Tomorrow is my first full day back at work after a week of leave with family; I am slowly easing myself into my regular routine.

There are so many crosscurrents that I thought a few “food for thought” questions might help the process. These are meaty issues, some of which I hope to address in greater detail in the coming weeks.

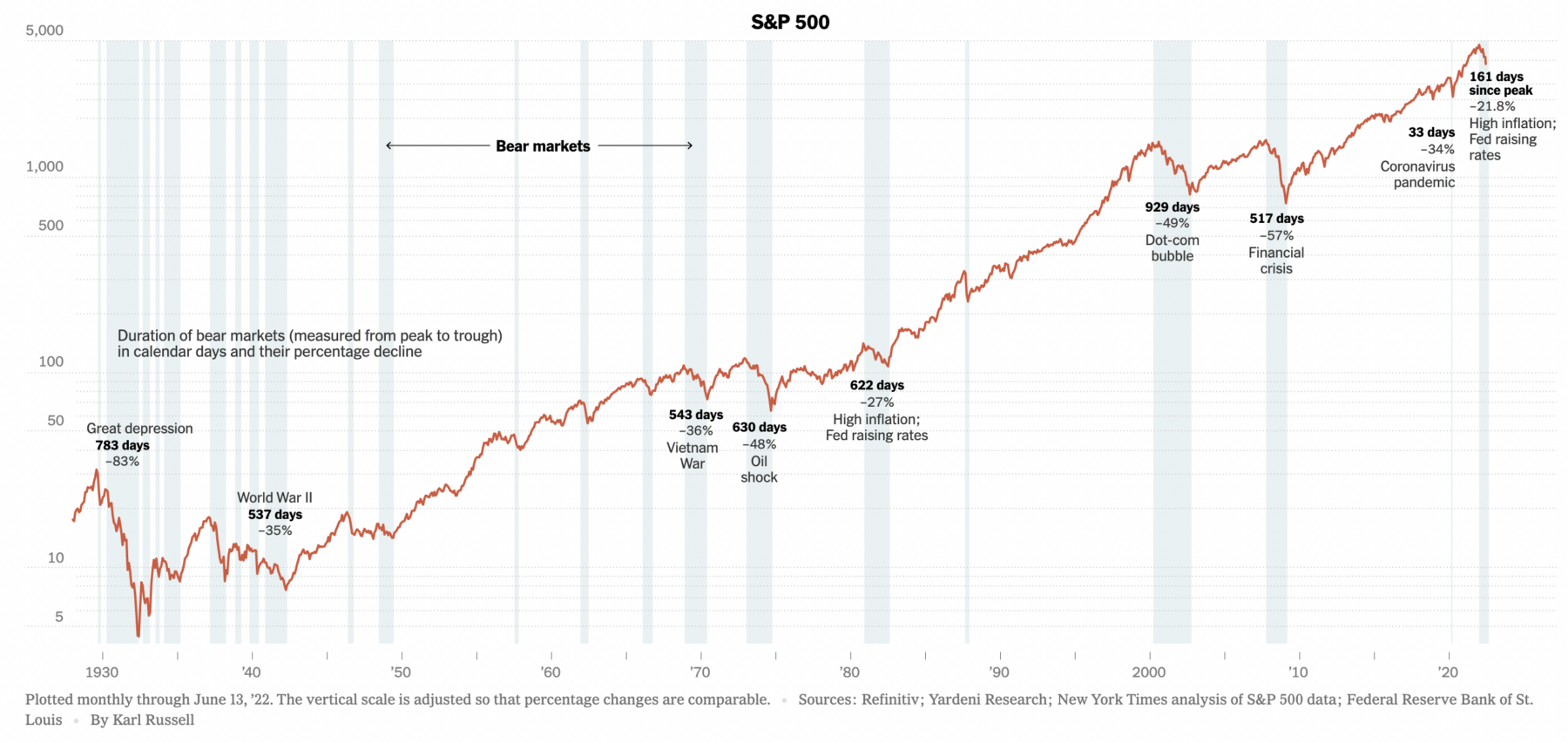

1. Bear Market: Recessions usually see Bear markets accompany them, but not always. The New York Times chart above shows the history of the two. Our first question: Will this Bear bring on a recession?

2. Inflation: Are we near peak inflation? Will the bite on consumers slow consumption, and therefore prices? Does the world return to the Deflationary regime anytime soon? Does the FOMC believe inflation is monetarily based? Do they think rates are the driver?

3. Bonds: What are the ramifications of the bond bull market, which began 40 years ago in 1982, ending?

4. Recession: Will the economy suffer a growth slowdown? Can the Fed cool the economy just enough to curtail demand-driven inflation without creating a full-on contraction? Is a soft landing possible/probable? Is the plan simply to crimp demand just enough to allow supply chains to normalize? Or will the Fed over-tighten credit and cause a recession?

5. Crypto: Does Crypto present a systemic risk? Is this an asset class that will spill over into the rest of the economy, e.g., Housing/Mortgages in the mid-2000s? Or, is this more like the collapse of a single 3 trillion-dollar company?

6. Cyclical versus Secular: Will this be a long and drawn-out secular bear market, e.g., 1966-82 or 2000-2013? Or will this be a cyclical bear within a secular bull, e.g., 1998, 2010, 2018, 2020?

7. Earnings: Profit growth has been healthy the past decade; can profits grow with higher — or much higher — rates?

8. Retail Sales: How does the consumer respond to inflation and a general slowing? How will they adjust to increased supply? What do higher rates do to demand?

9. Housing: Are enough homes being built to balance the demand? How long will a decade of undersupply affect the housing market? What do 6%+ mortgage rates do to the demand side of the equation?

10. War/Russian invasion of Ukraine: Will this war end anytime soon, or is this another Afghanistan that will run for years? Will it spill over into Europe? What does this mean for Russia as a nation?

These are the questions I am asking myself. I don’t know the answers, but I will continue to explore all of them…

Previously:

Capitulation Playbook (May 19, 2022)

Secular vs. Cyclical Markets, 2022 (May 16, 2022)

Panic Selling Quantified (March 24, 2022)

Source:

What Happens When Stock Markets Become Bears

By William P. Davis, Karl Russell and Stephen Gandel

New York Times, June 13, 2022