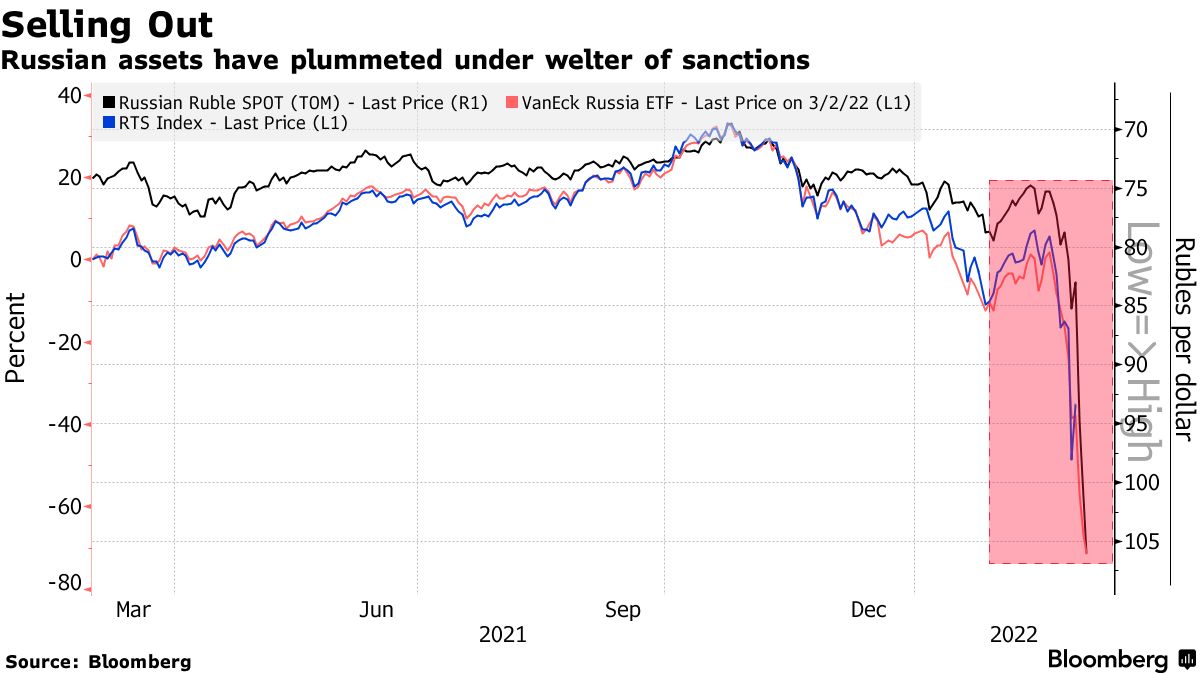

If you own stocks in companies based in Russia (through mutual funds, ETFs, or direct indexing), there is good and bad news: The bad news is these stocks are now effectively worthless (or at most worth very little). ADRs are not trading on the London or NY Stock exchanges. The good news is it’s likely a very tiny percentage of your portfolio.

How tiny? Less than 2% in most emerging market indices and less than 1% in most direct indexing strategies.

Index investors unhappy with Russia’s brutal and illegal military campaign against the Ukrainians can be heartened that two of the largest index companies in the world – MSCI and FTSE Russell – have removed all Russian securities from their indices. As was telegraphed on Monday, this is not even a downgrade to frontier market status, but rather, they have simply declared Russian equities to be “Un-investible.”

Indexers have marked Russian stocks down to zero in their portfolios and will liquidate if and when there is ever a bid. The “U.S. Treasury Department gave fund managers until May 25 to find non-U.S. buyers for their equity and debt holdings” in major Russian entities. This affects the investing giants as well as smaller ETF/Index providers. Thus, if you are a holder of emerging market ETF’s or mutual funds from Vanguard or BlackRock, you soon won’t be an investor in Russia.

Further, factor shops like Dimensional Funds have already committed to adding Russia to their “do not purchase” list and are committed to removing Russian stocks from their holdings as soon as a bid appears.

If you are a direct indexer (as we are with OSAM’s Canvas), these firms are in the process of liquidating whatever holdings they can.

Previously:

The Cutting Edge (September 30, 2021)

History Shows War Shocks Have a Modest Impact on Equities (BusinessWeek, March 2, 2022)

How Geopolitics Impacts Markets: 1941-2021 (February 25, 2022)

A Personal Recollection From a Day of Horror (September 12, 2001)