I have been putting together my Q2 quarterly client call, and impatiently waiting for two last data points to show: State Coincident Indicators and Q1 GDP. Together they paint a fascinating picture of an economy robust enough to withstand the fastest set of rate increases in history, but also one that is showing signs of slowing. (Crosscurrents of these types are not uncommon in a world that is rife with shades of grey…)

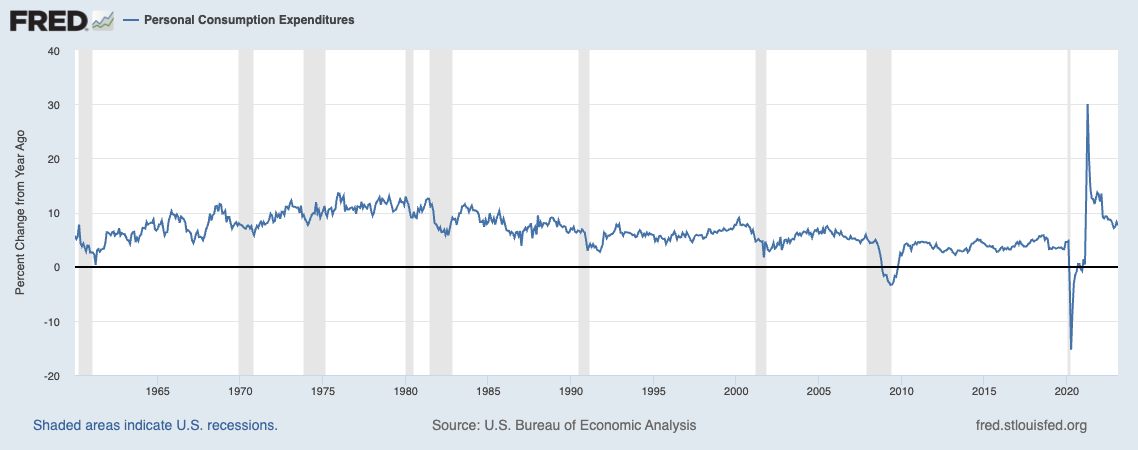

GDP for the first quarter of 2023 was 1.1% – lower than Wall Street’s 2.0% consensus — but also included a consumption gain of 4%. Core PCE was an elevated (but improved) 4.9%. Consumers are still spending, but in many areas, it is a case of price over volume due to the impact of elevated (but slowing) price increases.

Hold these two thoughts in your mind at the same time: We have a robust and resilient economy, but it is not Superman: It is slowing in response to higher rates, elevated service prices, high real estate costs, and tightening credit levels.

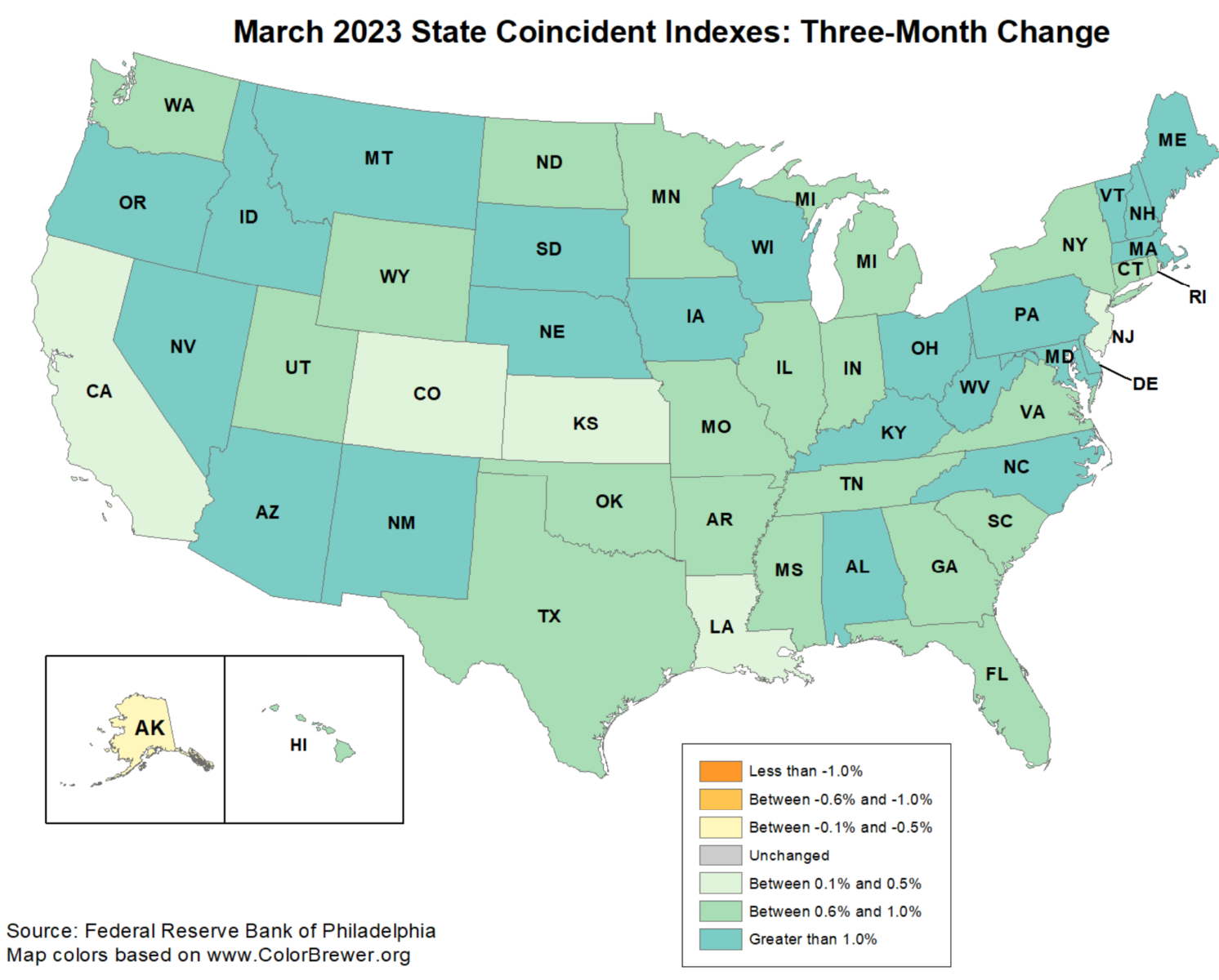

Of the 50 states in the Philadelphia Fed’s State Coincident Indexes for March 2023, only one — Alaska — is negative. “Over the past three months, the indexes increased in 49 states and decreased in one, for a three-month diffusion index of 96.” The one-month diffusion index was 98.

This suggests a slowing, but not necessarily a recession. Last June, we looked at the prior six recessions going back to 1979. We currently see none of the pre-recession warnings that are typical before economic contractions. In the past, the State Coincident Index has been a fairly reliable “early warning” of increasing probabilities of recessions. Typically, we see state-by-state slowings several quarters (or sometimes years) prior. Instead of most states showing expansion, before recessions, that will drop to 45, 40, then 35 before a recession begins; eventually, the number of expanding states then fall to 10, 5, or 0.

The takeaway from this is that there is no recession imminent, and none on the horizon for the next few months. This obviously could change rapidly, most notably if the Fed overtightens or if credit conditions and availability get appreciably worse.

Previously:

The Tide of Price over Volume (April 21, 2023)

Signs of Softening (July 29, 2022)

Are We in a Recession? (No) (June 1, 2022)

Sources:

State Coincident Indexes March 2023

Federal Reserve Bank of Philadelphia, April 26, 2023

Gross Domestic Product, First Quarter 2023 (Advance Estimate)

Bureau of Economic Analysis, April 27, 2023