To hear an audio spoken word version of this post, click here.

I believe the consensus about inflation is wrong:

My priors: The dominant driver for the past 3 decades has been deflation, with occasional spasms of inflation. Much of the current price increases are due to complications from re-opening. I expect many of these issue-driven price increases to eventually normalize, but some of those increases — especially wages at the lower half of the pay scale — will likely be sticky.

Hence, “Reset” is the right word for some price increases (e.g. wages) but “Transitory” applies to those price spikes that are likely to fall back to a more modest annualized rate of increase. This will not occur until adjustments are made in manufacturing and transportation logistics.

This is why so much inflation confusion abounds — it is too easy to focus on those prices that confirm one’s priors.

Let’s consider the prime drivers of how we got to the point where complexities have led to a general misunderstanding about rising prices:

– Surge: Consumers and businesses are flush with cash; For many reasons (safety, convenience, etc.) they have accelerated purchases generally and online/app driven purchases specifically. Retailers have been for the most part unprepared for this surge of buying — they have too little inventory and staff to manage this. The surge has also revealed that many of their systems are inadequate, and not up to the task.

– Reopening: Vax-driven Post-Pandemic economic re-opening has revealed supply chain constraints, why “Just in Time” inventory is terrible in any sort of an emergency, and how supplies of everything, from raw commodities to semi-conductors to homes, have been constrained.

– Wages: Average hourly wages have lagged everything for decades — productivity, profits, exec pay, etc. — have all raced ahead of minimal compensation.

– Deflation: We have become accustomed not only to low inflation but to actual deflation: For most of the past few decades, the prices of goods and services have been falling in real terms. That is no longer the case in 2021 and quite possibly 2022. But it is a reasonable presumption that inventory and the supply chain will be caught up over the next 14 months.

I find the comparisons to the 1970s era stagflation to be outright weird. Any sort of comparison of the two eras reveals many more differences — interest rates, unemployment, wages — than similarities. It is a silly comparison, one I do not believe is made in good faith.

A few further examples reveal why the two eras are so distinct.

Consider Energy prices: They have risen substantially this year, with Crude Oil over $80 a barrel. I just paid $4.17/gallon for premium gas, and that is the most I have paid in a long while. But in 2006-08, Crude Oil hit $150 (briefly); and I was regularly tanking up at over $5/gallon. Regardless, this is nothing like energy in the 1970s, when crude oil prices quadrupled from $3 to $12 per barrel. In the 1960s, the average U.S. family was spending nearly 10% of their household budget on energy; today it is less than 3%.1

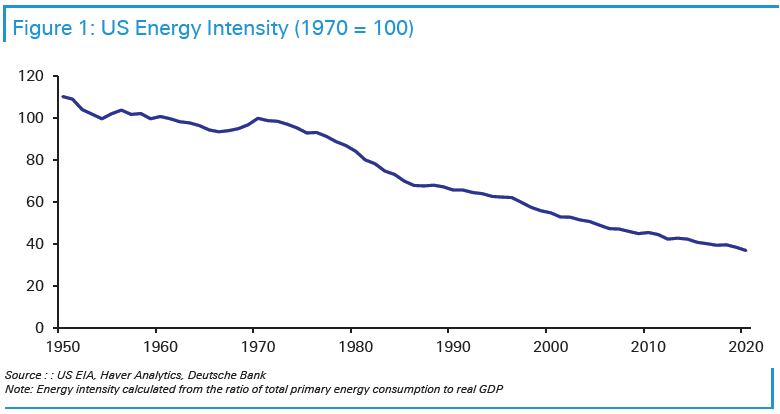

Jim Reid of Deutsche Bank (see chart) points out how much less energy-intensive the US economy is today, making the present oil price surge far less impactful than it was in decades past. The move off of the lows for energy is significant, but it is simply incomparable with 2007 and not remotely like anything in the 1970s.

If we are contemplating Wages, we must also note Productivity: In 1987, Robert Solow famously quipped that “You can see the computer age everywhere but in the productivity statistics.” A lot has changed since then. It took a full generation, but technology is now the default setting for nearly all workers. The productivity of workers has been making steady gains over the past few decades.

Then the pandemic hit, and the economy saw a massive gain in productivity, with output per hour tripling since the pandemic. Federal Reserve vice chairman Richard Clarida cited “rising productivity as one reason to think inflation will be temporary.” Employers are not just (belatedly) paying workers more; they are paying them more for greater output per hour. That is an offset versus inflation, and quite different from the 1970s circumstances.

Speaking of the Fed: The staff at the Federal Reserve observes that “Wall Street Is Getting Inflation Call All Wrong.” Bloomberg News reported that “The Federal Reserve’s army of more than 400 Ph.D. economists has a message on inflation for policy-makers and the American public: Chill out.”

Why is this newsworthy? Because Wall Street is filled with awful forecasters generally, and about inflation specifically. The economists at the Fed have historically bested Wall Street consensus, and by a wide margin. Of the many Wall Street opinions you can underweight, Inflation is near the top.

~~~

I am not blasé about inflation risks, and I can see where reasonable people can disagree. But on balance, we must consider the totality of the circumstances. And those suggest that the concerns over Stagflation or persistent annual inflation (beyond next year) are overwrought.

Update October 21, 2021

I think Paul Krugman on why the supply chain is cracking is exactly right: “We’ve been afraid to indulge in many of our usual experiences and bought stuff to compensate. People ate out less, either because indoor dining was banned or because it didn’t feel safe, so they remodeled their kitchens. People couldn’t or wouldn’t go to the gym, so they bought exercise equipment.”

Previously:

Inflation

Deflation, Punctuated by Spasms of Inflation (June 11, 2021)

The Inflation Reset (June 1, 2021)

Finding it Hard to Hire? Try Raising Your Wages (May 6, 2021)

Stop Stressing About Inflation (February 11, 2021)

Did Covid Lockdown “Solve” Productivity Mystery? (December 9, 2020)

Wildly Wrong About Interest Rates, Jobs & Inflation (June 11, 2019)

Inflation: Price Changes 1997 to 2017 (February 12, 2018)

Why Can’t We Find Productivity Gains? (April 4, 2016)

________

1. Citation needed; I have a source for this but damn, I can’t find it.

click for audio