A short digression about an interesting topic:

What is an investable asset class?

This seems like an obvious question — but the answer may be more nuanced than you might think. Try to create a definition yourself, and it goes something like this. An investable asset class consists of a set of members that all share the characteristics of being:

-Readily identifiable;

-Easily objectively valued;

-Trades on a market that is deep and liquid;

-if no market, than a reliable method exists for pricing and transactions;

-Fungible – any one of them (e.g., share of Amazon) can be substituted for any other;

-Legally identical – all are subject to the same laws and regulations;

-Has positive returns expectations.

There is some wiggle room in that definition — some companies are harder to value than others, and what is anyone’s return expectations for negative yielding bonds? — but there are ways to work around those issues.

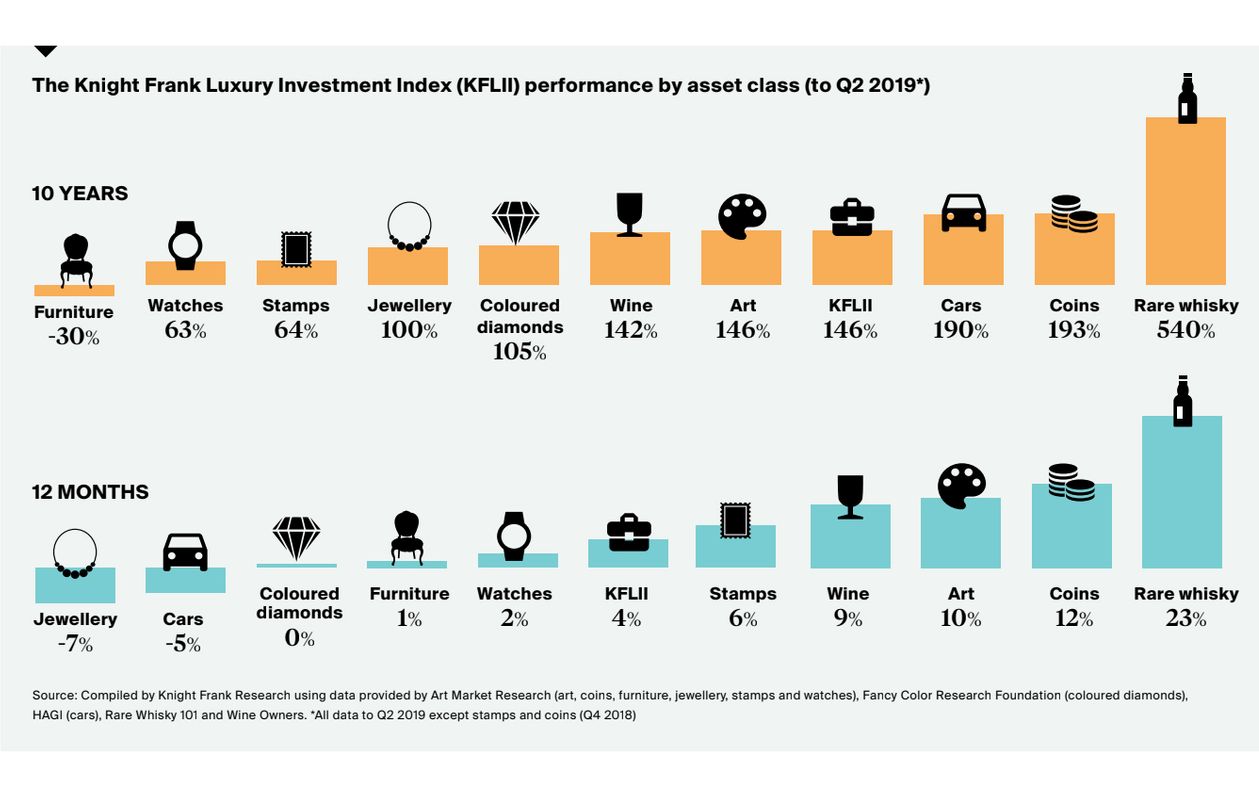

Consider the graphic above. Are they truly asset classes? I think the phrase “valuable collectibles” better describes what they are.

For example: Classic cars, in either original or fully restored state, are not identical. Take two of the same 190 Porsche 365s; they are not identical nor fungible and even they may have left the factory as identical twins, they no longer are. The market for art is completely subjective and driven by thew whims of a few dozen billionaire buyers and even fewer galleries. That is hardly the definition of a deep marketplace. The same for furniture, beanie babies, jewelry, sneakers, and diamonds.

Rare whiskey? How deep and liquid (no pun intended) is that market?

Previously:

Survivorship Bias (& Compounding) in The Art World (May 16, 2019)

Survivorship Bias on Wheels (August 14, 2018)