The Federal Open Market Committee is meeting today. There is a lot to unpack here, but let’s get one thing straight: This is a completely unnecessary rate cut, one that is motivated by political expediency, not economic needs.

It is reckless, it is irresponsible, and it dramatically increases the possibility of another 2008-09 like disaster.

Of all the norms which Trump as President of the United States has violated, perhaps the single most dangerous one is his politicization of the Federal Reserve. The ramifications are significant: potential for long-lasting economic damage is getting ratcheted up, and the institution of the Federal Reserve is being damaged.

Do I have your attention yet? Good, because there is a lot more to discuss.

Let’s start with the obvious: Ask yourself: Why does “the greatest economy ever,” with a 3.8% unemployment rate and 21.54 million new jobs created since January 2010 (when the recession ended) even need a rate cut?

There are very few legitimate reasons to cut rates from the low Effective Federal Funds rate of 2.38%. Some argue Underemployment is a reason, others say its insurance against an ordinary recession (?!), still others say it is needed to reduce the strength of the US Dollar.

To which I call bullshit.

None of those are persuasive. And, all of those must be weighed against a basic understanding of what we just lived through a mere decade ago in the financial crisis: It had numerous drivers, but the entire crisis can trace its roots back to the ultra-low rates of the Greenspan Fed. They took rates under 2% for 3 years, to 1% for a full year. That kicked off a massive inflationary spiral in everything priced in dollars or credit. Dropping rates raises the risk of a repeat of that disaster. That’s why the Fed had been on the path to normalizing rates the past 24 months. Avoiding a repeat GFC is why the Fed has been moving away from ZIRP.

The Fed remains on emergency footing and normalizing their monetary posture has been their primary motivation the past few years. Perhaps you can claim the Fed should move more slowly on quantitative tightening (e.g., the unwind of QE) but that is trimming the tabs, and not much more.

The more compelling reason for cutting rates is obvious: The presidential election next year. That is why POTUS has been jawboning the Federal Reserve vociferously. It an assault on the independence of the Central Bank unprecedented in modern history.

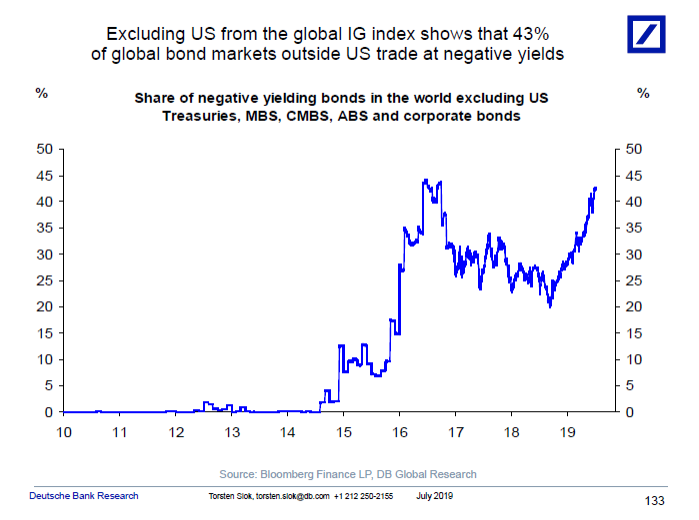

43% of global bonds ex-US trade at negative yields

Source: Torsten Sløk, Deutsche Bank Securities

As the nearby chart shows, global markets don’t appear to need a rate cut. : Torsten Sløk of Deutsche Bank Securities explains:

Excluding US Treasuries, US corporate bonds, MBS, CMBS, and ABS shows that 43% of the global ex-US IG index is trading at negative yields at the moment, up from 20% late last year, see chart below. With this backdrop, it is not a surprise if real money investors in Europe, Japan, and Asia show renewed interest in buying US credit, in particular when the Fed at the same time is cutting short rates and thereby lowering hedging costs for foreigners buying US fixed income.

Which brings us back to the political motivations of today’s rate cut.

Recall Trump complained earlier in the recovery that then Fed Chair Janet Yellen “should be ashamed” of low rates and that “the Fed has created a “false stock market.” Now, with the economy much further recovered, unemployment lower and inflation higher, he demands those low shameful rates.

Hold Trump’s hypocrisy aside and recognize his modus operandi: He may be a terrible long-term strategist, but as we have seen over the past 5-years, he is a brilliant short-term tactician. The tax cuts he passed, and now these lower rates, both create great very short-term results.

The problem is they are sugar highs, that leave you worse off then when you began. He will be gone in either 2 or 6 years, and the clean-up will be someone else’s problem. That’s his MO. And the damage he will have wrought will take a generation to repair.

Never give in to blackmailers on the false belief that the first payment makes them go away.

UPDATE 1: July 31, 2019 12:55 pm

I see a few others have said similar things:

NYT: Why We Should Fear Easy Money

Fortune: Why the Fed Lowering Interest Rates Would Be a Mistake

WSJ: Why the Fed Is Cutting Rates When the Economy Looks Good

CNN: Trump’s attacks on the Fed are about to get worse.

UPDATE 2: July 31, 2019 4pm

Bloomberg:

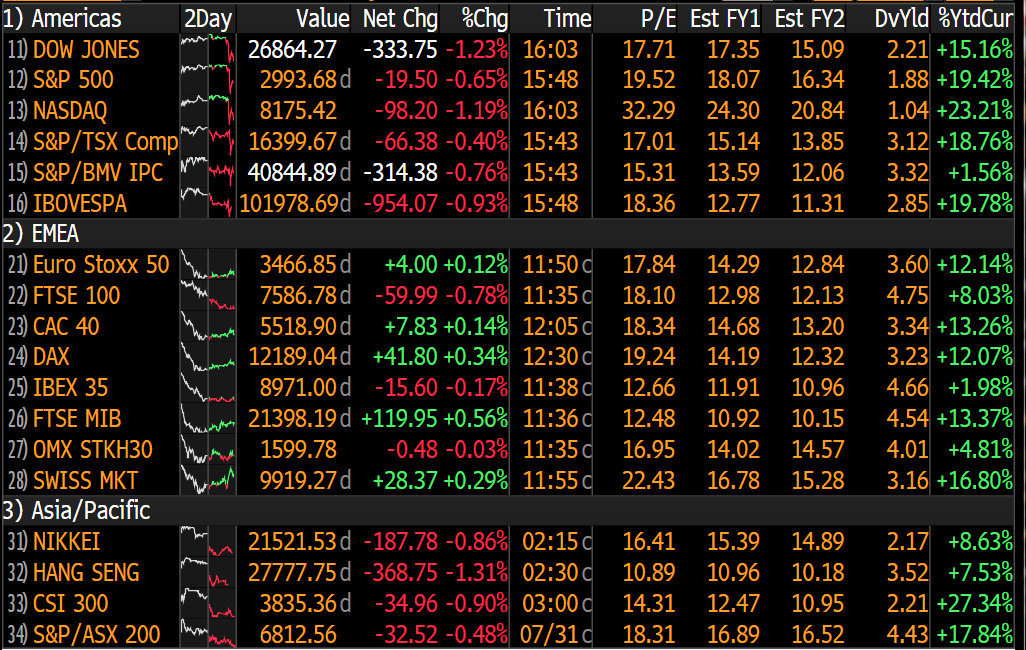

“The S&P 500 Index fell as much as 1.8% after the Fed chairman said the quarter-point cut amounted to a “mid-term policy adjustment,” fueling speculation the central bank is not necessarily at the start of an easing cycle. The measure rebounded more than 1% after Powell said the Fed hasn’t ruled out further cuts. The 10-year yield held near 2.01%, while the two-year rate jumped to 1.88%. The dollar advanced versus major peers, and gold slid.”