This week on our Masters in Business interview, we speak with David Enrich, Finance editor at the New York Times. He is the author of The Spider Network about the LIBOR manipulation scandal; his new book is “Dark Towers: Deutsche Bank, Donald Trump, and an Epic Trail of Destruction.”

Enrich discusses how Deutsche Bank changed from a sleepy, provincial bank focused on serving local German companies into a global juggernaut. They were early proponents of using derivatives to hedge positions, and began morphing into a more Wall Street like investment bank. A “blinder’s on, short-term focused, decision making” process led to both its rise and subsequent fall.

Deutsche bank spent 10 billion dollars purchasing Banker’s Trust in the late 1990s, and that led to a complete change of the bank’s culture. He explains how the “great migration” of 1000s of traders from firms like Merrill Lynch and UBS to Deutsche completely changed the nature of the firm’s revenues and power structure. Even the bank’s official language changed from German to English.

The focus on return on equity led to a shift in both clients and risk profile. The bank’s internal supervision — as well as regulators in the U.S. and Germany — failed to adequately stay on top of the massive growth of assets and risk at the bank. Making matters worse was a terrible patchwork of inconsistent computer systems unable to track all of the banks positions. This led to an inability of the bank to monitor in real time (or even quarterly) its own risks.

Perhaps most shocking is how Deutsche Bank became Trump’s sole banker in the 2000s. After Trump defaulted on a loan for a Chicago Skyscraper, he got banned from division (Construction Lending), he somehow managed to become a client of a different division (Private Banking).

A long list of his favorite books are here; A transcript of our conversation is available here.

You can stream and download our full conversation, including the podcast extras on iTunes, Spotify, Overcast, Google, Bloomberg, and Stitcher. All of our earlier podcasts on your favorite pod hosts can be found here.

Be sure to check out our Masters in Business next week with Simon Hallett, Co-CIO at Harding Loevner, which manages about $70 billion dollars. Hallett is also the owner of Plymouth Argyle Football Club, a League One team based in the city of Plymouth, Devon, England.

David Enrich Authored Books

The Spider Network: How a Math Genius and a Gang of Scheming Bankers Pulled Off One of the Greatest Scams in History by David Einrich

Dark Towers : Deutsche Bank, Donald Trump, and an Epic Trail of Destruction by David Einrich

David Enrich Favorite Books

Straight Man by Richard Russo

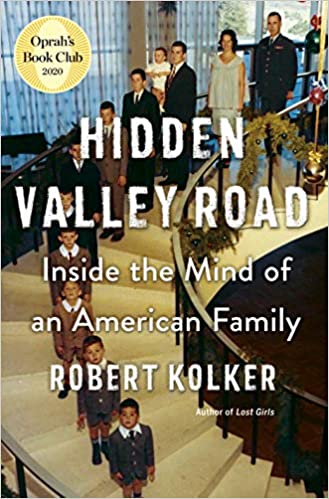

Hidden Valley Road: Inside the Mind of an American Family by Robert Kolker

Or I’ll Dress You In Mourning by Larry Collins and Dominique Lapierre