My Two-for-Tuesday morning train WFH reads:

• Was the Office Always This Distracting? Get Ruthless About Your Productivity Now Chatty colleagues and hybrid meetings don’t have to break your concentration as you transition from remote work; ‘We can reclaim control over our environment’ (Wall Street Journal) see also The 37-Year-Olds Are Afraid of the 23-Year-Olds Who Work for Them Twenty-somethings rolling their eyes at the habits of their elders is a longstanding trend, but many employers said there’s a new boldness in the way Gen Z dictates taste. (New York Times)

• Despite Losing Market Share, Smaller Asset Managers Keep Battling the Giants Boutiques and specialists, which offer benefits like higher risk-adjusted returns, still have to fight hard to make their case in an industry of mega firms. (Institutional Investor)

• Banks Tried to Kill Crypto and Failed. Now They’re Embracing It (Slowly). Digital payments technology is forcing the financial system to evolve. Banks feel their power waning and want to regain control. (New York Times) see also Cryptocurrency: How Advisors Can Get Up to Speed Rapid expansion of the cryptoasset markets hasn’t afforded advisors the kind of grace period for educating themselves on this new asset class that they have had with traditional investments. That has led to a dynamic where clients have a better understanding of the asset class than their financial advisors do. (Morningstar) 1

• Greedy Bots Cornered the Sneaker Market. What Now? But bots don’t just buy cool sneakers. They buy up those concert tickets you wanted, so they can then scalp them to you at an outrageous markup. At the beginning of the COVID pandemic, bots were buying hand sanitizer and face masks. Later, they were booking all the vaccine reservation spots. Anything that’s very high demand with a very limited supply. That’s an opportunity for the bots to become greedy hoarders and corner the market.(Slate)

• The United States Has Been Going Broke For Decades In 1972 the 10 year treasury yielded around 6%. From there yields only went higher. In fact, from 1972-1985, the 10 year government bond yield would average 9.6%, getting as high as 15% in the early-1980s. Today we worry about rates going from 1.3% to 1.6%. (A Wealth of Common Sense) see also Time to Stop Believing Deficit Bullshit What do you do if you have a philosophy that over the course of half a century, is continually proven wrong? (The Big Picture)

• The World’s Top Business Cities Are Still Failing Women No city is doing enough to keep women safe while ending gender inequality. (Citylab)

• As closed-door arbitration soared last year, workers won cases against employers just 1.6% of the time U.S. companies are increasingly relying mandatory arbitration to settle employee and consumer grievances during the pandemic. Family Dollar closed 1,135 such cases last year, up from three in 2019. (Washington Post) see also Workplace strikes are surging. Here’s why they won’t stop anytime soon. Economists say the walkouts could contribute to near-term inflation but, over time, fundamentally change the economic standing of millions of workers. (Washington Post)

• Is Trump running in 2024? The Claremont Institute hopes so Once one of the most prestigious bastions of conservative thought, Claremont now spends its time putting lipstick on the Trumpian wildebeest. How a bastion of conservative thought devolved into Trumpian madness (MSNBC)

• Facebook Joins a Crowded Field in the Race to Build the ‘Metaverse.’ We All Have a Stake in the Outcome. Mark Zuckerberg’s new plan for Facebook is one of several competing visions for an immersive digital reality (Wall Street Journal) see also Metaverses Zuckerberg is announcing Facebook’s new mission in a world with the Internet, which is why he tried to expand his definition to basically be Internet+; the Internet, too, is about not just gaming and entertainment, but all aspects of life. (Stratechery)

• What It’s Like to Have a Record Deal and Justin Bieber For a Fan at Age 14: Prentiss Furr taught himself to make music in Jackson, Mississippi by editing YouTube videos. Now he’s playing shows in L.A. and Skrillex wants to work with him. (GQ)

Be sure to check out our Masters in Business interview this weekend with Lisa Jones, CEO of Amundi U.S., the $100 billion arm of the French asset management giant. Amundi has over $2 trillion (€1.729) in AUM via 100 million clients from 36 countries, making it the second-largest asset manager in Europe and one of the world’s top 10 asset managers.

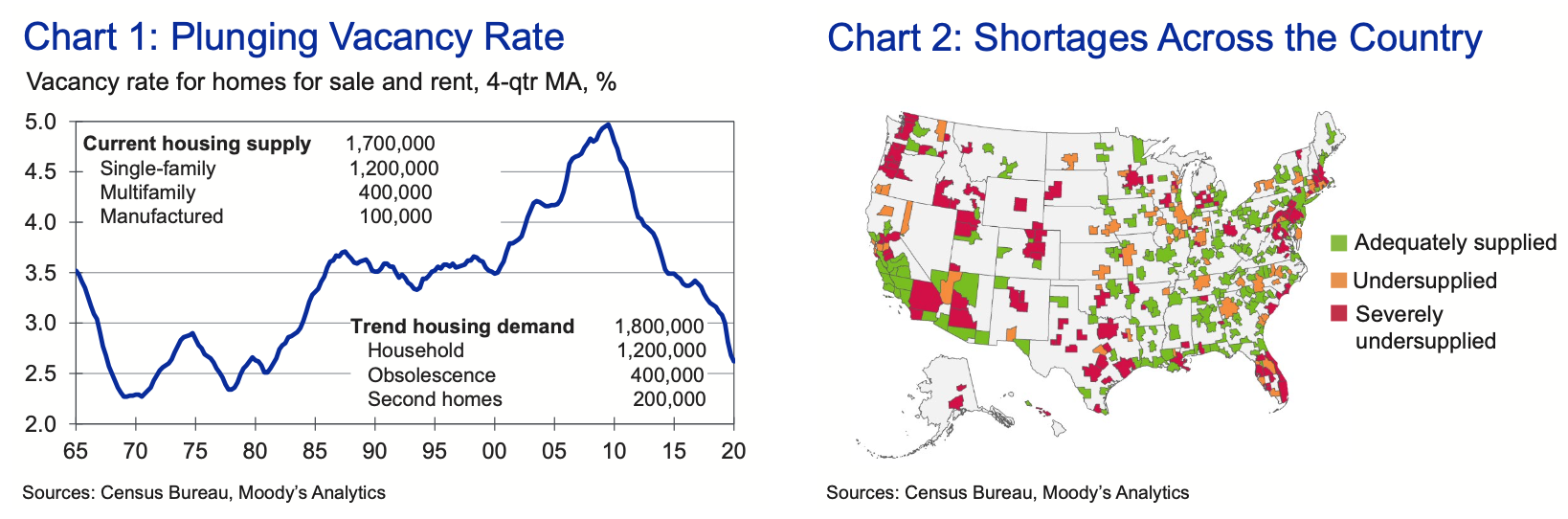

There is not enough housing for sale or rent in communities across the country

Source: Moody’s

Sign up for our reads-only mailing list here.

__________

1. Tyrone Ross, author of this column, is Co-founder of Onramp Invest; RWM is an investor in the company.