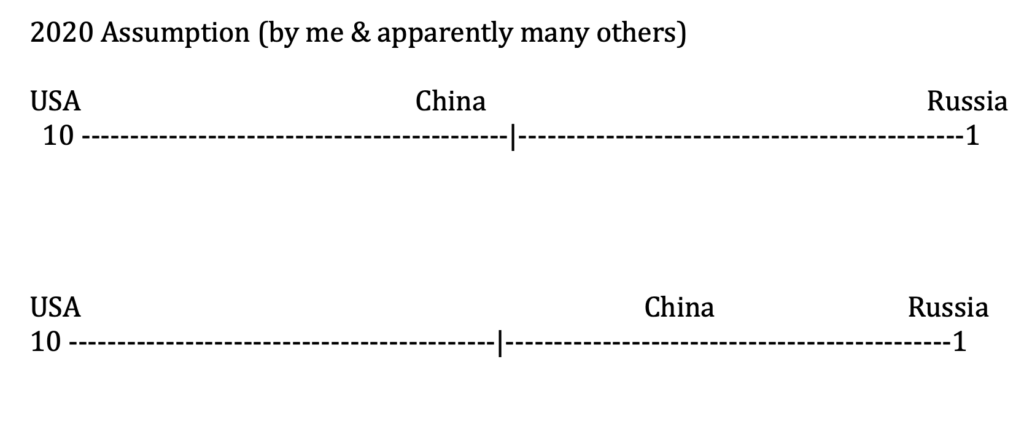

This is still an issue up in the air, but I would ballpark it this way: Imagine the capital markets rule of law spectrum, with the US markets at one end (10), and Russia’s markets at the other (1). Before President Xi’s crackdown began on Jack Ma and Alibaba late in 2020, I would have (naively) put China between somewhere between 5 and 6; Now, I would rate them about 3ish.

Capital Markets Rule of Law Spectrum

I suspect Perth Tolle is even harsher in her assessment of China.

Previously:

How Much is the Rule of Law Worth to Markets? (August 2, 2021)

Tyranny & Terms of Service (January 18, 2021)

Silicon Valley De-Platforming: Freedom & Censorship (January 13, 2021)

See also:

Jack Ma’s Costliest Business Lesson: China Has Only One Leader (WSJ)