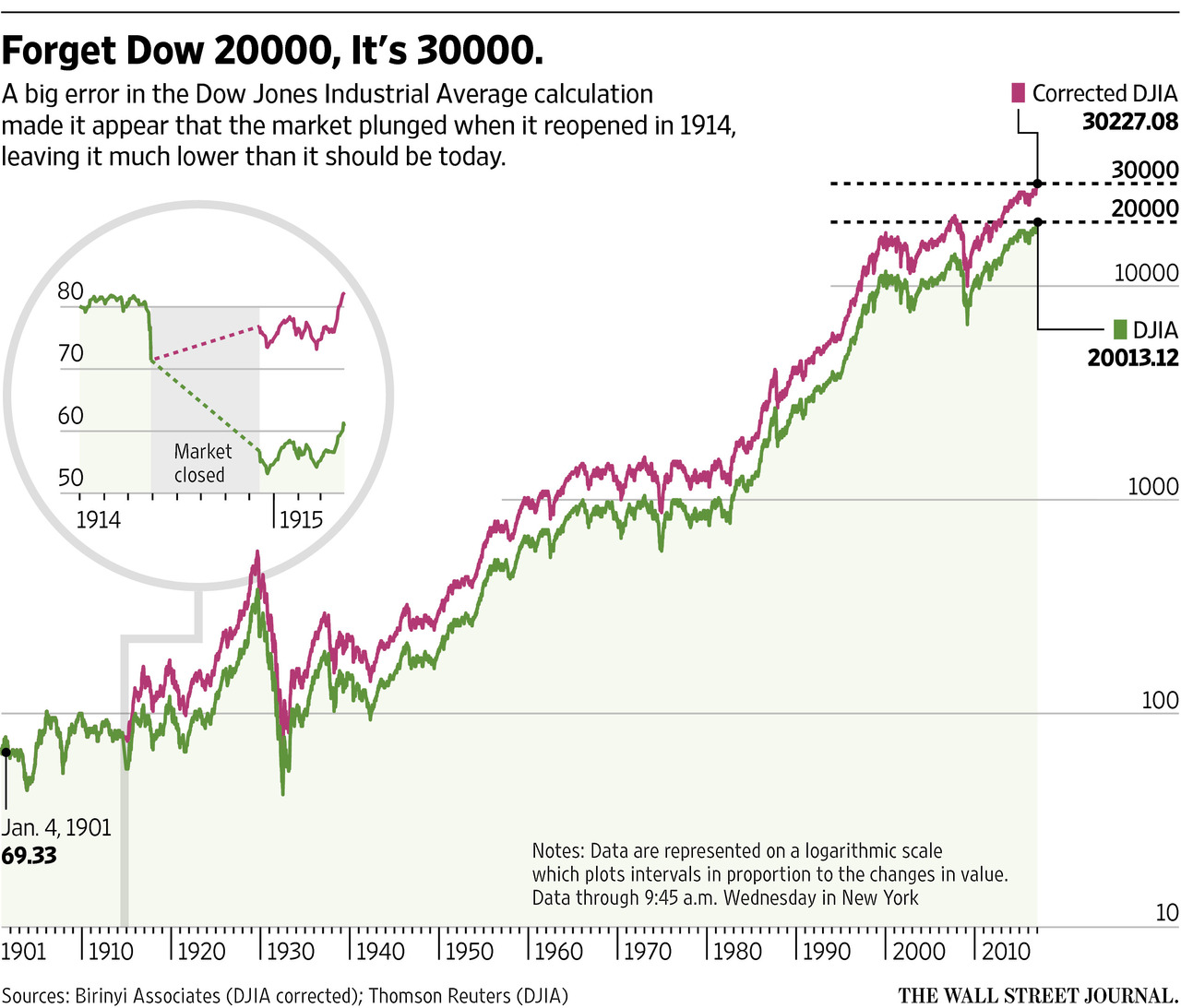

January 2017: the Dow trails its actual calculated value by a third

Source: WSJ

To hear an audio spoken word version of this post, click here.

Lots of folks have been slagging on the authors of “Dow 36,000” (See DeLong, Zweig, Russillo, me) and for good reason: the book was based on a fundamentally flawed premise of value and was soon after overtaken by events that showed it to be disastrously wrong.

But there is a much larger issue than a pair of foolish forecasters being wildly wrong: It’s the Dow Jones Industrials itself — it is an anachronistic index, calculated in a way that makes no sense, rife with historical inaccuracies.

James Mackintosh pointed this out brilliantly in this January 26, 2017, Wall Street Journal column:

“It’s time to ditch the Dow. After 120 years, the venerable Dow Jones Industrial Average is an embarrassing anachronism, abandoned by professionals and beloved only by a media that mostly knows no better. It needs to be updated or, better, replaced . . . The fact is that the Dow is deeply flawed. It is not a good measure of the broad market—indeed it is not even designed to be. It is not a good guide to investing. It is not calculated in a sensible way. And it isn’t even right.”

About that last point: Jeffrey Yale Rubin of Birinyi Associates has calculated the actual value of the Dow Jones Industrial Average. To be more precise, he corrected all of the historical flaws and recalculated the Dow correctly. The results?

“If we adjust for all the errors, miscalculations, and lack of a divisor, the DJIA would today be at 54,452.”

50.60% higher than where the Dow closed yesterday (36157.58). That is an astonishing error. Note this is not an abstract or theoretical measure of value, but rather, the proper price of the Dow if we correct those historical mistakes and errors and properly calculate the index.

One solution that beckons would be to lose the DJIA, replace it with a Dow Jones U.S. Total Stock Market Index. Make the index market-cap weighted.

But all of this goes to show just how much we must challenge our own assumptions and question conventional wisdom.

Not too long ago, Nick Magiulli reminded me of this when he sourced a famous market aphorism to Gary Shilling: “The market can remain irrational longer than you can remain solvent.” I had (along with the rest of the investment community) long thought that was a quote from John Maynard Keynes. As Quote Investigator revealed, there is no evidence to support that belief.

It is truly astonishing how many of the things we take for granted are simply untrue. Much of our investment beliefs (indeed, our lives) are based on thinking things that turn out to be either unproven or outright false. That should be very humbling to anyone in this business.

click for audio