On Bloomberg TV this week, Tom Keene surprised me with this question: “What is your best Apple story?”

I shared a war story from my Sell-Side days. I bought Apple stock back in 2002-03, when the newfangled iPod rolled out. (*Note: iPod, not iPhone!) AAPL was $15, $13 of which was cash, so it was a low-risk trade. We purchased tons, and I mercilessly mocked our brokers who at $20, took the mere 33% gain: “You guys suck, I held to the 40s, making it a 3X winner for me, haha, aren’t I great!”

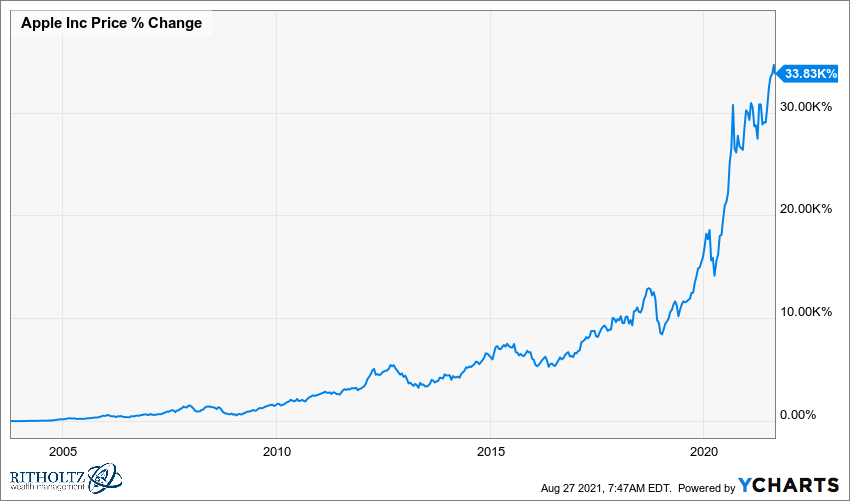

A ~200% return does not sound like a bad trade, until you realize that since that sale, Apple has gained 33,800%.

Nice sale, idiot.

That conversation with TK sent me down the memory hole, thinking about some of my best and worst trades. Nobody wants to hear about the big winners — were they luck or skill? But it is the losers that are more interesting and revealing. There are lessons to be learned here, and ideas worth exploring.

There seem to be several categories of bad trades, but most fall into 1 of 3 major categories: Errors of Ommission (missed buys), Errors of Commission (early sells), and straight-up Dunning Kruger ignorance (wait, I could have done what?).

All of which raises these simple questions:

What Was Your Worst Trade? Why was it so bad? What did you learn from the experience?

I pulled together my 5 worst trading snafus from a long history of errors. My worst trade column is 90% written, all it needs is a little color from, and I would love to hear your experience:

Please share what your dumbest trading debacles and disasters were here.