This is a little inside baseball, but in light of the various conversations I have have down in Florida about trading and fees and data costs, this BusinessWeek discussion is intriguing:

“Banks, brokers, and traders have complained about the cost of getting data feeds from most of the exchanges. (Bloomberg LP, the parent company of Bloomberg Businessweek, has also contested some of these fees with regulators.) Virtu last year noted it can cost a trader $3.2 million a year for a single vital category of feeds from exchanges. Exchanges say they provide a lot of value for what they charge.

Nasdaq Chief Executive Officer Adena Friedman said in October that exchanges, by fueling a shift toward automation, have helped bring down investors’ costs dramatically. “The reality is that most Main Street investors pay nothing for quote and trade data, while the cost of retail commissions have been falling,” she told analysts on a conference call.”

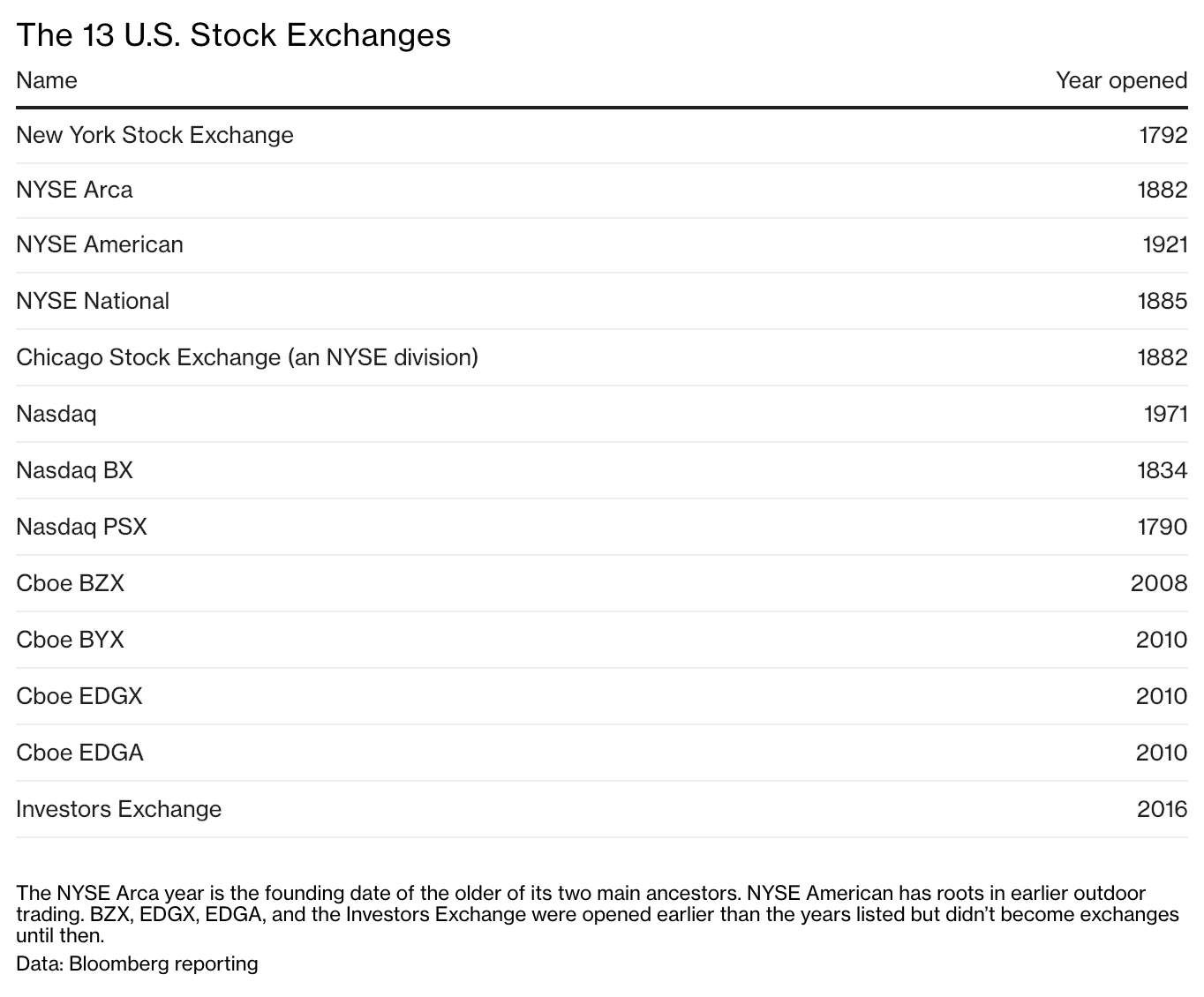

Other than the NYSE I had no idea how old some of these exchanges actually were:

Wall Street’s Biggest Traders Are Building Their Own Exchange

Source: Bloomberg