Source: FT Portfolios

So You Think You Can Time the Market?

All it takes is a couple of lucky trades to end up with a false belief in one’s ability to jump in and out at the right times.

Bloomberg, August 25, 2020

How are your market timing skills?

Quite a few investors imagine themselves to be pretty good timers. This is usually an example of delusional over-confidence, rarely demonstrates by a P&L. The recipe for this misbelief is one-part hindsight bias (“I saw that crash coming”), two-parts Dunning-Kruger metacognitive failure. Add to that a dollop of selective retention as to one’s past successes; Combine together, marinate over time, and voilà! A false misbelief in one’s own skillset in jumping in and out of markets at the right times.

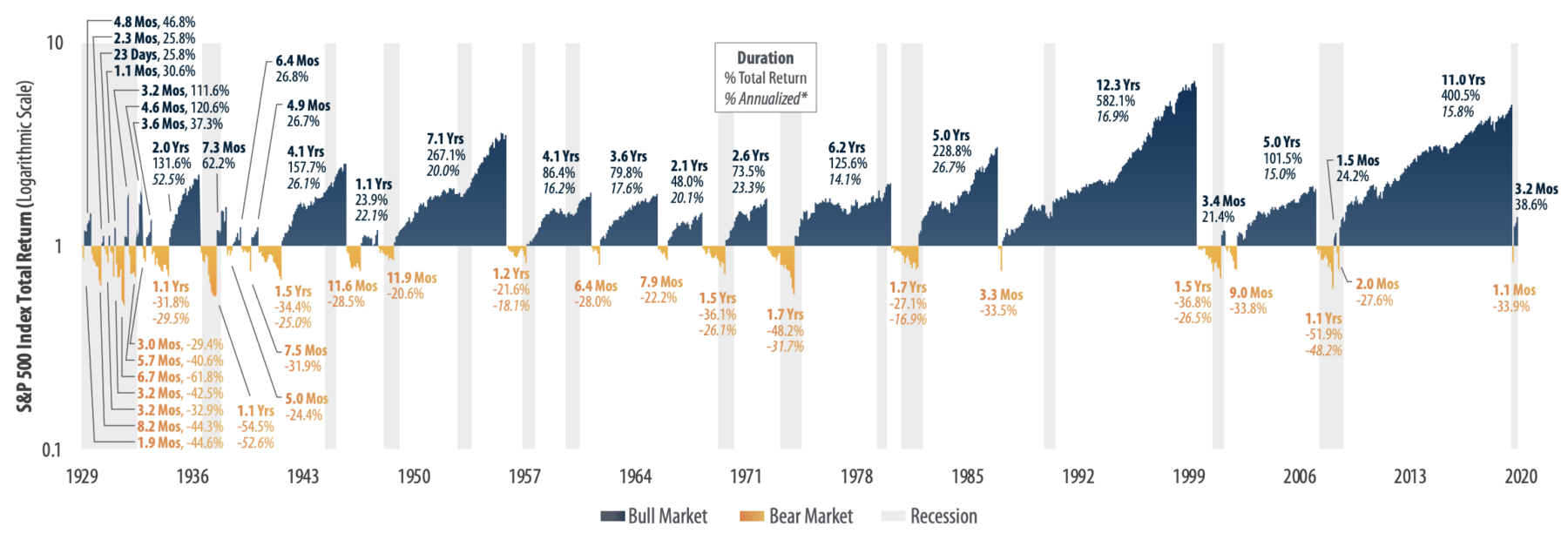

Those of you who fantasize about being able to sidestep the downturns but still participate in the recoveries should ask yourself these simple questions: 1) What repeatable, not chance-based process would have had you selling equities in late February near the highs? 2) What process would you have followed to buy back in after the 34% collapse? 3) Would you have had the discipline to ignore your instincts to make a timely repurchase near the March 23rd lows? Both ends of that trade are hard to time, emotionally challenging to execute and more costly than many people realize.

I was reminded of the risks of trying to time the market by a recent column from my Bloomberg Opinion colleague Farnoosh Torabi. Last month, Torabi explained why she was reducing her equity exposure from 81% of her portfolio to 60%, and tripling her fixed-income holdings to 27% in her retirement accounts. For a variety of reasons, not least of which is her age – she has decades before she retires – I would have advised her against those actions.

As someone who has had a decent amount of luck1 in the timing space – emphasis on the word “luck” – I am both fascinated and horrified by how timing is done by retail investors. Given 2020’s first quarter sell off and new highs in the third quarter, let’s consider all that goes into attempting to time the market, its emotional challenges and financial costs.

The Exit: What motivates people to exit equities, in whole or in part? Most of the time, it is emotion. I almost never hear investors say, “Everything is going great, the market and the economy look fantastic. Liquidate all of my holdings immediately!” But that is pretty much what you would need to do to catch the market at a top. It is rarely cool, contemplative analysis about a high probability event that no one else sees. Those are incredibly rare, as is having the personality to manage the process.

What tends to happen is that as markets fall, the drumbeat of bad news feeds upon itself. Eventually, that leads to panic. Too often, the exit is part of what technical types call “capitulation.” The word means “total surrender” and it usually results in doing whatever it takes to make the pain stop. There’s no shortage of studies showing that strategy is never the recipe for strong market returns.

The Re-Entry: Getting back in when everyone else wants out is even harder to do. We have evolved as social primates, and our skills in cooperation and group dynamics create a distinct survival advantage. Doing the exact opposite of what your peers are doing requires fighting your most basic instincts. Buying into a panic selloff is much easier said than done. You have a choice of a variety of indicators – technical, quantitative, sentiment, momentum, economic – but none have been shown reliability in nailing the lows.

Catching the bottom requires three things: First, you must have a subjective feel for when stocks have reached their nadir and that the selling has reached its conclusion. Second, you must have conviction in your ability to do what nearly all investors cannot. And last, you must have the discipline to act on your beliefs, following your trading plan despite the mayhem that occurs near market bottoms.

If any of this were easy, people would nail the lows all the time, but we know they don’t.

The Costs: Do not forget that you have a partner in all of your trading: Uncle Sam. Even after the Tax Cuts and Jobs Act of 2017, capital gains taxes still exact a hefty premium for non-qualified (not tax deferred) accounts. This is a hefty price to pay for the small chance of getting the timing right.

Depending upon the length of your holding, your tax bracket, and which state you live in, the government could end up capturing more than a third of your gains. Long-term Federal tax rate on capital gains can be as high as 23.8%; add in your state taxes as much as 13.3%, and you quickly realize that Uncle Sam is more than a silent, junior partner.2 Short-term is even worse, as high as your individual tax bracket.

This is a huge bogie to overcome. You don’t only have to get the top and the bottom right, but you must exceed the 20% to 30% “vig” on the transaction due to realized gains caused by the exit just to break even. If you had been riding the equity train since the Great Financial Crisis ended, that is an enormous amount of tax to pay for the mere chance to sidestep a downturn.

It turns out that most people are much better off merely riding it out than trying to time the market. Unless you have developed a secret formula that none of the Ph.D’s roaming Wall Street have been able to replicate that ensures being able to successfully move in and out of equities, do your future self a favor and stay away from market timing.

Previously:

The Timing Mistake: Thoughts & Pushback (August 26, 2020)

Don’t Panic! with apologies to Douglas Adams (March 9, 2020)

Watching From Afar (March 2, 2020)

Capitulation? Hardly (July 11, 2006)

__________

1. See, e.g, my 2006-09 writing on the coming real estate crash and its impact on the stock market, suggesting the Dow Jones Industrial Average stocks could see 6,800 as a potential downside target.

Rank State Rates 2019 Rates 2020

1 California 13.30% 13.30%

2 Hawaii * 11.00% 11.00%

3 New Jersey * 10.75% 10.75%

4 Oregon * 9.90% 9.90%

5 Minnesota 9.85% 9.85%

6 D.C. 8.95% 8.95%

7 New York * 8.82% 8.82%

8 Vermont 8.75% 8.75%

9 Iowa * 8.53% 8.53%

10 Wisconsin * 7.65% 7.65%