This week, we speak with Alex Guervich of Hon Te Advisors, a discretionary global macro hedge fund. Previously, Guervich ran JP Morgans’s macro book of trades. In 2020, Hon Te was ranked 2nd in net return, and a top 10 emerging manager. He is the author of The Next Perfect Trade and most recently, The Trades of March 2020.

We discuss his positioning heading into 2020: Based on his macro view, he believed the Bond Market was mispricing the probability of economic dislocation relative to an economic slowdown. Once the pandemic hit, he pressed those downside rate bets and other secondary effects, leading to substantial gains in his portfolio.

Guervich says he prefers to be the house rather than the gambler, and most of his trades have a known range of probable outcomes. But he also explains the challenges of large hedge fund strategies, like Risk Parity; they create opportunities for smaller more nimble trading firms (like his).

We discuss why too many successful investors and traders become “Ultracrepidarians.” Derived from Latin — “Sutor, ne ultra crepidam,” (literally “Shoemaker, not beyond the shoe”). The reference is to a person who “expresses opinions on matters outside the scope of their knowledge or expertise.” Over the past few years, ultracrepidarians have shown themselves in every field, from polling methodologies to epidemiology to constitutional law to military strategy.

One of the surprising aspects of The Trades of March 2020 was the heavy use of Slack excerpts — about 30% of the book is Hon Te’s real-time trader’s slack channel, showing actual time-stamped communications. Both of his books use metaphors — in his most recent book, trading is a battle with medieval weaponry and shields; his prior book used the nomenclature of astrophysics: accretion discs, black holes, time dilation, and wormholes are all used to explain how his trading unfolded.

A list of his favorite books is here; A transcript of our conversation is available here Monday.

You can stream and download our full conversation, including the podcast extras on iTunes, Spotify, Stitcher, Google, Bloomberg, and Acast. All of our earlier podcasts on your favorite pod hosts can be found here.

Be sure to check out our Masters in Business next week with Boaz Weinstein of Saba Capital. The firm specializes in credit and capital structure investing, including Credit default swaps, Tail Protection & Volatility trading. Saba is one of the 5 largest SPAC investors (though not in the way you think of). Previously, Weinstein was Co-Head of Global Credit Trading at Deutsche Bank managing 650 professionals and a member of the Global Markets Executive Committee. Boaz became infamous as being on the other side of the London Whale trade for JPM, which lost the bank $2B and netted Saba 100s of millions in gains.

Alex Guervich Favorite Books

“The Lord of the Rings Trilogy”: The Fellowship of the Ring / The Two Towers / The Return of the King by J.R.R. Tolkien

Wheel of Time Premium Boxed Set I: Books 1-3 (The Eye of the World, The Great Hunt, The Dragon Reborn) by Robert Jordan

Temeraire by Naomi Novik

Spinning Silver by Naomi Novik

A Brightness Long Ago by Guy Gavriel Kay

The Dragon’s Path by Daniel Abraham

Ender’s Game by Orson Scott Card

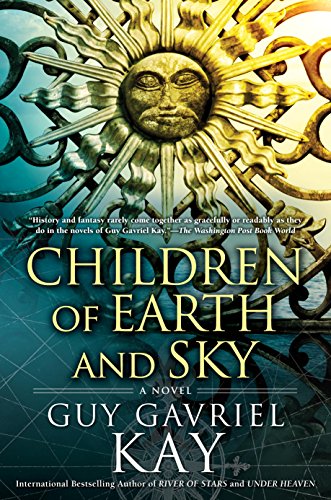

Children of Earth and Sky by Guy Gavriel Kay

A Game of Thrones by George R.R. Martin