U.S. Bureau of Labor Statistics:

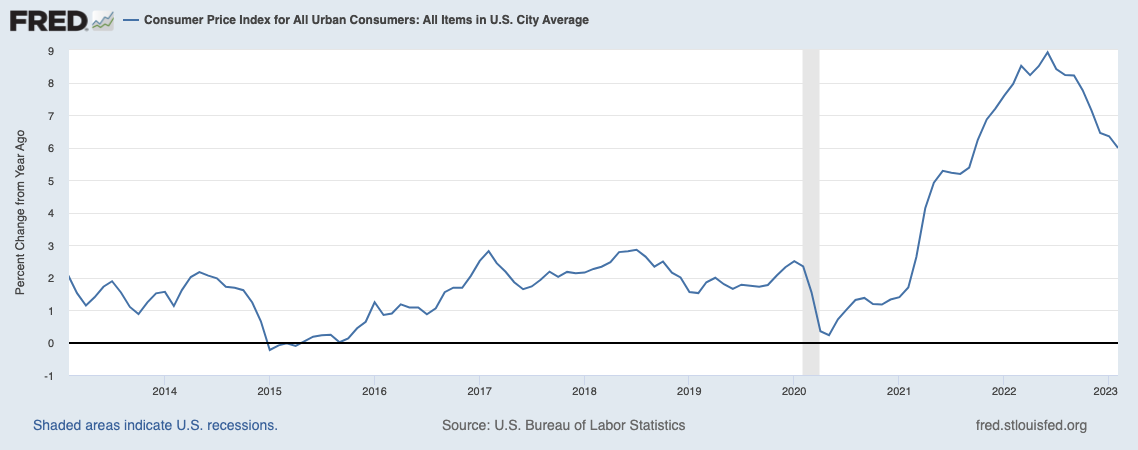

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.1 percent in March on a seasonally-adjusted basis, after increasing 0.4 percent in February. Over the last 12 months, the all items index increased 5.0 percent before seasonal adjustment. (April 2023)

As much as I want to jump up and down about 0.1% seasonally adjusted (after a 0.4% prior month), the big number is not so big:

5.0%

A 5 handle is a huge development, even with the core remaining slightly elevated.

Note the food at home index fell 0.3% over March — this was the first decline since September 2020.

And despite a hot war on the Euro-Asian border, energy prices dropped significantly. Gasoline plummeted 17.4% year over year, while the overall energy index fell 6.4 % over the past 12 months.

If the FOMC were plugged in, they would realize that their work is done, there is no need to throw millions out of work because we have a shortage of houses, semiconductors, and workers of all kinds. Most goods have returned to pre-pandemic price levels. The biggest driver of apartment prices is the shortage of homes and the high price of mortgages. (Gee, whoever is responsible for that?)

Regardless, consumer prices continue to fall. Even housing costs posted the smallest monthly increases in a year.

UPDATE: April 13, 2023

Here is Scott Grannis‘ take:

“There are only two things you need to know about inflation today: 1) without the Owners’ Equivalent Rent component (which makes up about one-third of the CPI), the CPI would have declined at a -1.6% annualized rate in March, and 2) OER inflation has peaked and will almost surely decline significantly in coming months. In short, our national inflation nightmare is over. If the economists at the Fed can’t understand this, they should be fired. There is absolutely no reason the Fed needs to raise rates further, and every reason they should begin cutting rates—beginning with the May 3rd FOMC meeting if not sooner.”

Previously:

For Lower Inflation, Stop Raising Rates (January 18, 2023)

Inflation Comes Down Despite the Fed (January 12, 2023)

Supply Chain Is 40% of Inflation (November 17, 2022)

Why Is the Fed Always Late to the Party? (October 7, 2022)

How the Fed Causes (Model) Inflation (October 25, 2022)

Why Aren’t There Enough Workers? (December 9, 2022)

How Everybody Miscalculated Housing Demand (July 29, 2021)]