For the past 2 days, Rev Shark at Real Money has been talking about the recent action as a Capitulation.

I have to disagree. Perhaps I have a different definition of Capitulation than does Rev Shark; While we both describe the recent market action as “lousy as all get out,” I would hardly call it Capitulatory.

For a true Capitulation to occur, we need to see a “total surrender;” Interest in equity ownership will be replaced with disgust and loathing. I do not think we are there yet

I don’t think of 1987 as a capitulation at all; stocks got ahead of themselves, and they saw a major correction. It was a short sharp drop that gave back 8 months of gains — yet 1987 was still a positive year. Within a few days of the 23% drop, stocks started to climb again, and didn’t let up until March 2000. The appetite for equities was hardly diminished, and the correction was only temporary. Indeed, at the time, we were still in the first third of the 1982-2000 bull market.

True capitulation involves laying down of arms, an admission of defeat. That does not define 1987 to me.

Think back to the selling climax we saw June 13/14 — I would say that was mildly capitulatory at best. After a solid month of selling, we saw some extreme readings. But that was as much as buyers strike than a true capitulation. I think of 9/21/01, the Friday after markets reopened post 9/11. Sellers sold until they were exhausted.

Maybe this is only a semantic disagreement, but that’s not where we are now; Heck, as of last Thursday, markets were the highest they had been since that June low. Barring a 9/11 type event, I suspect we need more

than 2 or 3 days of selling for a true capitulation to take place.

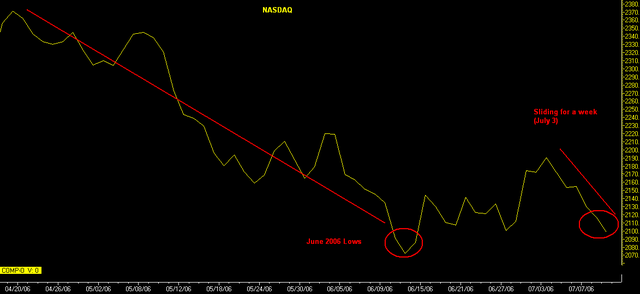

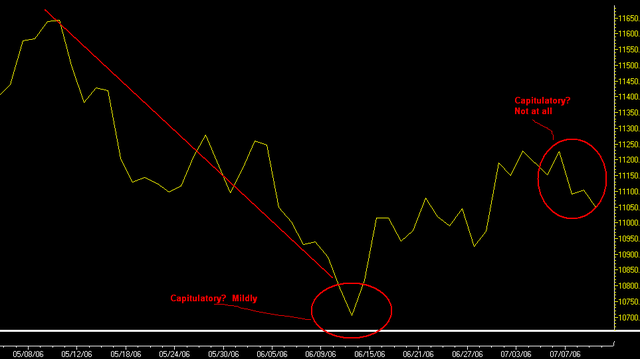

It wouldn’t surprise me if we revisited those June lows over the next few weeks (see chart below) . . .

I will add that the Nasdaq looks much much worse than the Dow does — but when Capitulation occurs, it typically applies broadly to all investors.

Dow: 3 month Chart

Nasdaq: 3 month Chart

>

UPDATE: July 11, 2006 2:41 pm

Understand this: Capitulation is something special.

Understand this: Capitulation is something special.

Its not a tradeable low, or a short term bottom, or a quick reversal. Capitulation is not a term to be used lightly by day traders or housewives, sitting at their screens wearing a nightgown and slippers, flipping a few 100 shares of Haliburton or Yahoo.

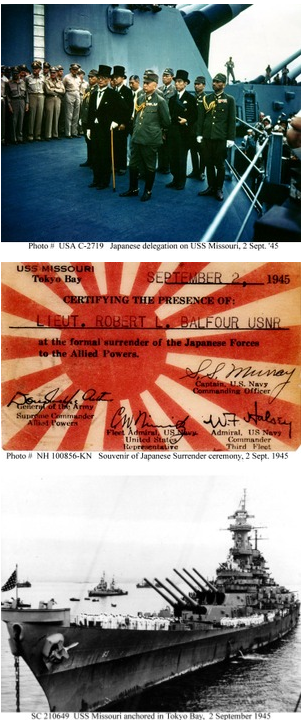

No, true capitulation is public resignation in the face of the inevitable. Its falling on your sword — or in the case of the Japanese generals, not falling on their swords for the sake of millions of their countrymen, making the more difficult and honorable decision to surrender. Capitulation was turning over their swords on the USS Missouri to the Americans;

It was General Robert E. Lee at Appomattox, with his men too weak and exhausted to fight on, realizing there was little choice but to surrender his Army to General Grant.

THATS capitulation; not a market down 50 and climbing back towards the flatline.

>

UPDATE 2: July 13, 2006 9:58 am

As you can see from action over the past two days, the Friday/Monday selling was hardly what you would call “capitulatory.”

See, once there is a capitulation, the selling is supposed to end. 300 Dow points and 3% on the Nasdaq is not consistent with a capitulation on Monday.

>

UPDATE 3: July 15, 2006 8:58 am

For those of you without RM access, here is Rev’s response:

Semantics

7/11/2006 2:37 PM EDT“Yes, Barry, I believe you are focusing on definitional issues rather than my larger point. I’m simply pointing out that turns often occur not in a sudden burst of passion, but only when market players are feeling miserable and lonely and want little to do with the stock market. A sudden laying down of the arms is a nice, neat indication of a bottom, but the market is seldom that cooperative.

It seems to me that the misery level is approaching a point where we are due for a relief bounce. I have no idea how much of a bounce we might turn and by no means am I predicting that a lasting low is in, but it strikes me that conditions are ripe for a stealth capitulation that will produce a bounce.”

>

UPDATE 4: July 17, 2006 6:58 am

It turns out I am in Richard Russell’s camp:

“Three days in a row with the Dow down over 100 points each day — you don’t see that very often. But still no signs of real fear, no capitulation, no panic — just down, down, and down. The key consideration here is that there is still no sign of big money coming into this market. In fact, the big money has been leaving this market all year. … The longer the market continues down without a panic decline, the worse the ultimate panic will be when it arrives.”

First of all, Rev Shark is an ultra-short term trader constantly shuffling his portfolio daily as necessary. So capitulation by his definition is different than that of others.

I think he is mainly just referring to the give up that is necessary just for a short term bottom, which may or may not turn out to be a longer term bottom.

Frankly, I don’t know how you cannot call Oct 1987 capitulation. Just because markets continued higher after that? Sure it occurred during a very short time frame, but if you could measure puking/stress/pain/panic then Oct 1987 would probably be one of the major peaks. Why is that not capitulation?

You say it requires a laying down of arms, an admission of defeat. Isn’t hitting the sell button an admission of defeat? Wasn’t there massive just massive selling on Oct 1987? So investors appetite for equities returned after Oct 1987. So the market was positive for the year. Are you saying that there is a requirement for capitulation, that investors need to be down and out for years and years and that the market absolutely has to close majorly negative that year?

Just because stocks eventually roared back does not mean there was not capitulation at that point in time. Can’t capitulation occur at any time whether in a bear market or bull market?

Sorry, not ranting here, just asking.

In the last 2 weeks we had the volume on the NYSE produced volume with more than ten times as much upside volume as occurred on the downside…….a take-off of a 9-to-1 signal that Marty Zweig used to note occasionally…. usually bullish signs , but not much follow through yet

>>>In the last 2 weeks we had the volume on the NYSE produced volume with more than ten times as much upside volume as occurred on the downside…….a take-off of a 9-to-1 signal that Marty Zweig used to note occasionally…. usually bullish signs , but not much follow through yet<<< I think I know of the up thrust signals to which you are referring. One of the take aways is that the downside is almost always limited afterwards. So, if the S&P gives up more than 1-2% here, then the signal is likely false.

this market isn’t even close to 1987 …. we fell 800 points in 5 sessions including 500 in one… you couldn’t get reports for days ….. 33 specialist firms ran out of capital …. OTC rules changed forever after that as it brought about the beginning of SOES….. we’ll never see that again….. that’s capitulation …. read Black Monday by Metz , or the SEC’s 800 page report

I must have missed the capitulation. The only fear I saw out there was a fear of not buying all dips quickly enough.

Other than some traders caught the wrong way for the May expirations, there hasn’t been much selling at all.

There are many ways to measure capitulation, and the first responder to this post (Michael C.) also correctly points out the importance of making sure the discussion is on the same timeframe wave length (short-term capitulation vs long-term).

Either way, if you look at sentiment polls, money flows, options data, and many technical measures of breadth, the June low was about as capitulatory as we have seen in a few years. This does not mean that we won’t eventually break that low at some point, but it does suggest it won’t be for a while.

One thought is that we stay firm into August, historically the most common month during which the market sets its annual high. By that time, we will have worked off the oversold capitulation, and will be ready for new lows, if that is indeed what’s in the cards.

Capitulation is when CNBC is telling you to sell the indices short.

1987 was fun !!!!

the old axiom is that Bear markets don’t die violently , they usually die a quiet , slow , long bleed….. this market could drip , drip , drip for months and months

Zweig would also say that today’s market is negative. His 9:1 upside needs to be taken in context.

Zweig would also say that today’s market is negative. His 9:1 upside needs to be taken in context

…………………………….

please elaborate

For me bars/candlesticks with vol overlays are a more useful chart when examining “capitulations”. The huge hammers w/massive volume spike combined with 90/10 and 10/90 days are what I would call capitulation points.

It’s the same thing, just seems a little clearer graphically in bars rather than a line.

“First of all…

Frankly…

You say …

Just because…”

sounds like ranting to me mr. comeau.

Kind of OT, but not really….

Who is “Rev Shark” and is that his actual name or some jackass nickname like the doom n gloom and goldbug writer crowd are partial to? (e.g. “zorro”, “capt hook”, etc)

My favorite email from an anonymous coward at RM:

“BRCM down 50% isn’t capitulation ?”

Uh, no, SFB, its not.

I think the main distinction between crashes like 1987 and “ordinary” capitulation is the emotion at work. Capitulation runs its course as investors hit whatever sell point they’ve established for themselves. It could be technical, buy point, macro, whatever. It will be different for each investor, and as has been mentioned, the emotion at work will be disgust at his idea having not worked out. As the capitulation progresses, new thesis are formed by others seeing value, and eventually a bottom is formed. Liquidity is available on both sides of trades throughout the process.

Crashes involved manifest fear and panic. Liquidity becomes unbalanced and the process feeds on itself. Behavior changes suddenly, in much the same way as it does during emergency evacuations. The emotions and dynamics are quite different than during capitulations.

I see growing risks of a panic this time (not predicting one mind you, just noting risks). We all have fast computers, real time quotes, reliable broadband access, wireless alerts etc. today, so we all assume we’ll see the storm coming and can exit quickly. I’m not so sure.

Seems to me that capitulation is when you give up hope of the big payoff and just focus on protecting what you’ve got. We won’t see it until more people believe that 1) they’re better off in bonds, and 2) that the market will be much lower in six months or a year than it is now. It can come fast, in a panic, or slow, like a balloon deflating- but we don’t seem to be seeing it yet.

hey mike, love your realmoney photo. yeahh baby, yeahh!!

your a tiger.

Well, the subject of capitulation and where one sets the bar to define it as such is clearly subjective.

That much is clear…

How catty. You mean the lack of professionalism at RM actually stoops to those types of emails? Oh, I feel so filthy. lol. Have any of these people ever had real jobs where you disagree with peoplel on a daily basis but yet still keep a level of professionalism?

Well, hopefully, those dumkoffs are loading up on BRCM. They might have noticed it has decisively broken its five year trend line and dropped decisively below its 2004 top. It has a chance of bouncing at the 200 month moving average which also happens to be at another area of strong support, it’s 61% fib retracement. Until then, I hope they enjoy the ride because if we get there within the next few months, what’s it gonna do when and if we really start a correction?

Something that’s getting lost in this discussion is how ephemeral “capitulation” is. Back in 1987, if you had bought on the 20th after “capitulation,” Mr. Market would have summarily handed you your head over the next two weeks. And in 2000-2002, I can’t count the number of “capitulations” on my fingers and toes.

It is true that the 2000-2002 bear market ended in a whimper, and that the bottom in 1987 was relatively uneventful. My point is that we need to see more than a 5% loss on the S&P before “capitulation” even enters our vocabularies, and that capitulation is a relative term that would have lost you a hell of a lot of money trading off of over the years. Besides, to suggest that we’ve already seen capitulation after a 5% drop in the S&P is kinda strange to me.

BTW, Barry, what does SFB mean (if you have to use euphemisms I’ll understand, but that’s a new one to me).

SFB = The anon emailer

but it could also be “Stupid f&*%$ bast%^#@

Even with the weakness of the past few days, and even before today’s silly rally, my impression has been that the big boys want their summer rally. They want the market up going into the “traditional” September-October selling season. If that’s the case, they’ll probably get what they want. They usually do.

Gotcha now – was the way he signed his email. Wasn’t sure if that was some kind of acronym I didn’t know anything about or what.

I have an incredibly accurate measure of capitulation. I call it the Vomit Indicator. When it gets so bad that I literally want to hurl all over my keyboard, it signals capitulation and time to buy. Upchuck leads to up markets.

glad that DJIA -23% is not capitulation !!!

I added puts ons the QQQQ at the close. Nice to see no one else is buying this capitulation junk.

the market is not going down …

No capitulation today and High Low Logic Index rose another .11 to 1.31. Longs are abandoning poorer performers and crowding into the stronger stocks.

Saw it firsthand with the homies I’m short going down while the energies I watch went up. Tale of two cities…

Two ways to rectify that imbalance. 1) The weaker stocks get a bid and everything rallies. 2) The stronger stocks run out of new buyers and everything falls.

Also, New High/New Low Ratio was negative on this up day. The bump in the indexes masked what was really a bad day for the overall market.

This was the reason for spiking up INTC 2.5% and HPQ 2% from deep negative territory (both Dow components):

“Stocks fell at the opening bell and have been lower most of the day, but they were recently paring their losses, led by a rebound by technology stocks after chip bellwether KLA-Tencor said its fiscal FOURTH-quarter bookings COULD exceed guidance at semiconductor conference in California.”

(Shares of KLA-Tencor spiked 8% [and all other big tech companies spiked 2-3%] after this “COULD” in “4th” quarter)

It looks like another case of shorts panicking and jumping in front of each other to cover.

There are a lot of really dumb day traders in this market following the herd and buying / shorting stocks without really understanding why they are doing it.

This reminds me of 9% GM spike last week secondary to fairy tale GM-Nissan-Renault alliance rumor B.S.

All should take note: BR went WWII & Civil War in the same post!

Just out of curiosity — why stop short of including a line or two from “Pulp Fiction”?

per Estragon:

“We all have fast computers, real time quotes, reliable broadband access, wireless alerts etc. today, so we all assume we’ll see the storm coming and can exit quickly. I’m not so sure.”

Very interesting observation. But in the past, the problem has rarely been “I didn’t hear about it until it was too late” it has been “Just a correction, hold or good time to buy.” And I don’t see that changing.

I also don’t think that anything really important happens to the market in a single day anyway. For that matter, I don’t think that anything that happened last week was important given that the A team wasn’t even in town for the most part.

People got margin calls in May and June, but we haven’t seen anything resembling capitulation/exhaustion yet and probably won’t until September. A volatile, grinding slide seems the most likely course between now and then.

From Liz Rappaport’s Markets column at TheStreet.com:

The U.S. Treasury bond yield curve has inverted several times this year, but the current inversion has some economists ringing warning sirens about a possible recession or dire financial strain. As of the end of the day Tuesday, the two-year gained 1/32 to yield 5.10%, the 10-year Treasury gained 6/32 to yield 5.10%, and the 30-year bond added 10/32 to yield 5.15%.

Crucially, all those maturities have yields lower than the fed funds current target rate of 5.25%.

This condition has only happened four other times in the past 25 years, writes David Rosenberg, chief North American Economist at Merrill Lynch. Each time the Treasury yield curve traded below the fed funds rate, it preceded an economic horror story, a bond market rally, a decline in commodity prices and defensive-sector outperformance in the stock market, he reports. Rosenberg asserts that the big economic slide is also foretold by sharp declines in the housing stocks, the Nasdaq and the semiconductor indices.

http://www.thestreet.com/_tscana/markets/marketfeatures/10296195_2.html

whipsaw,

Most of the time, the real-time quotes won’t make a huge difference. But we haven’t yet had a real panic while everyone had real-time quotes, cell-phone alerts, and other instant information technology. Imagine everyone being used to having instant quotes and nearly-instant order fills and then encountering a high-volume market crash. When you realize that your quotes are half an hour behind and your market orders are taking 10 minutes to fill, you might panic more than you otherwise would. As estragon said, everyone thinks they can run for the exits on a moment’s notice. That might lead to people taking larger risks than they would if they expected that in the event of a really bad day, they might have to wait an hour or two to get an order filled. The risk is more in people expecting orders to fill quickly than in people expecting instant quotes.

Of course, the people who will panic most are the day traders that don’t know what they are doing. And they would panic even without quick access to information if the market looked like it was crashing. So maybe it won’t matter. I doubt the big players will panic just because their data feed slows down a bit. But there must be a few hedge funds that think they will always be as fast as they are in a normal market. I bet there are some really large hedge funds that are guarding their positions with stop orders instead of options or offsetting positions. There are probably even a few large hedge funds that are guarding against losses with virtual stop orders on their own computers that won’t even notice the market dropping if the volume gets high enough to slow down data feeds. When large hedge funds blow up, anything can happen.

Yup, GRL, it’s kind of obvious that the train is coming and one should best step away from the tracks. But I would add that “defensive-sector outperformance” is Wall Street code for “loses less money” rather than a pointer to a good hiding place.

To my mind, the issue isn’t directional, it’s whether we are heading into typical recession or stagflation? I lean towards the latter in which case TIPS might be the way to go for a while I suppose.

per jkw:

“Most of the time, the real-time quotes won’t make a huge difference. But we haven’t yet had a real panic while everyone had real-time quotes, cell-phone alerts, and other instant information technology. Imagine everyone being used to having instant quotes and nearly-instant order fills and then encountering a high-volume market crash. When you realize that your quotes are half an hour behind and your market orders are taking 10 minutes to fill, you might panic more than you otherwise would.”

Good point. But maybe I am just unduly cynical because what I think would happen in that scenario is:

_Nobody would care about the day traders or most individual investors, they just die and aren’t that important anyway

_Nobody would care about a hedge fund unless it was duly connected to the power structure- some are and some aren’t

_If anybody with a lot of juice was in danger of taking a major hit, trading would be stopped, probably because of a “terror threat.”

I think that 1987 and 1998 taught the Big Boys that market manipulation must be a full time pursuit, so I don’t think that we’ll see any more 500+ DJIA plunges in a day.

In 1987 it was reported that many market makers simply stopped answering their telephones, focusing on larger institutional clients and their own book, causing smaller clients to lose more because they could not exit their positions. There are companies now offering ‘direct’ access to a market but it is not clear that will make a substantial difference when everyone rushes to the exit: the network will either fail or begin to oscillate as gates snap open and shut (rather than just slowing, data will stop then flood then stop, with the distinct possibility information will be become corrupt in the process); what is worse – no data or incorrect data?

1987 came a lot closer to the bone than the blip it now represents on a long-term chart would indicate IMO — only massive intervention and strenuous jawboning by the Fed prevented it from becoming a full-scale rout — but I would agree it was not a “capitulation” (with its strong connotation of beaten down weariness), it was a panic, an introduction to the gustatory pleasures of an adrenalin and bile cocktail.

I agree with RW – There is a difference between capitulation and panic.

What has happened to Real Money?

Shark says the same thing 3 days in a row (wrongly I might add), and they seem to be tripping over each other to congratulate him.

Last week he was talking capitulation then Monday, then Tuesday. Are you right if you say the same thing over and over until it is eventually right?

SW ——–happens on this site all the time