My fishing pal Sam Rines has spent much of this year pushing a thesis of “Price over Volume”; I found it a compelling narrative, one that fits in nicely with an apsect of inflation that I had originally underestimated: “Greedflation.”

The Price over Volume thesis is both compelling and underappreciated. I hope you find his take thought provoking… -Barry

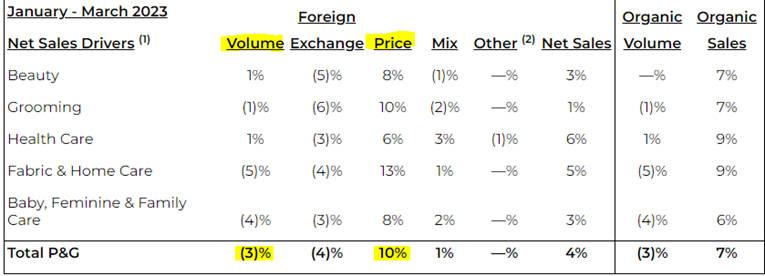

Price over Volume remains a key theme this earnings season with PG’s earnings report the tip of the iceberg. As a reminder, this has been one of PolyMacro’s themes for the past year.

It remains early in the current earnings season. But the persistence of the PoV narrative is becoming almost comical. The amount of price flowing through the system to consumers is rather obscene. Pushing 10% price at P&G with relatively little pushback on volumes (-3%??) makes for a difficult argument that there is a disincentive to continue finding that elasticity breaking point. And P&G does not appear to have found it yet.

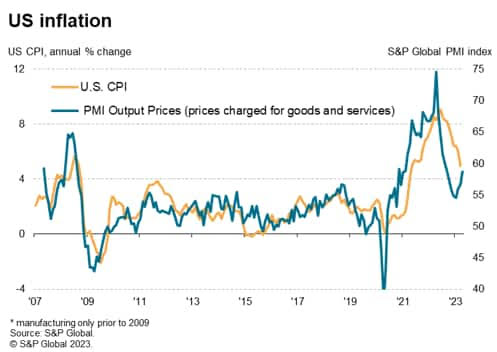

And the current S&P Global PMI numbers serve to reinforce the PoV narrative. Manufacturing firms? Pushing price. Services firms? Pushing price.

And taking it all together – the uptick in demand is causing pricing pressures to re-emerge that cannot be ignored. If the S&P PMI report proves to be correct (inflation reaccelerating) that is going to be highly problematic for risk assets that have become more comfortable with a “hike to pause” narrative.

Companies are saying prices are going higher, and the surveys are confirming it. It should also not be ignored that this survey is following the banking scare.

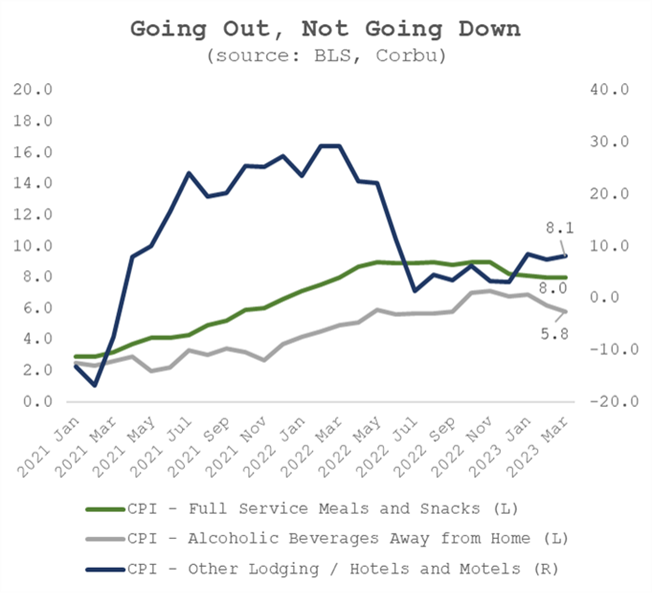

When you combine the narrative from P&G (“we have price power and we know it now”) with the FOMC’s greatest fear (services inflation), it is not difficult to parse out what happens next. There is little in the way of relief coming in the pipeline for the consumer.

This is not the same economy as the pre-Covid era. This is the economy of “pushing price” and finding that marginal dollar.

There was – was – a rational argument for a less aggressive PoV coming through the system. Following the SIVB debacle and the subsequent funding pressures seen by some regional banks, the stability of the financial sector was at risk. That was supposed to be a headwind to the US economy and inflationary pressures.

But as it turns out that is simply not what is happening.

There is a sense that the banking scare solved the inflation problem. And – while there are theoretical reasons to believe it to be the case – it has not proven to be true thus far in earnings. United Airlines called it out as a “two week” headwind, and there have been scarce others that face consumers even acknowledging it.

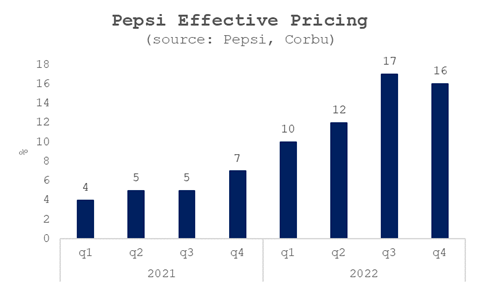

And Pepsi – the one company that was not supposed to be able to raise prices because of the direct competition from KO – is one of the most obvious PoV culprits.

The acceleration in pricing all around – but particularly at Pepsi and the like – is astonishing. It is indicative of the current corporate mentality. There are very few chances to find the elasticity of demand. And – for the time being – there are ample excuses to figure it out.

There is a war. There is a labor shortage. Those are good excuses to raise pricing and not care about volume. And that is the world we are living in. Volume doesn’t matter. Price does.

~~~

Samuel Rines is the managing director at Corbu, Samuel Rines is an analyst of all things economic with a focus on how “the micro meets the the macro”. Sam is the author of “After Normal” and writes frequently on the cross-section of the economy and markets.

Samuel Rines | Managing Director

CORBŪ

samuel.rines@corbu.co