A regular theme around these parts is “Nobody Knows Anything.”

Specifically, nobody knows what will happen in the future. This is true about equity and bond markets, specific company stocks, and economic data series. We do not know which geopolitical hot spot will erupt in turmoil; we have no idea where or when the next natural disaster will hit. We remain clueless as to what sports teams will win it all or who will be the MVP for any league. The best films, books, and music releases are unknown in advance.

This should not be a radical or contrarian outlier position, yet it feels that way. We hardly know anything about next week, even less about next month, and practically nothing about next year.

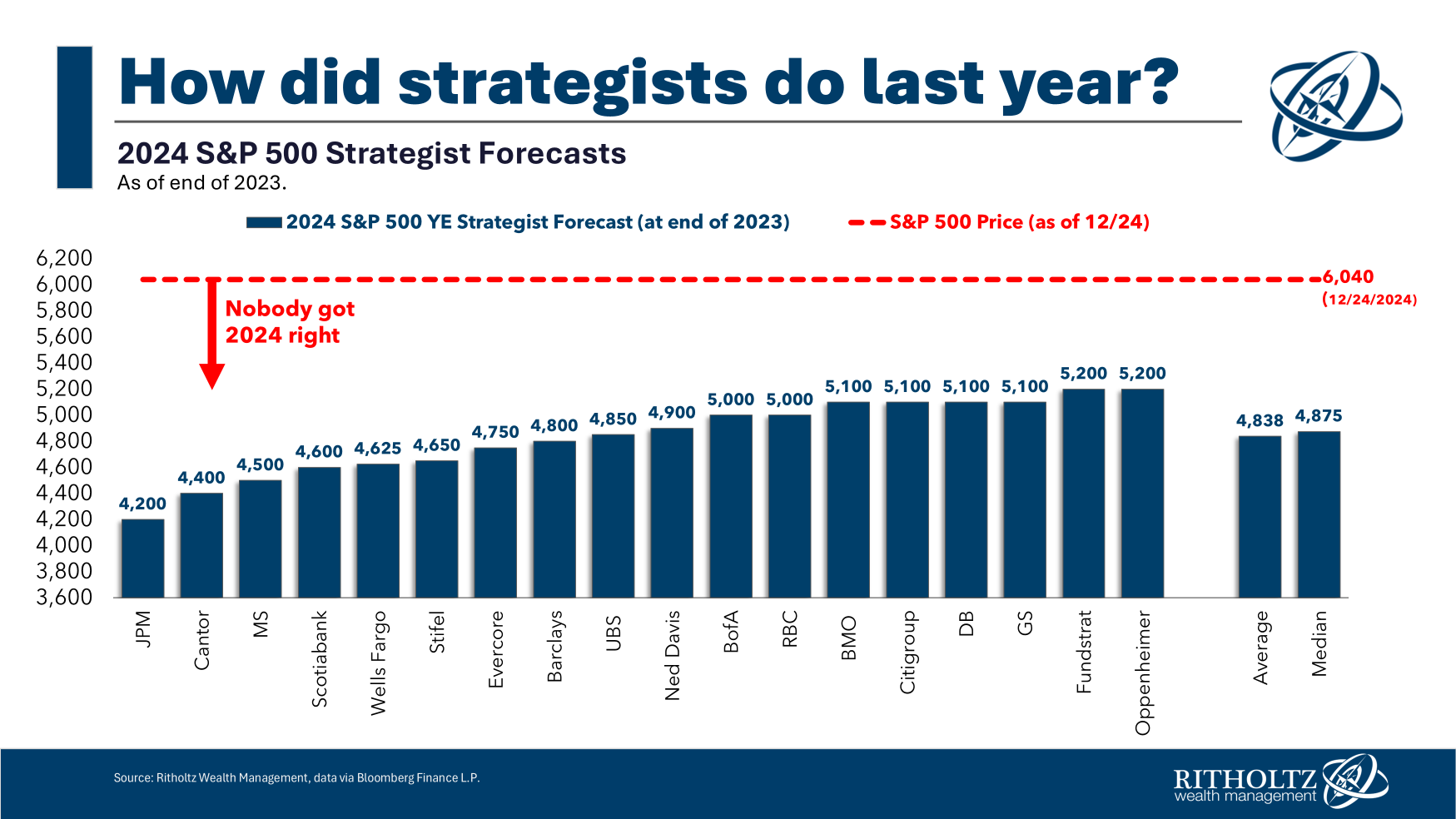

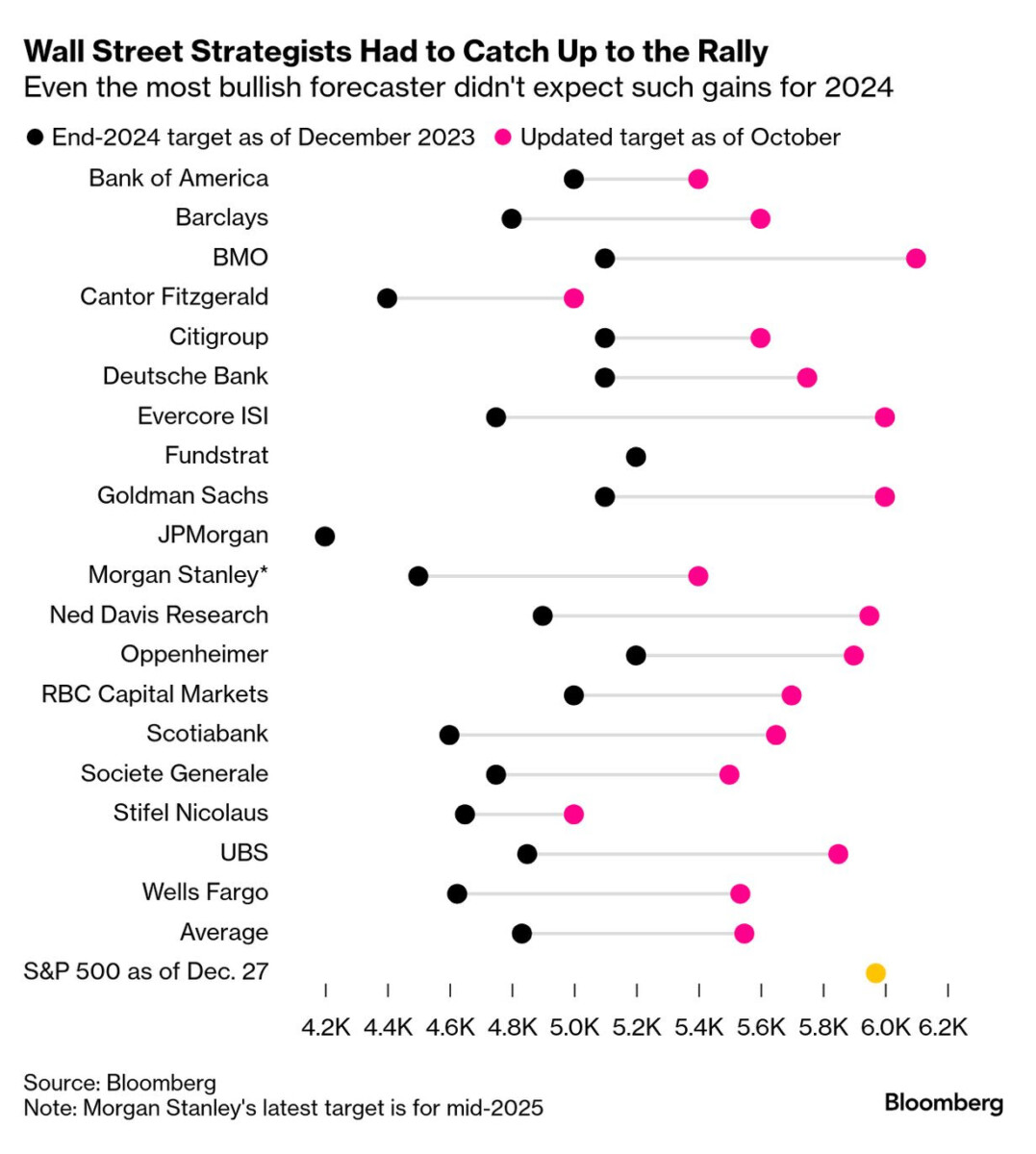

It is especially true for strategists and forecasters at large brokers and banks. Consider this December 29, 2024, year-end review in Bloomberg:

“By this time last year, the stock market’s rally had blown past even the most optimistic targets, and Wall Street forecasters were convinced it couldn’t keep up the dizzying pace.

So as strategists at Bank of America Corp., Deutsche Bank AG, Goldman Sachs Group Inc., and other big firms sent out their calls for 2024, a consensus took shape: After surging more than 20% as artificial intelligence breakthroughs unleashed a tech-stock boom and the economy kept defying the doomsayers, the S&P 500 Index would likely scratch out only a modest gain. As the Federal Reserve shifted to cutting interest rates, Treasuries were seen as ripe to give equities a run for their money.”

As the chart above shows, all the major Wall Street brokerage and bank strategists failed to anticipate how well the market would do in 2024 (Bloomberg’s chart below). Strategists don’t do these forecasts exceptionally well, but this year, they were extra-terrible:

Only part of the problem is that these folks are bad at this; the bigger issue is that they do it at all. It’s kinda like Phrenology, the pseudoscience feeling bumps on people’s skull to predict their personality traits. It’s not that there are better or worse phrenologists, but rather, why was anyone doing phrenology? Similarly, there are numerous problems with forecasting. I’ll discuss why psychological biases and cognitive errors lead to prediction errors in an upcoming post.

For today, let’s just focus on how variable the future is. Random events can and will completely derail the best laid plans we may make. Even the most well-ordered, thoughtful forecasts turn to mush when randomness strikes. And randomness is served up daily.

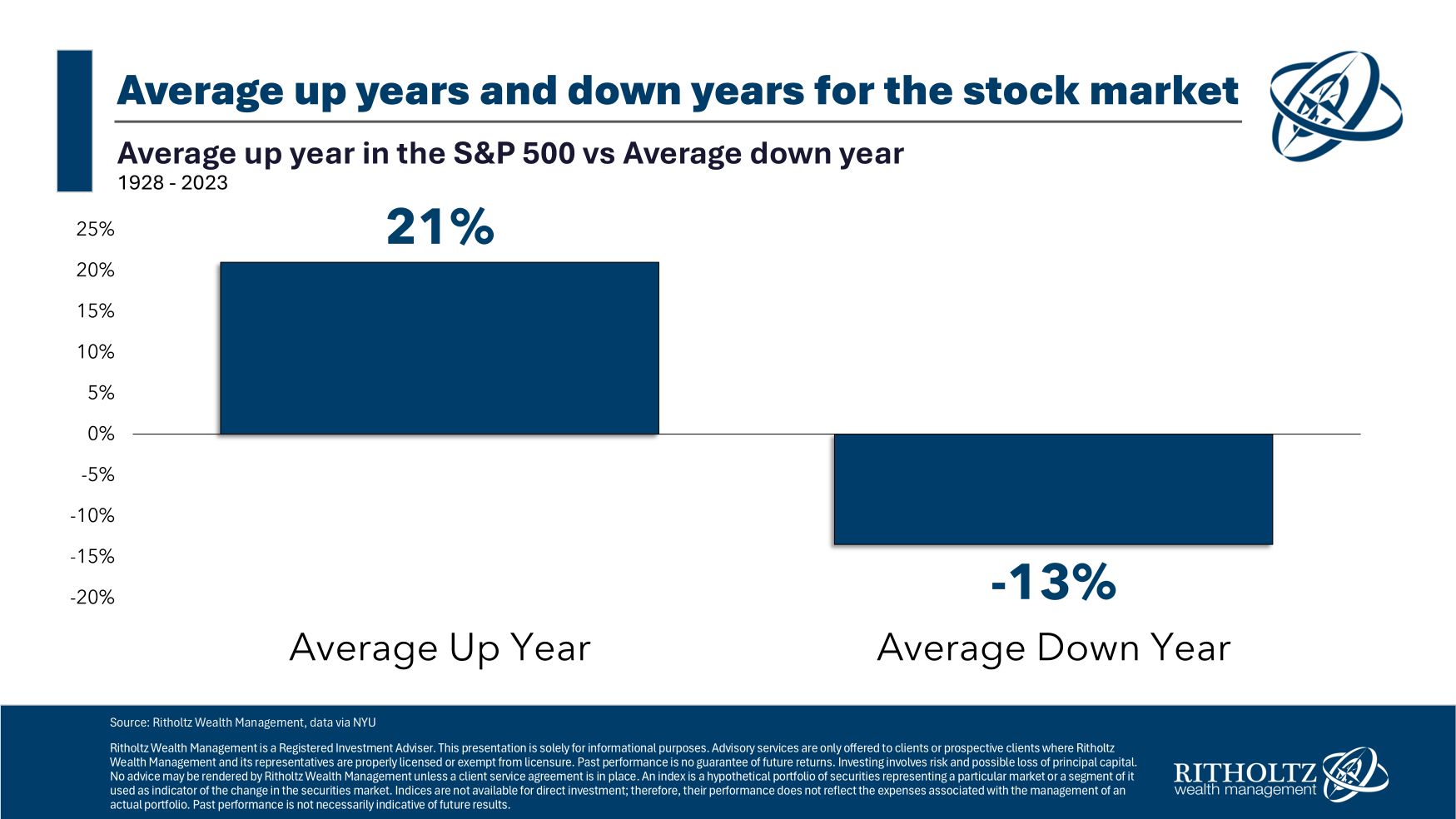

Anyone who has the temerity to make forecasts, should at least be intelligent about them. I like to think in terms of probabilities instead of time and price targets. Professor Philip Tetlock explained how to make better forecasts by urging us to use what we do know to color our decision-making process. My colleague Ben Carlson put this to use recently. He explained one of the inherent errors in the stock price prediction process by noting the annual average is completely misleading. Merely guessing it will be the annual average practically guarantees you will be wrong.

Instead, think about a two step process: Will it be an up or a down year? Once you have determined if it’s going to be a positive or negative year (!), then make your best guess:

“Double-digit moves in both directions are the norm. In fact, in 70 of the past 97 years, the U.S. stock market has finished the year with double-digit gains (57x) or double-digit losses (13x).”

Here is what that looks like over the past 95 years:

My advice is to skip the forecasting altogether — but if you must make a guess, then try the two step process. Sure, it adds another way to get it wrong, but it also means you have a better chance of getting it right.

One last reminder: All forecasts are marketing. Or, as John Kenneth Galbraith observed, “The only function of economic forecasting is to make astrology look respectable.”

~~~

Public Enemy’s 13th album was titled “Man Plans, God Laughs.” The title is based on a Yiddish proverb: “Der mentsh trakht un got lakht.” It’s a blunt observation about our inability to forsee the future.

In “How Not To Invest” (coming March 18!) I spill a lot of ink discussing the many silly things people do, including relying on forecasts and predictions. This is especially true for those made by analysts who are not working to provide you with good investing advice but rather are hoping to drum up business for secondaries and IPOs. Not only do many investors pay attention to this guesswork, but some change their portfolios in response to them. This has proven to be an unproductive strategy.

As much as I want you to buy HNTI, I’ll save some of you the $29 bucks with this summary: “Have a financial plan, stay with it, manage your behavior, practice good information hygiene, and let the markets work for you over time.”

If you want to read more of the fun details, well, than order the book. I promise you will find it both entertaining and informative.

Source:

S&P 500’s 2024 Rally Shocked Forecasters Expecting It to Fizzle

By Alexandra Semenova and Sagarika Jaisinghani

Bloomberg, December 29, 2024

See also:

My Year-End Stock Market Forecast (December 10, 2024)

All those 2025 mortgage rates forecasts are now wrong

By Mike Simonsen

Housing Wire, December 19, 2024

Previously:

Coming March 18: “How Not To Invest” (November 18, 2024)

Nobody Knows Anything, The Beatles edition (September 26, 2024)

Some Thoughts About Forecasting and Why We Stink at It (November 1, 2017)

Say it with me: “Nobody Knows Anything” (May 5, 2016)

Market forecasters should admit the errors of their ways (Washington Post, January 18, 2015)

Nobody Knows Anything (Full archive)

~~~

If you want to learn more about how the book was made, any related media appearances or background, get unique bonus material, or just ask a question, you can sign up here: HNTI -at-RitholtzWealth.com.

Please pre-order a copy today!