What Data Will the FOMC Focus On ?

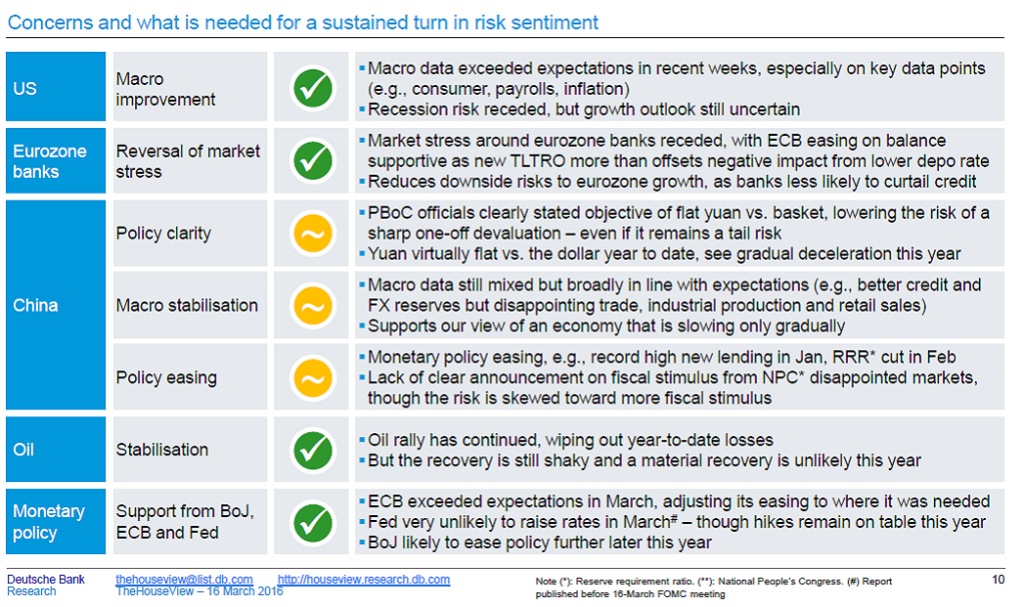

Click for larger graphic Source: Deutsche Bank Securities I really like this way of depicting data in an easy-to-understand...

Click for larger graphic Source: Deutsche Bank Securities I really like this way of depicting data in an easy-to-understand...

Treasury Department Tries Its Own QE/Operation Twist

It is usually several months later in the year that I begin my annual lament over the state of the U.S. federal budget. Not so much the...

Misunderstanding the Financial Crisis in New (but still wrong)...

Confusion About the Financial Crisis Won’t Die Explanations driven by ideology muddle rather than clarify. Bloomberg, January 28,...

Confusion About the Financial Crisis Won’t Die Explanations driven by ideology muddle rather than clarify. Bloomberg, January 28,...

Returning to “Normal”

Americans traditionally look at interest rates as the guide for monetary policy and have done so for half a century. We debate over...

BBRG TV: Election impact on markets?

2016 Race, Does the Market Care? Source: Bloomberg, January 26, 2016 FOMC Meeting: Where Does the Fed Go Next? Source: Bloomberg,...

Roubini: Global Economy Not Back to 2008

Unusually lucid commentary from Nouriel Roubini on why the Global Economy is not a replay of 2008