To hear an audio spoken word version of this post, click here.

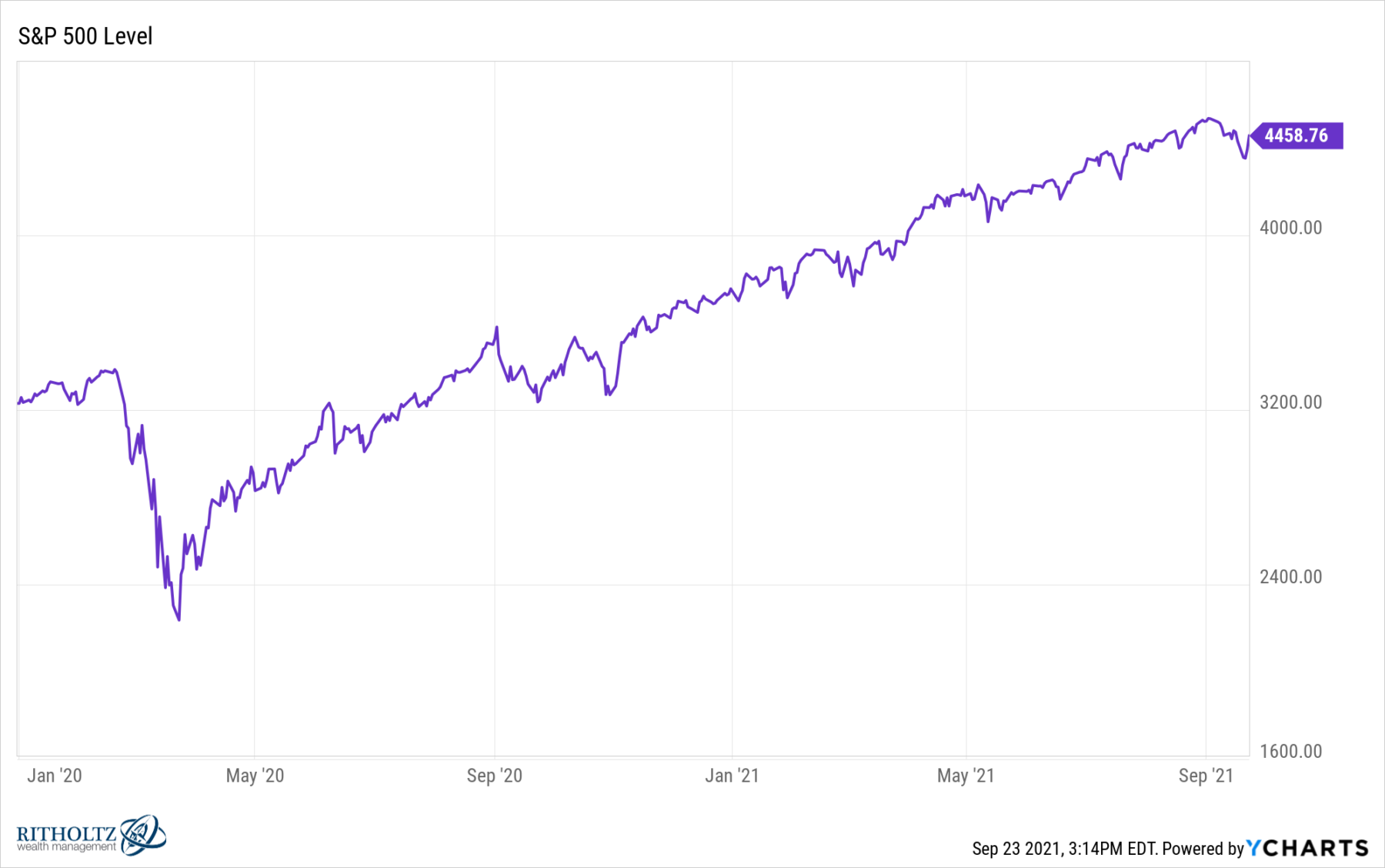

The Covid crash recovery (March 23, 2020 to present) was starting to look like it was on shaky ground: High equity prices, an uptick in market volatility after a period of tranquility, concerns about the Federal Reserve ending QE + low rates, credit problems with Chinese Real Estate Developers (Evergrande, plus Sinic and China Fortune Land) and more.

There are plenty of worst–case scenarios to consider if that is your preferred poison. Evolution has primed your brain to identify possible threats to your survival, hence our focus on the negative. But suppress that inherent bias for a few moments to try a simple thought experiment of inversion. Given my overall constructive stance on markets, I want to imagine for a moment a scenario that is the opposite of worst-case – what do the USA and the world look like if most things more or less go right? What if a normal economic recovery replaces the pandemic slowdown?

Consider these 6 factors:

• Vaccines for Kids: To me, this is one of the biggest game-changers out there. Children ages 5-12 get formal FDA approval for the 3 major vaccines soon, and the vast majority of schools require them for attendance. (Teachers Unions go on strike in the holdout areas).

There is lots of evidence unvaccinated unmasked kids can be asymptomatic carriers of Covid; with schools re-opening and a decided lack of available child-care, Covid-19 vaccinations will end up just like Polio, Measles, Mumps, Rubella, jabs – just another childhood vaccination required to send your kid to public or private school. Once we take care of this age group, the biggest stumbling block to economic activity is removed.

• Delta Variant Rolls Over: We are seeing signs that the dominant Delta variant may have peaked, as more people who were vaccinated or infected bring us closer to herd immunity. This is true even along the Gulf Coast, an area where local governments have botched their covid response, and hospitals are overwhelmed. Expect infections to peak, followed by hospitalizations, ands then deaths. As this happens, local economies cannot help but improve. Recall infectious disease expert Charity Dean’s observation that today’s mortality rates are a snapshot of infections 4 weeks ago. The FDA authorization of a booster (third) shot also helps reduce poor outcomes.

• Political Resolution: There are three big issues pending before Congress: Passing the Infrastructure Bill, raising the Debt Ceiling, and getting the 2022 Spending Bill completed. All three are likely net positives for the stock market. Will the progressives spike the chance for Biden’s infrastructure bill to pass? Does the GOP want to hurt the favorable odds of their retaking Congress in the midterms?

Even in DC some times things align towards accomplishment instead of derailment. This feels like one of those times. It is not hard to imagine that a deal gets cut, and all of them are resolved positively.

• Federal Reserve Remains Accommodative: Barring any surprises, the taper of Fed bond purchases is looking increasingly likely this year. It’s anti-climatic at this point. Regardless, rates will remain low for the foreseeable future, with modest increases unlikely to begin until 2H 2022 at the earliest. Fed Fund Rates above 3% is unlikely for years.

• Inflation: I have been in the “Reset/transitory” camp for a long time – deflation with spasms of occasional inflation. The biggest cost pressures seem to be related to reopening problems and supply chain issues. Maybe this lasts into mid-2022; if it goes much beyond that I will need to rethink my position on inflations.

• China problems stay in Asia: Assume Evergrande goes to zero – does it really matter? Is its paper festooned in every bond manager’s portfolio? Will global real estate take a 30% dive? Hardly likely.

China is deeply interconnected to global industrial manufacturing and its supply chains. But the integration of China’s credit and financial system is no way near as entrenched as America’s was in 2007-09. This looks to be a more Archegoes than Lehman Brothers to me.

There are always things to be concerned about in markets, millions of reasons to sell as the market climbs a wall of worry. The trick is to understand what is merely day-to-day noise versus what is deeper and more significant.

It is as much Art as it is Science, so don’t expect any magic bullets.

UPDATE September 27, 2021

Here is the reverse argument: How Wrong Can Things Get?

UPDATE September 24, 2021

I agree with the concept that these well-known risks are already priced into markets:

“QE is ending! The witches’ stew of COVID brews. Inflation, inflation and stagflation strike. China’s real estate woes threaten a “Lehman moment”–dooming global growth. Tax hike hype and debt ceiling drama dead ahead.” –The Flaring Fret-O-Meter Is Sweet Music for Stocks

Previously:

DELTA is Coming For Your Economic Recovery (August 13, 2021)

Inflation: Long-Term, Transitory or Reset? (July 28, 2021)

End of the Secular Bull? Not So Fast (April 3, 2020)

Markets Drive News (not vice versa) (April 2, 2018)

click for audio