Source: Dave Wilson, Bloomberg

The general rap against this market is that its being driven by “only a handful of stocks.”

If you are a thoughtful analyst, you need to consider something else. It sounds scary that only a few stocks are responsible for most of the gains, but the key question to ask is “What does history show about SPX gains relative to the number of stock drivers: Are we in an aberrational period relative to the past, or is this merely business as usual?”

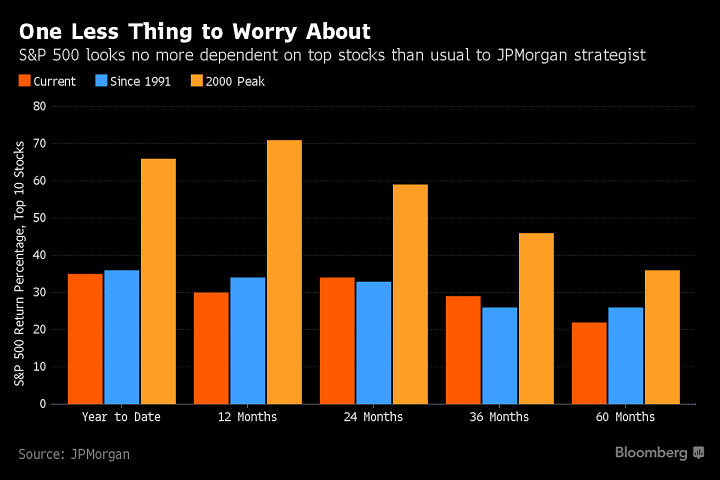

The answer to that question comes fromJPMorgan’s Dubravko Lakos-Bujas. He posed the claim “Too few stocks are pushing the S&P 500 Index higher” and found it overstated.

The data showed the 10 stocks adding the most to the index this year accounted for a combined 35 percent of its advance. This was in line with the 36 percent average for five-month time periods since 1991 and far below the 66 percent when stocks peaked in 2000. (Report: JPM) You can see this in chart above.

What's been said:

Discussions found on the web: