A month ago, I asked: Has Inflation Peaked? There were persuasive indications that at least in terms of three major drivers of inflation — Automobiles, Homes & Wages — we had seen the end of broad price increases.

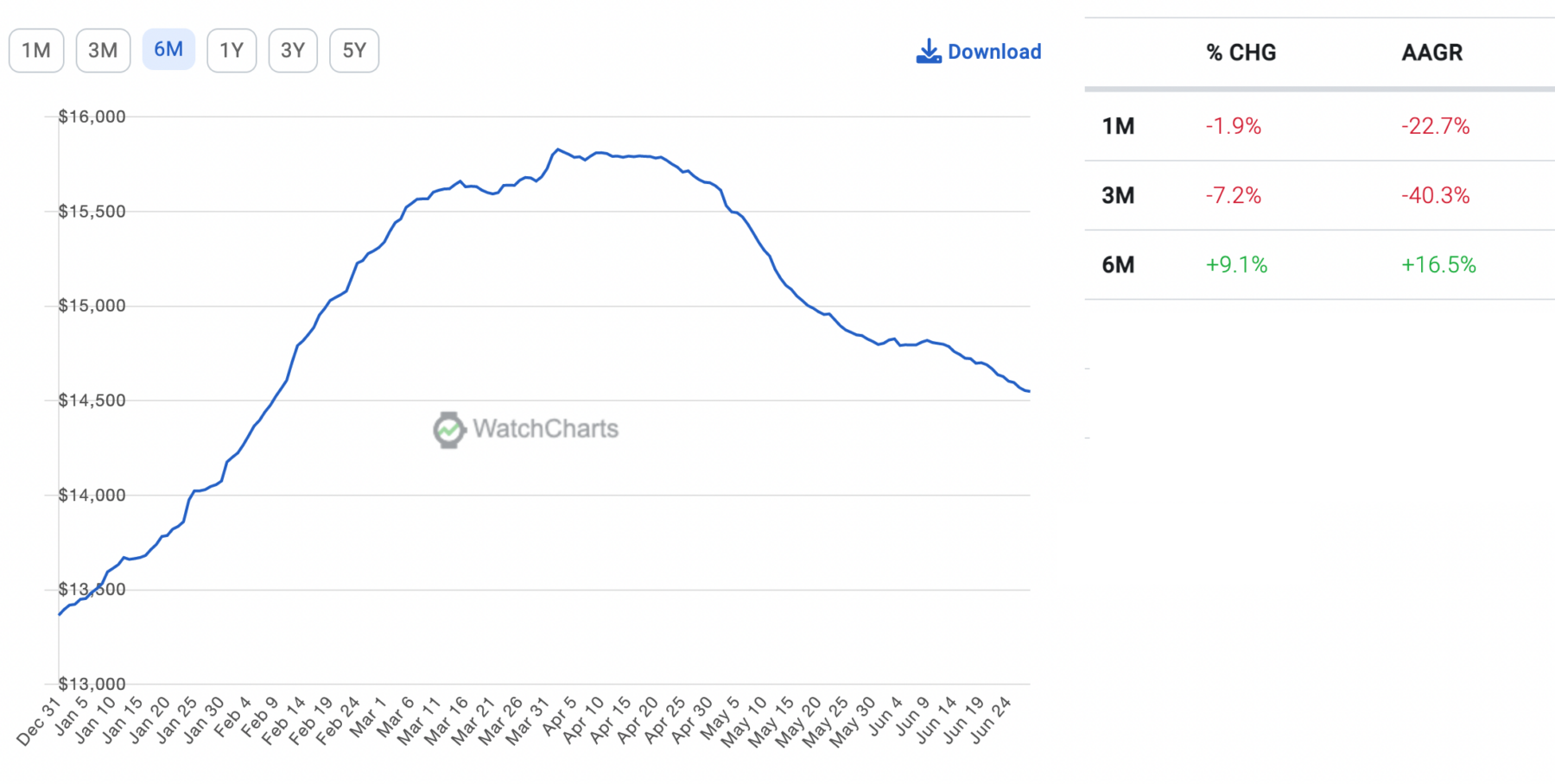

My colleagues Tracy Alloway and Joe Weisenthal, only slightly tongue in cheek, pointed out some other specific items that had seen their prices top and roll over: Rolex watches, Graphics chips, Industrial metals, Bored Apes, Trucking, Yeezys, Shipping rates, Used cars, (Some) houses, and Lumber.

It’s not that any of these items are so significant, but rather, the kinds of across-the-board price increases seen in 2H 2021 and most of 1H 2022 have begun to ease.

Broadly speaking, we see these 6 large categories as showing encouraging price moderation:

1. Commodity prices: Lumber, Copper, other undustrial metals off substantiually from their peaks; even Energy is off its highs.

2. Inventory: Target, Walmart and other retailers have accumulated lots of stuff; too much stuff that will lead to discounts in the near future;

3. Home Prices: Bidding wars are falling, sales over ask dropping. Homes are staying on the market longer, and more are offering price redcutions. More supply is coming as well.

4. Wages: An increasing number of layoffs, especially in the hottest sectors (Tech, warehouses, crypto, AI and autonomyous driving) suggests a reduced ability to demand higher wages.

5. Automobiles: Production is rising, and inventory of new cars is improving.

6. Travel: Airline ticket prices have been falling during June, see also here

Apollo Group’s Torsten Slok notes:

“The bottom line is that inflation may stay elevated for another month or two, but given the trends listed above, the probability is rising that inflation going into the second half of this year could come down faster than the market currently expects.”

I concur. The official economic data is released on a lag, and we are likely already a month or two past peak inflation.

Previously:

Who Is to Blame for Inflation, 1-15 (June 28, 2022)

Has Inflation Peaked? (May 26, 2022)

Normalization vs Inflation (March 14, 2022)

Goods Versus Services (June 3, 2022)

Source:

From Chips To Rolexes, 10 Things Where Prices Are Actually Going Down

By Joe Weisenthal and Tracy Alloway

Bloomberg, June 28, 2022