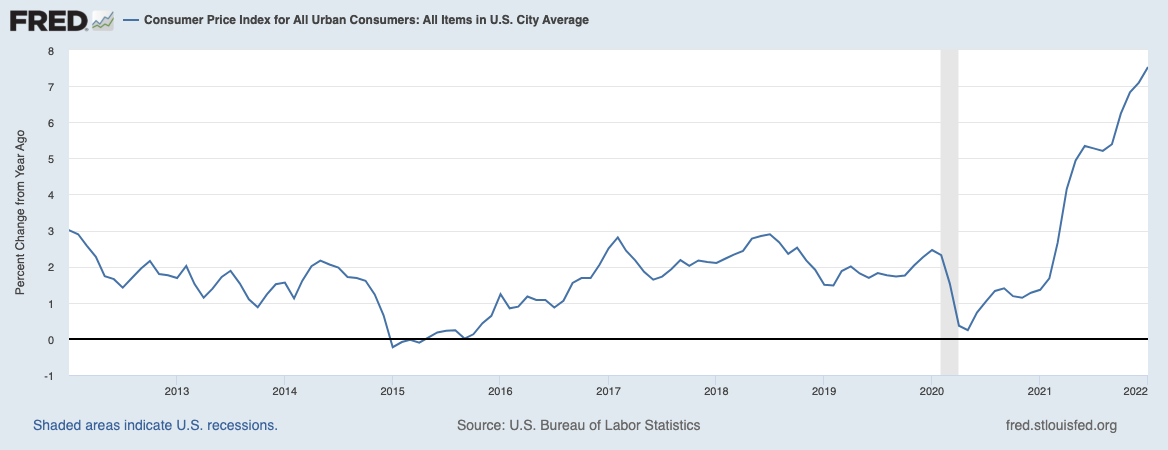

CPI came in hotter than expected today, up 0.6% in January (seasonally adjusted); Year-over-year the increase of 7.5% (no seasonal adjustment needed) was the highest since 1982. Gasoline and Natural Gas fell for the month, but Energy was the biggest component of the annual increase up 27%, with Gasoline up 40%, and Fuel Oil up 46.5%. The Food index rose 0.9% for the month, up 7% annually. Back out Food and energy — what I like to call “Inflation ex-inflation” — and we see a high (but more modest) 6% annual increase.

A few weeks ago, we discussed how you can find different flavors of inflation, depending upon where you look. Break the numbers down, many elements are less likely to be structural, and more likely part of the “Demand Shock” caused by the combination of momentary stimulus, a massive fiscal stimulus of the combined effect of 4 trillion dollars via multiple CAREs Acts, and the supply snarls due to increased goods consumption and post-lockdown re-openings.

A quick look at the components that go into CPI might explain why transitory is taking longer than expected:

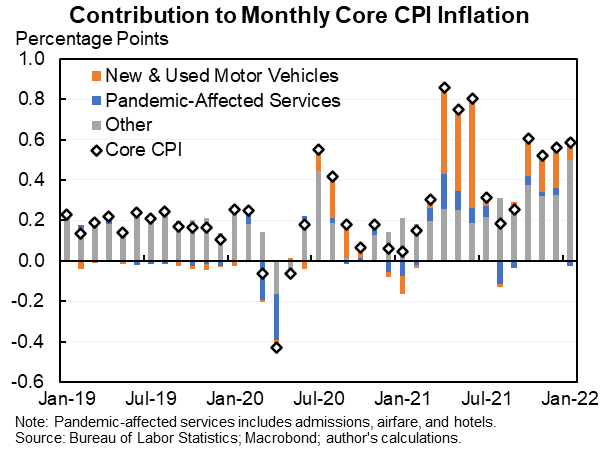

Automobiles: The chip shortage is beginning to improve, but there is much still to be done to return to normal. The shortage of new cars led to those prices rising 12% year over year (but flat for the month), and that shortage caused used car prices to surge 40.5% (+1.5% monthly). This has been almost of third of CPI inflation; the good news is it is beginning to attenuate, as Jason Furman shows. But note fewer new cars sold today means fewer used cars available for sale in 3 years.

Automobiles: The chip shortage is beginning to improve, but there is much still to be done to return to normal. The shortage of new cars led to those prices rising 12% year over year (but flat for the month), and that shortage caused used car prices to surge 40.5% (+1.5% monthly). This has been almost of third of CPI inflation; the good news is it is beginning to attenuate, as Jason Furman shows. But note fewer new cars sold today means fewer used cars available for sale in 3 years.

Energy: One of the biggest contributors to inflation. Gasoline, Crude, and Heating Oil all have similar charts — they crashed at the beginning of the pandemic, then recovered to surpass pre-pandemic levels. They are above where they were in January 2020, but below where they were in the peaks in 2008, 2011, 12, 13, and 14. Base effects mean the rest of 2022’s year-over-year comparisons start to show much smaller gains.1

Wages: The biggest issues in wages are: 1) A belated catch-up after decades of lagging bottom half/minimum wages, and 2) the shortage of workers. The unofficial minimum wage of $15 is likely to prove sticky, but I see no signs it is going to rise rapidly from here. The labor shortfall has many demographic elements: Decreased immigration, new business launches, a lack of childcare, covid deaths, and early retirements.

Housing: We have discussed the miscalculation in housing demand prior, but that shortfall remains an issue. It will take a few years to before the supply has caught up to existing demand levels. And as Jonathan Miller informs us, the big spike in NYC rent still has prices 2.4% below pre-pandemic levels.

Housing: We have discussed the miscalculation in housing demand prior, but that shortfall remains an issue. It will take a few years to before the supply has caught up to existing demand levels. And as Jonathan Miller informs us, the big spike in NYC rent still has prices 2.4% below pre-pandemic levels.

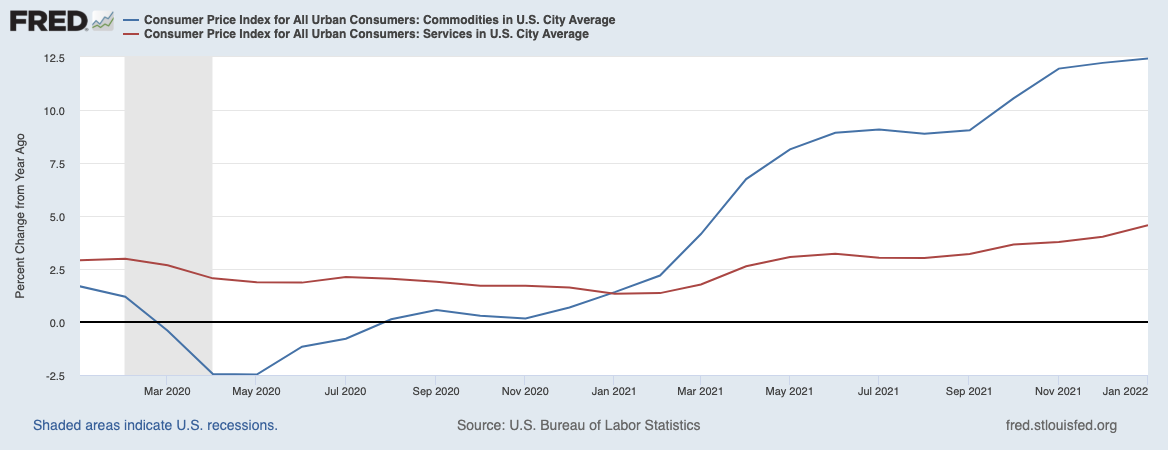

Re-Opening: Prior to the pandemic, the balance of Goods (38.7%) and Services (61.3%) was clearly tilted towards Services. That was shifted as so many had to scramble to work from home. Global production of goods is now up 5% over 2019 pre-pandemic levels, but demand has risen 20%. And while we have more ships on seas, and more containers, and ports working 24/7, it still is insufficient to meet the demand for Goods. That initially sent CPI Goods up over 8%, while CPI Services is about where it was in 2019 ~3%. As measured by CPI, Services are now 4.6% higher than a year ago but Commodities are up a whopping 12.4%.

We are buying lots more stuff than we used to, and consuming fewer services. This will eventually revert back towards the prior balance. It might be temporary, but it is still inflationary.

~~~

Inflation has been a significant issue the past few quarters, “Transitory is taking longer than expected…“. The snark is incidental; what I meant by that is that much of inflation is not likely to be structural, but it is also likely to take longer than people expect to revert back towards a 2% or 3% level of price increases.2

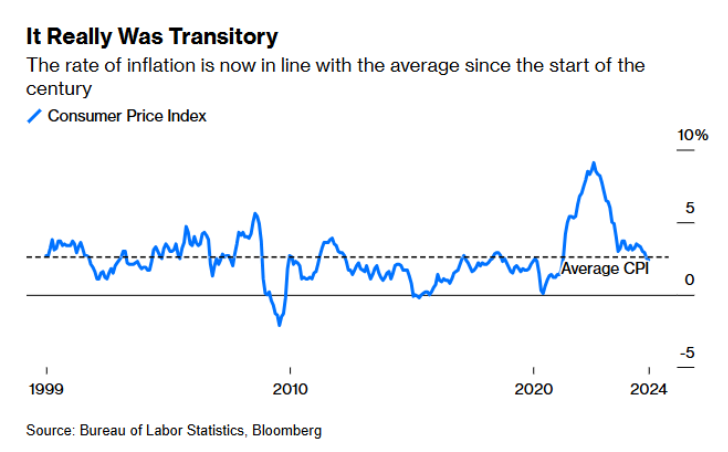

UPDATE: October 30, 2024

Bloomberg points out that Inflation turned out to be transitory after all.

Previously:

Inflation: CPI, Core Rate, Inflation ex-Inflation (October 4, 2007)

Inflation & the Elephant (January 19, 2022)

How Everybody Miscalculated Housing Demand (July 29, 2021)

Deflation, Punctuated by Spasms of Inflation (June 11, 2021)

The Inflation Reset (June 1, 2021)

Inflation: Price Changes 1997 to 2017 (February 12, 2018)

Inflation (2004-2021)

______

1. About gasoline prices: Your local station raises prices when their suppliers raise prices, but they lower prices only in response to competition — e.g., when the station nearby to them lowers their prices. Hence, increases are rapid, while decreases seem to take their sweet time.

2. Each quarter, I do an RWM conference call, where I review the state of the economy, markets, and our portfolios and answer questions for clients. Some of the work you see in these pages is just me thinking through the issues I want to address across 30 slides in 30 minutes. The specific topics may vary from Q to Q, but the key ideas and concepts are consistent. In the 2022 Q1 discussion last month, I labeled the middle section “Transitory is taking longer than expected…”