My RWM colleagues Josh Brown and Michael Batnick do a bang-up job each week diving into the specifics of the newsflow in What Are Your Thoughts?

Don’t miss my favorite chart from this week’s discussion 46 minutes deep into the episode; its from Bank of America by way of Batnick (above).

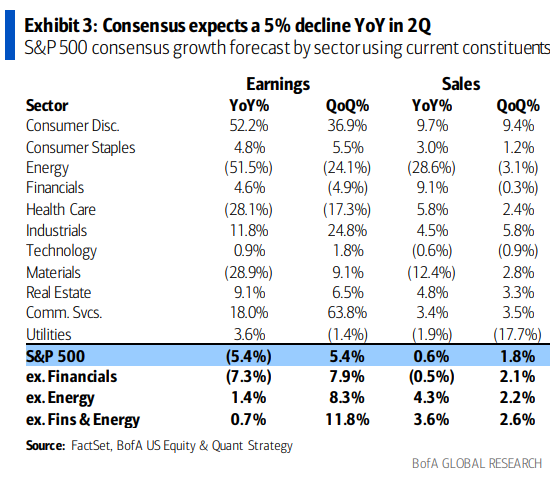

All of the fall-off surrounding the 8% pullback in S&P 500 profits — literally, more than 100% of it — is due to the huge drop in energy profits. Recall 2022, energy was one of the few bright spots as oil prices rallied mostly due to the Russian invasion of Ukraine. This year, with lower oil prices, energy company profits dropped in half

Back out the 51.5% drop in Energy profits Year-over-Year, and SPX profits are up 1.4%. Q/Q its +8.3%. The flip side of this is the sectors that got shellacked in 2022 are now showing massive profit recoveries. Consumer Discretionary Year-over-Year is +52.2%, Communication + 18%, and Industrials 11.8%.

When looking at any data series, the Base Effect matters. We will see something similar in the next few CPI reports, as the hottest year-ago numbers drop off from the 12-month series.

I am normally skittish about showing things “Ex” anything — recall my mid-2000s fisking on Inflation Ex Inflation — but in this case, the framing reveals rather than hides what is going on.

Previously:

Earnings

Ex-Inflation, There is No Inflation (September 26, 2005)

Inflation Ex-Deflation (this time, INCLUDING energy) (June 22, 2012)

CPI: Imperfect But Useful (May 24, 2022)