To hear an audio spoken word version of this post, click here.

Over the past 20 years, I have tried to explain, with varying degrees of success, why the day-to-day noise can so distracting to investors. A few of my attempts have included:

• Discussing Signal to Noise Ratios;

• Explaining how we live in the moment but invest for the future;

• Focusing on avoiding errors;

• The forecasting industry is mostly nonsense;

• Contextualizing market cap weighted stocks.

Regarding that last bullet point, Rick Ferri summed up a column I wrote over the summer of 2020 (Why Markets Don’t Seem to Care If the Economy Stinks) by observing, “Stocks are market-cap weighted, but the news is equal-cap weighted.”

That sums up a lot of these bullet points nicely.

One of my favorite ways to demonstrate this equal cap versus market cap weighting of the news comes annually from Birinyi Associates. Each year, they track the more influential media stories and then bind them into a single volume.

Scrolling through these stories after the fact is eye-opening.

It is not that these stories are wrong per se, but rather, that they were right at catching the emotional zeitgeist of the moment. This is fine if you are trading each day, but for long-term investors, it creates an inherent tension between rational thinking and emotional stimulus. All too often, the emotions win out.

I just got the 2020 version, and many of the featured columns have aged like fine cheese left out in the summer’s sun. It’s a bit shocking to see stories that I recall being very concerned about a year ago as ephemeral and trite with little impact on markets. What felt so significant and weighty in hindsight look meaningless.

The Zeitgeist passes, but the shrieking headlines remain. Is it any wonder that investors can get confused?

Consider these three examples:

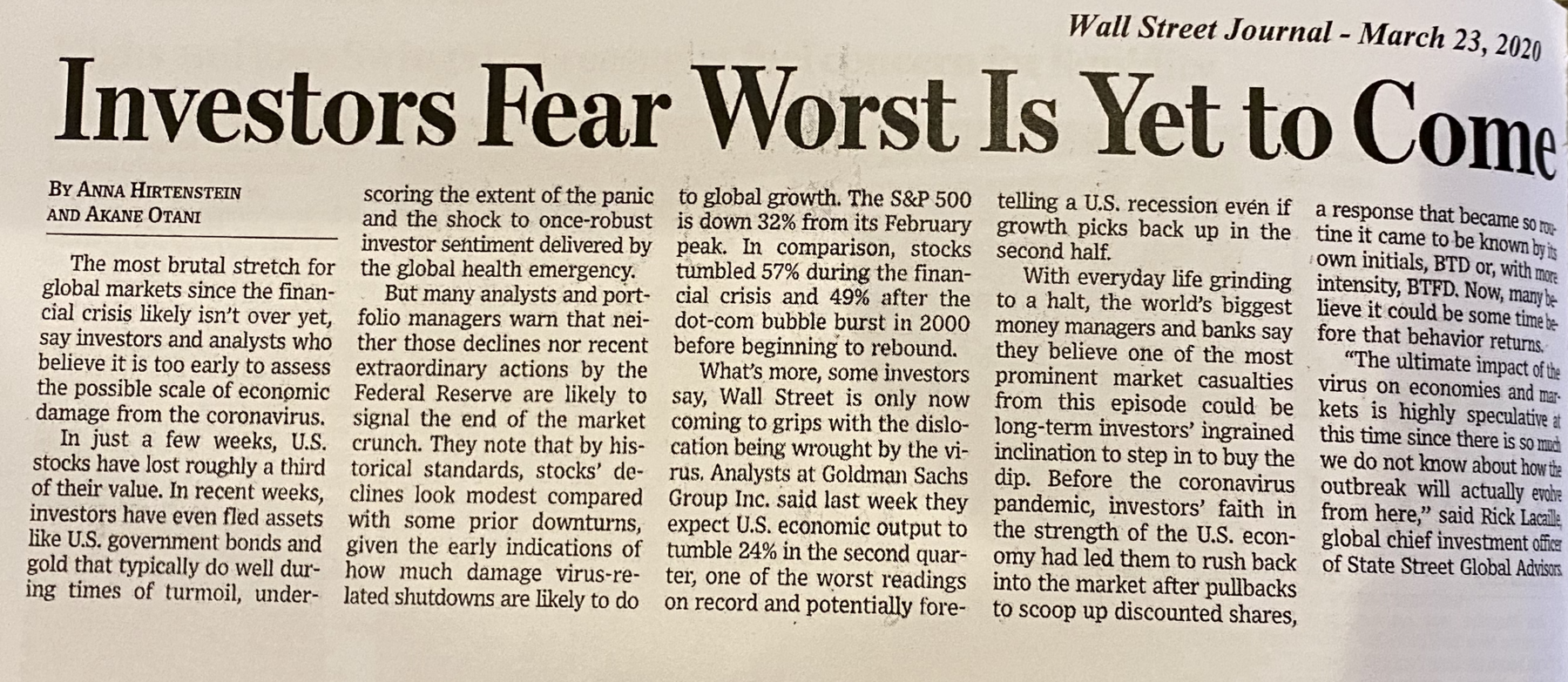

• The timing on this March 23, 2020 WSJ column “Investors Fear the Worst is Yet to Come” is — *Chef’s kiss* — the exact market bottom.

• April 21 2020 NYT “A Very Contradictory Stock Market Rally” relative to the economy meant that lots of people were overlooking a giant opportunity.

• Last, consider this May 20 2020 Financial Times piece “Global fund managers warn bull run is doomed without coronavirus vaccine” misses the obvious point: The bull rally was the market anticipating a vaccine.

Note that none of these stories were wrong; all of them accurately reported the news of the day.

But that does not mean they are not contributing to the angst that so often can lead people astray.

Solution: Whenever you read a scary headline, ask yourself these questions:

1. Is this resonating with you on an emotional or logical level?

2. How might this story look one year from now? In 10 years?

3. How much of this “News” is already reflected in stock prices?

Those questions will hopefully provide an appropriate perspective…

Previously:

Why Markets Don’t Seem to Care If the Economy Stinks (April 4, 2020)

More Signal, Less Noise (October 25, 2013)

Apprenticed Investor: Lose the News (June 16, 2005)

click for audio