Check out these recent headlines about the classic 60/40 investment strategy1:

The 60-40 Investment Strategy Is Back After Tanking Last Year

BlackRock Ditches 60/40 Portfolio in New Regime of High Inflation

Sorry, but all of these headlines utterly miss the point. No, the 60/40 mix of stocks and bonds is not dead; No, this is not the first time we had a regime of high inflation, transitory or otherwise.

The 60/40 is not “back” because it never left.

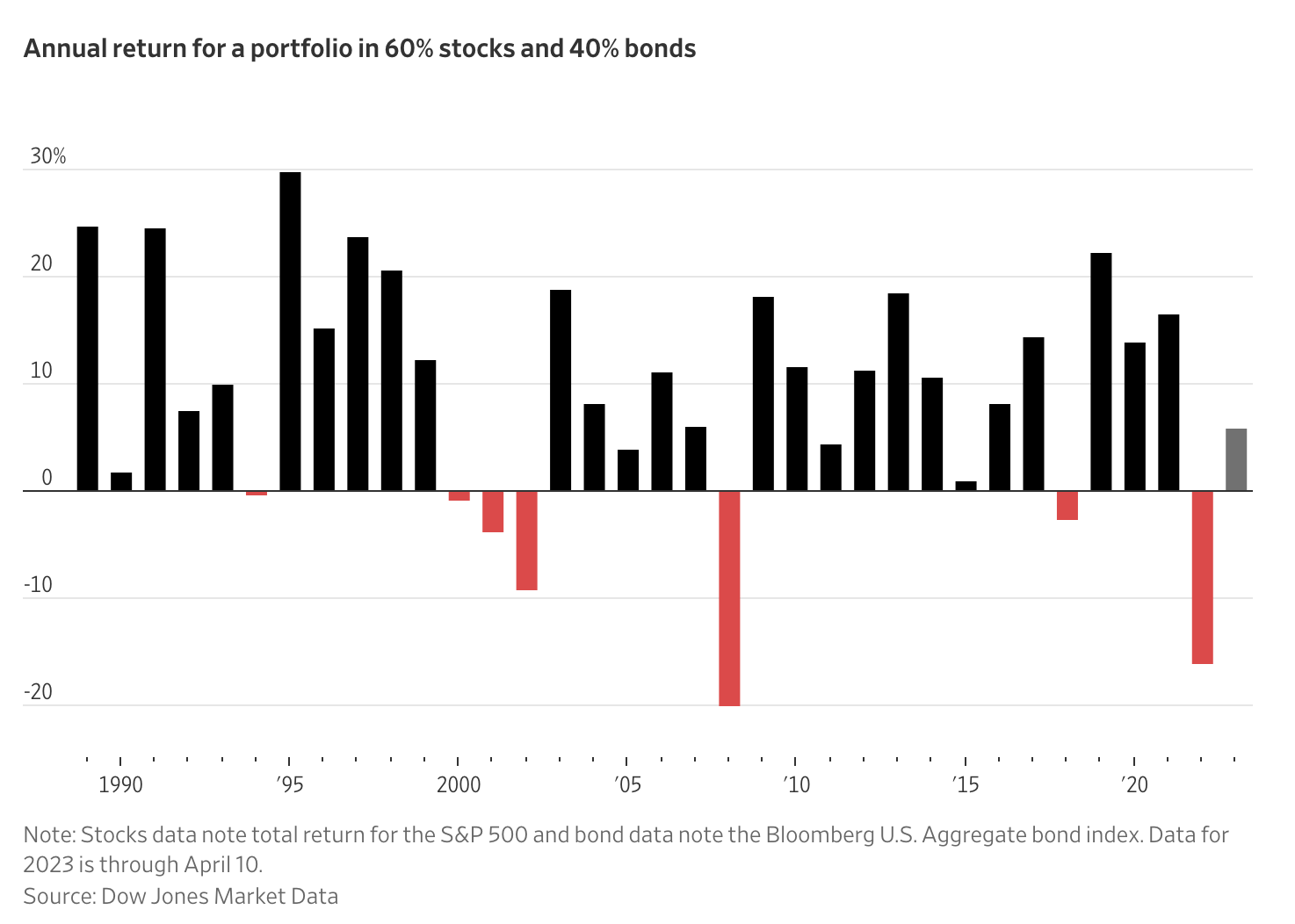

Despite the headline, the Wall Street Journal chart (above) reveals 2022 as the exception that proves the point: Prior selloffs — 2000-03 and 2008-09 — were all equity driven. You need to go back to 1981 to find another year when both stocks and bonds were down double digits in the same year. Those years are fairly ugly for investment portfolios.

And that is exactly the point: One outlier year every 4 decades or so makes for a pretty reliable investment strategy. The academic evidence that this sort of investing outperforms all others over a long enough timeline is overwhelming.

I find Vanguard’s take to be more in line with my own: Improved outlook for the 60/40 portfolio. Meaning, with rates nearing the terminal value, bonds now generate decent yield as well as provide ballast against the volatility of the equity portion of your portfolios.

I have read endless screeds the past few years as to the return of the active investor and why passive is definitely going to fail this cycle. It’s amazing how much enthusiasm gets generated when almost half of active managers outperform for a quarter or two…

See also:

What Beat the S&P 500 Over the Past Three Decades? Doing Nothing. (Morningstar, )

__________

1, The caveat being 60/40 reflects a fairly moderate risk tolerance, and higher equity allocations (e.g., 70/30) might be appropriate for people with higher risk tolerances and/or longer investment horizons.