Don’t Bet on a Market Crash If Trump Gets Ousted

Based on the past, major political events don’t have much effect.

Bloomberg, August 24, 2018

President @realDonaldTrump: “I don’t know how you can impeach somebody who’s done a great job.” pic.twitter.com/3BZNpSzish

— Fox News (@FoxNews) August 23, 2018

On Tuesday, after two key allies of Donald Trump — his former campaign manager and his personal attorney — become felons, the president declared in an interview with “Fox & Friends”:

If I ever got impeached, I think the market would crash. I think everybody would be very poor. Because without this thinking, you would see numbers that you wouldn’t believe in reverse … I got rid of regulations. The tax cut was a tremendous thing.

It is an assertion that deserves closer scrutiny: What happens when external events roil markets? How do impeachments, or for that matter, military or terror attacks or even presidential assassinations, affect equity markets?

The short answer: Truly unanticipated events — think Pearl Harbor, Sept. 11 or John F. Kennedy’s assassination — cause markets to temporarily wobble under the strain of the emotional shock. Once that subsides in a few days or weeks, markets then resume their prior trends.

The more telegraphed events, where probabilities were well understood — and I believe we can include the 2003 invasion of Iraq, the impeachment of Bill Clinton, even Brexit and the election of Trump — hardly affect markets at all. Let’s take a closer look at these events to see what we can learn.

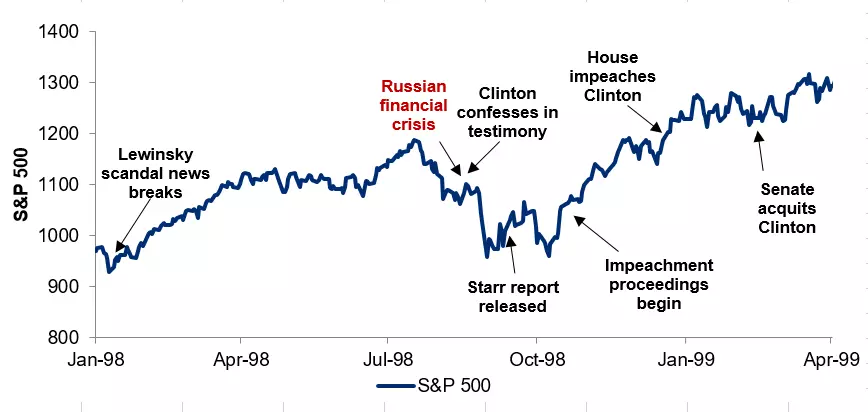

• Nixon and Clinton: The impeachment of Clinton in December 1998 and President Richard Nixon’s resignation to avoid being impeached in August 1974 each took place in very different market and economic environments. Clinton’s travails occurred amid a roaring economic expansion, modest inflation and a technology boom. The torrid stock market shook off the impeachment, and finished the year strongly.

Nixon faced the opposite set of economic and market conditions. Inflation became worrisome in 1972, and was aggravated by the 1973 oil embargo. The Standard & Poor’s 500 Index peaked in early 1973 and then proceeded to plunge 47 percent by October 1974.

Nixon’s resignation on Aug. 9, 1974, was in the late innings for the market collapse. Stocks were already in a steep decline before Nixon departed, and that trend continued for several months after he left office. In other words, there’s nothing here to suggest that either presidential event played any role in the direction of the stock markets, either before or after.

• The JFK assassination: When Kennedy was inaugurated, the markets had been rising at a healthy pace. The assassination on Nov. 22, 1963, certainly shocked the market. The S&P 500 fell 2.8 percent that day. But it quickly rebounded in the ensuing days, resuming its upward trend. Sam Stovall, chief equity strategist at S&P Capital IQ, told USA Today on the 50th anniversary of the killing that “Wall Street assessed very early on that the assassination, while tragic, would not alter U.S. or global growth … It’s not as if the death of the president would close shipping lanes, or cause oil wells to shut off or interest rates to spike.” Stocks gained 25 percent during the next 12 months.

• Pearl Harbor, Sept. 11: When each of these surprise attacks occurred, markets around the world reacted immediately. The day after the Japanese attack on the U.S. military facilities at Pearl Harbor, equities fell 4.4 percent; the following day they dropped another 3.2 percent, then stabilized. Anyone who was a buyer the week after the attacks saw surprisingly strong gains through the end of the war.

The 9/11 attacks on a Tuesday forced the New York Stock Exchange to close for the rest of the week in the longest shutdown since 1933. When the exchange opened the next Monday, the Dow Jones Industrial Average fell 7.1 percent while the S&P 500 declined 4.9 percent. Although these declines were big, directionally they were in keeping with market trends since March 2000, which marked the peak of the dot-com boom.

Having a better understanding of what drives long-term market returns is helpful when analyzing these external geopolitical events. Politics tends to be noisy and distracting, and while it makes for good headlines, it is typically not relevant to investing.

The more relevant questions to ask are: How do these events affect revenues and earnings? Could this event have an impact on inflation, and therefore interest rates? Last, will this dampen investor sentiment and thus affect risk appetites?

Global capital markets are vast, taking in hundreds of trillions of dollars. To derail that takes more than a temporary event involving the legal status of the American president. A large part of the world’s interest in the U.S.’s stock market is the institutional support for the rule of law, and although Trump has recklessly attacked it, this institutional framework remains in place.

What about a President Mike Pence? The things the equity markets like about Trump — tax cuts, deregulation and deficit spending — are likely to continue under a Pence administration.

I suspect the markets would be just fine with that.

Markets Don’t Care About Impeachment . . .

Source: FT Alphaville

—

I originally published this at Bloomberg, August 24, 2018. All of my Bloomberg columns can be found here and here.