Welcome to the Second Half of this annus horribilis, the worst start to any year since 1982? 1971? 1929? Pick your favorite year, the specifics no longer matter.

The headlines are all shouting at us how bad the first half was. The New York Times is fairly typical: “After Worst Start in 50 Years, Some See More Pain Ahead for Stock Market.”

Mohammed El-Erian sums it up well:

Further to yesterday’s tweet, some of this morning’s media headlines.#Investors are finding that the notion of “#inflation impacting everyone” applies to them too.

A key issue for the outlook is the extent to which a late #Fed will aggressively hike rates into a slowing #economy pic.twitter.com/GDxqPBT9GO— Mohamed A. El-Erian (@elerianm) July 1, 2022

The problem with all of this handwringing: It’s a feature, not a bug, and there is nothing you can do about it. If you want the upside, you must tolerate the uncomfortable downside (more or less).

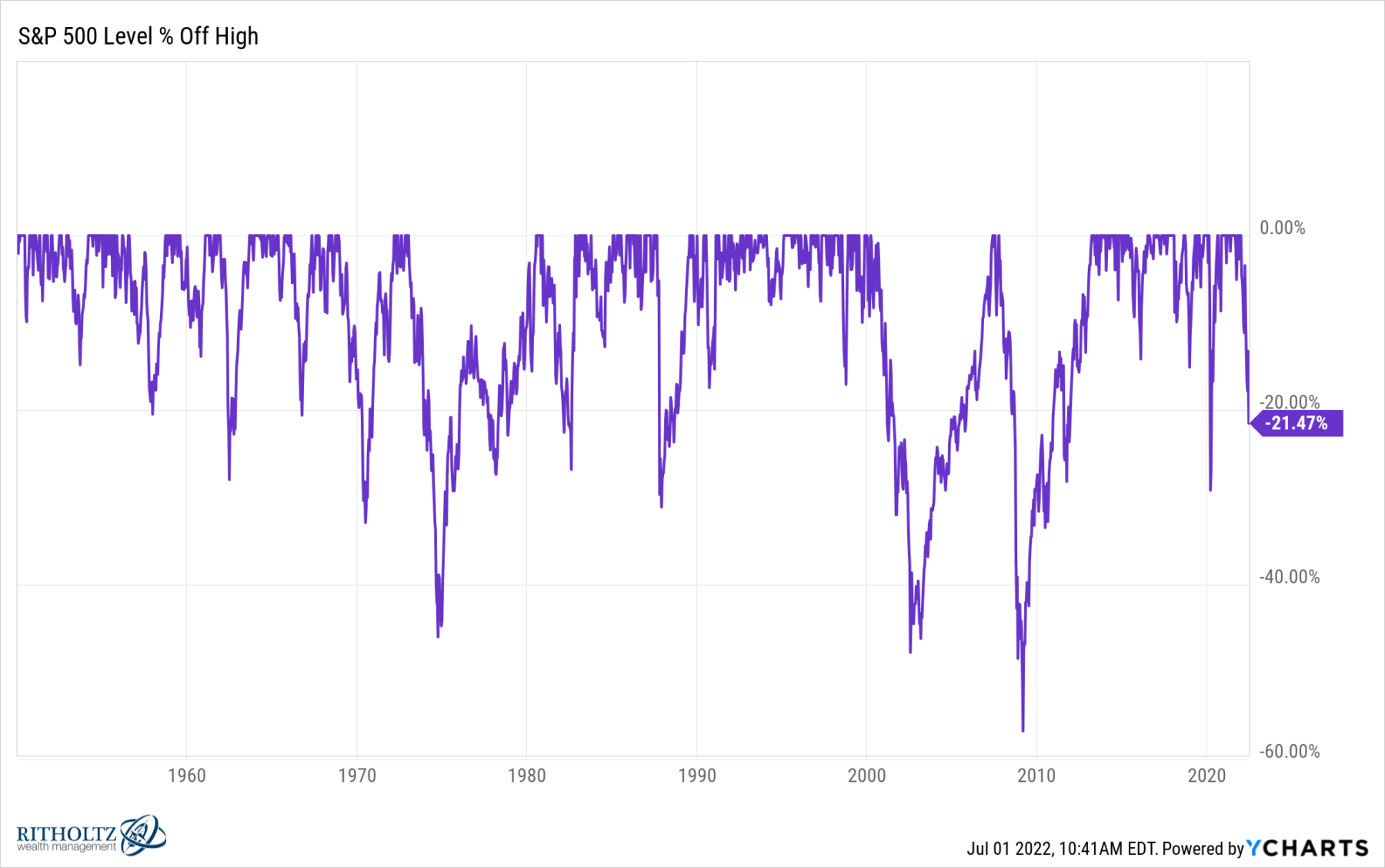

Consider the century of drawdowns as shown in the chart above. If you want to see any kind of long-term returns, putting up with regular decreases in value is simply the cost of admission.

You can diversify, but that has not helped very much this year. You can try to time the market, but good luck with that. Few can do it, fewer still with any consistency, and fewer yet will do it on your behalf. You can try to miss the big down days, but then you end up missing the big up days, too.

Worse, people who try to time make a hash out of the process, with 30% never returning to risk assets or equities — just move to cash, and * SHEESH* stay that way for the rest of their lives.

Rather than get pulled into this mania, it is much more useful and psychologically healthy to recognize we must accept that drawdowns, corrections, bear markets, and crashes are simply part of the process.

Indeed, they are a very important part, because bear markets and crashes are where you earn the upside over risk-free treasuries. Risk is what leads to returns — and risk means suffering through markets that fail to meet your expectations.

Have a great holiday weekend . . .

Update July 3, 2022

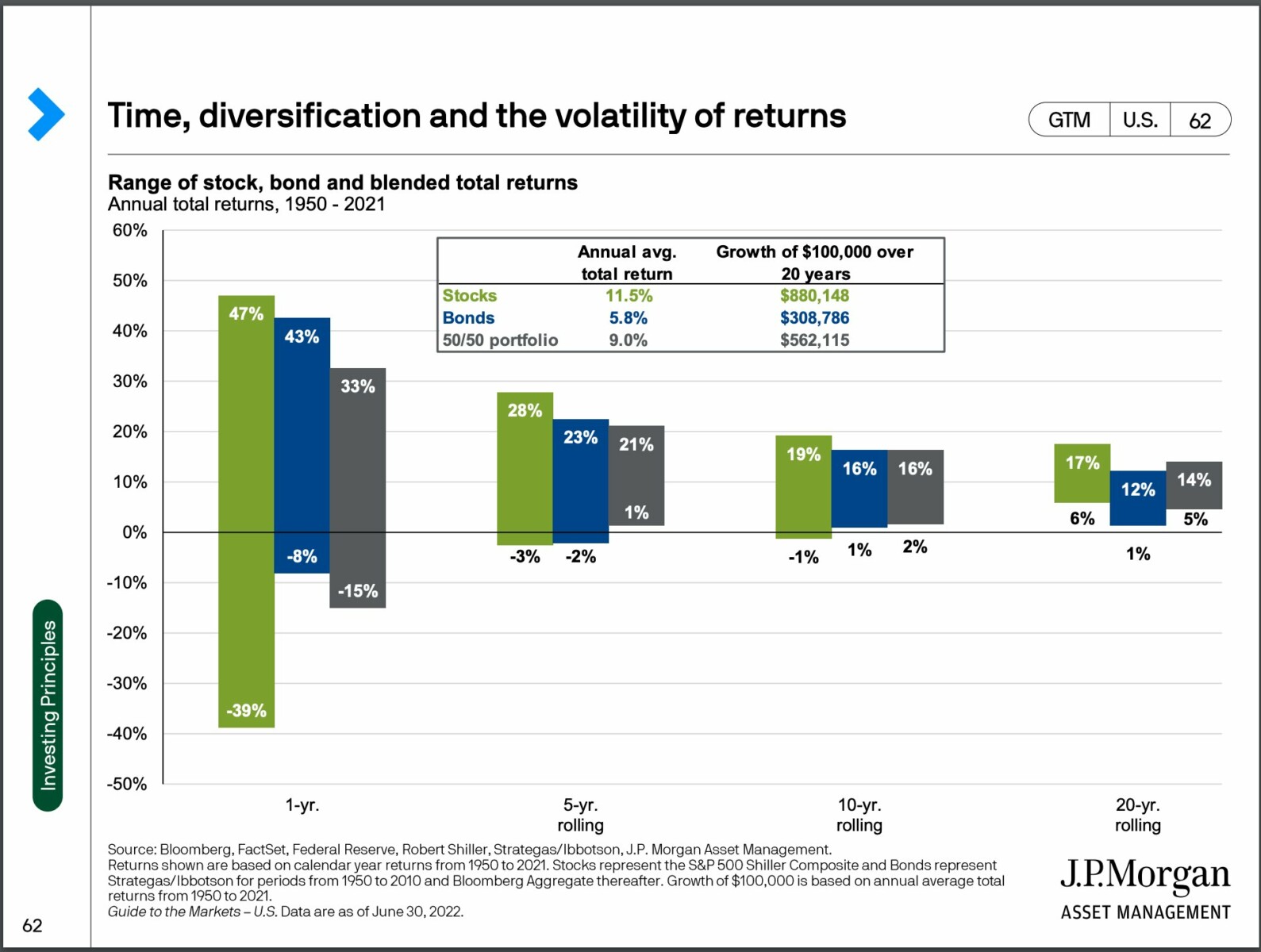

Wonderful visual depiction of the cost of admission, via JPM:

Previously:

Big Up Big Down Days May 5, 2022

Panic Selling Quantified (March 24, 2022)

If You Sell Now, When Do You Get Back In? (March 23, 2022)

Stop Listening to Pundits (December 8, 2021)

Market Volatility is a Feature not a Bug (February 11, 2019)

Pundit Suckitude: Its a feature, not a bug. (July 30, 2013)