How Corporations Scam Their Shareholders and Screw Over Workers

C-suite executives use share buybacks to manipulate stock prices for their own benefit, and no one else’s.

Bruce Bartlett, The New Republic, September 28, 2020

I recently wrote about the pernicious effect of Milton Friedman’s idea that public corporations should focus exclusively on shareholders, ignoring the interests of other stakeholders including employees, customers, and the communities in which companies operate. The single-minded focus on maximizing shareholder value has caused companies to sacrifice long-term value for short-term profits and, ironically, enriched corporate executives at the expense of shareholders.

At virtually the same time that the “shareholder revolution” was launched, corporations adopted a policy of downgrading dividends. This, too, was designed to deliver earnings to shareholders via the aggressive use of share buybacks. The buyback policy reinforced the negative trends resulting from the doctrine of shareholder primacy—including a decline in labor’s share of national income, higher pay for corporate executives and greater income inequality, reduced corporate investment, and slower economic growth.

It used to be that the main reason people bought corporate stock was for the dividend yield; the hope for a rising share price was a secondary consideration. But as corporations focused more on generating profits to the exclusion of all else and managerial compensation increasingly took the form of stock options, the share price became the primary focus, with dividends falling in importance. Over time, share repurchases became a substitute for dividends.

Managers rationalized the practice by saying they were doing shareholders a favor: Dividends were taxed as ordinary income, whereas capital gains were taxed much more lightly. Moreover, capital gains taxes weren’t payable until shares were sold, while taxes on dividends had to be paid annually. Assuming a share repurchase raised share prices by the same amount as would be the case if the money were paid out as a cash dividend, taxable shareholders would prefer share buybacks. (However, the bulk of shares are owned by nontaxable pension funds.)

But there are problems. One is that managers can control the timing of share buybacks, which they use to pump up stock prices around the time their stock options are vested. Here is the summary of a recent study of the explosion in buybacks:

We show that CEOs strategically time corporate news releases to coincide with months in which their equity vests. These vesting months are determined by equity grants made several years prior, and thus unlikely driven by the current information environment. CEOs reallocate news into vesting months, and away from prior and subsequent months. They release 5 percent more discretionary news in vesting months than prior months, but there is no difference for non-discretionary news. These news releases lead to favorable media coverage, suggesting they are positive in tone. They also generate a temporary run-up in stock prices and market liquidity, potentially resulting from increased investor attention or reduced information asymmetry. The CEO takes advantage of these effects by cashing out shortly after the news releases.

In effect, corporate executives use buybacks to manipulate stock prices for their own benefit. Indeed, for many years, corporations were restricted by the Securities and Exchange Commission from using profits to buy back shares precisely because it could too easily be done to manipulate stock prices. But the SEC changed its policy in 1983. Federal Reserve Board chairman Alan Greenspan explained the significance in a 2002 speech:

Prior to the past several decades, earnings forecasts were not nearly so important a factor in assessing the value of corporations. In fact, I do not recall price-to-earnings ratios as a prominent statistic in the 1950s. Instead, investors tended to value stocks on the basis of their dividend yields. Since the early 1980s, however, corporations increasingly have been paying out cash to shareholders in the form of share repurchases rather than dividends. The marginal individual tax rate on dividends, with rare exceptions, has always been higher than the marginal tax rate on capital gains that repurchases create by raising per share earnings through share reduction. But, until the early 1980s, share repurchases were frowned upon by the Securities and Exchange Commission, and companies that repurchased shares took the risk of being investigated for price manipulation.

In 1982, the SEC gave companies a safe harbor to conduct share repurchases without risk of investigation. This action prompted a marked shift toward repurchases in lieu of dividends to avail shareholders of a lower tax rate on their cash receipts. More recently, a desire to manage shareholder dilution from the rising incidence of employee stock options has also spurred repurchases.

As a consequence, dividend payout ratios, which in decades past averaged about 55 percent, have in recent years fallen on average to about 35 percent. But because share prices have risen so much more than earnings in recent years, dividend yields — the ratio of dividends per share to a company’s share price – have fallen appreciably more than the payout ratio. A half-century ago, for example, dividend yields on stocks typically averaged 6 percent. Today such yields are barely above 1 percent.

The sharp fall in dividend payout ratios and yields has dramatically shifted the focus of stock price evaluation toward earnings. Unlike cash dividends, whose value is unambiguous, there is no unambiguously “correct” value of earnings.

Former SEC Commissioner Robert Jackson warned that corporate executives frequently take advantage of buyback-driven spikes in stock prices to dump shares, thus capturing for themselves gains that belong to public shareholders. “The evidence shows that buybacks give executives an opportunity to take significant cash off the table, breaking the pay-performance link,” Jackson said in a 2018 speech. He added that SEC rules do not prohibit or even discourage such self-dealing.

In a 2019 letter to Senator Chris Van Hollen, Democrat of Maryland, Jackson said his staff’s research showed that the main victims of this action are long-term investors. After a short-term price pop, firms with significant executive cash-outs tended to see their stock prices underperform the market.

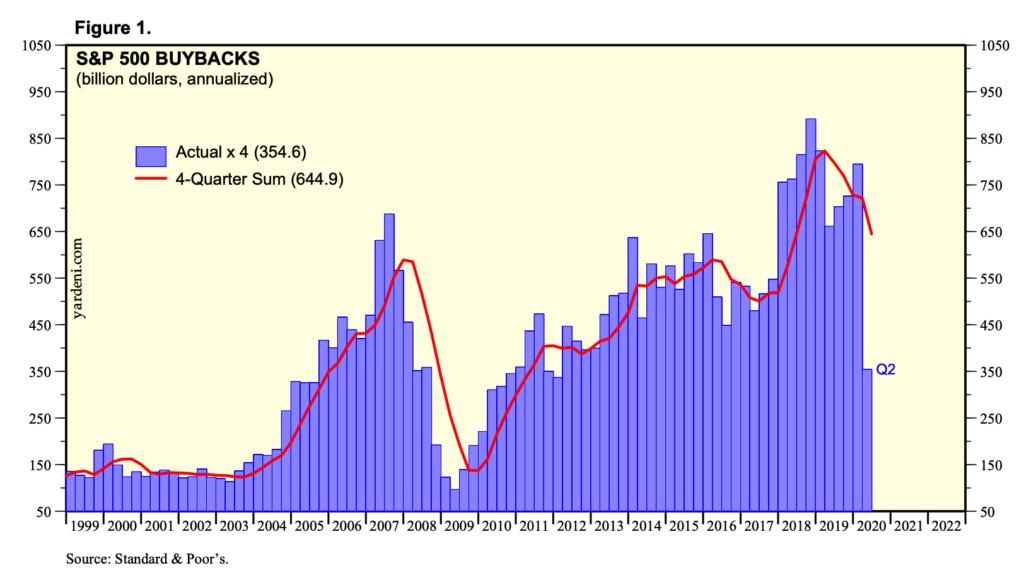

In 1980, corporations repurchased just $6.6 billion of their own stock. By 2000, that amount had risen to more than $200 billion. In the 2000s, the percentage of corporate profits paid out as share buybacks sharply increased. Before the recent economic slowdown, they approached $1 trillion per year.

But shareholders don’t benefit a great deal from all this paper revenue because shares are constantly being diluted by stock options granted to corporate executives, which were given a tax preference in 1981. The net benefit to shareholders is much less since much of the share buybacks simply offsets the dilution. Financial analyst Will Becker explains another problem:

Buybacks are typically initiated in good times when stock prices are high…. Corporations end up purchasing their own stock at inflated prices, only to have many of these same shares then redeemed by management as compensation committees increasingly hand out these perks in good times.

When an employee exercises her stock options, the company issues new stock to cover them. Thus stock options inherently dilute the value of the shares held by existing shareholders. When corporate profits are used for stock buybacks, shares are taken out of the market and held by the corporation; thus the number of shares outstanding falls and makes each remaining share worth more. If a company issues $100 million in stock options and buys back $100 million worth of shares, it’s a wash; existing shareholders have not benefitted. If the company buys back $150 million in shares, only $50 million of the buyback really benefits shareholders.

Because stock options don’t involve a direct cash outlay, as is the case with wages, shareholders tend to view them as cheaper than salaries. In reality, though, they are extremely costly from the point of view of the shareholder, coming directly at their expense. For this reason, many economists believe it would be better from the shareholder’s point of view if companies abandoned buybacks and went back to issuing dividends. The need to pay dividends and avoid reducing stock yields tends to discipline corporate executives to manage for the long term.

Disturbingly, there’s also growing evidence that share buybacks come at the expense of long-term profitability and the economy as a whole, because they lead managers to reduce or postpone investment spending for new projects, research and development, advertising and maintenance in order to meet near-term earnings targets. Buybacks also tend to raise corporate indebtedness and leverage, which can increase bankruptcies in an economic downturn. In other words, managers are literally destroying shareholder value as a routine way of doing business. This helps explain why nonresidential fixed investment has fallen even as overall profitability has risen.

The 2017 tax give-away appears to have led to an increase in share buybacks at the expense of federal revenue and corporate investment. Pressure to maintain corporate payouts may also be responsible for larger-than-necessary layoffs during the COVID-19 crisis.

There is now growing interest among both academics and policymakers to reform the law regarding share buybacks. And the interest is bipartisan. Senators Chuck Schumer, Democrat of New York, and Bernie Sanders, Independent from Vermont, are pushing legislation in this area, and even Donald Trump has expressed concern that government bailout funds have financed share buybacks. This is no assurance that something will actually happen, but at least there is growing recognition that we have a problem.

~~~