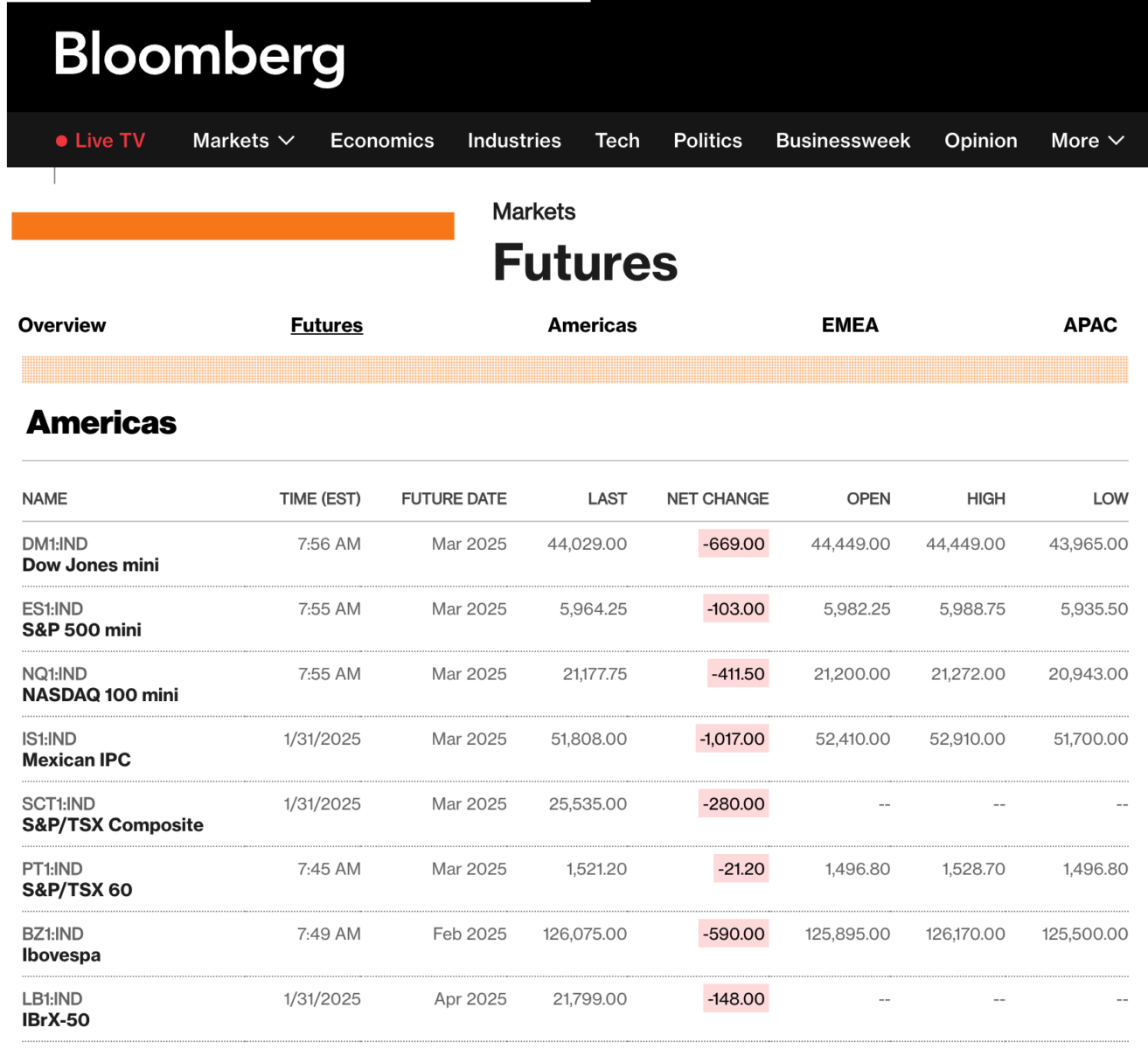

My weekend routine wraps up with checking in on the Futures markets (free via Bloomberg here) after 6 p.m. to see how equities are doing. Futures trading shows how markets are reacting to whatever news broke over the weekend. It can provide a snapshot of what Monday morning might look like, or even how the rest of the week could shape up.

~~~

We are but two weeks into the administration of Trump 2.0. As a new set of policies ramps up, I wanted to share some data points about where we are and what we might expect from an administration that presents risks and opportunities. I want to discuss Policy, but before I do, a quick word about Politics, and especially about mixing politics with Investing.

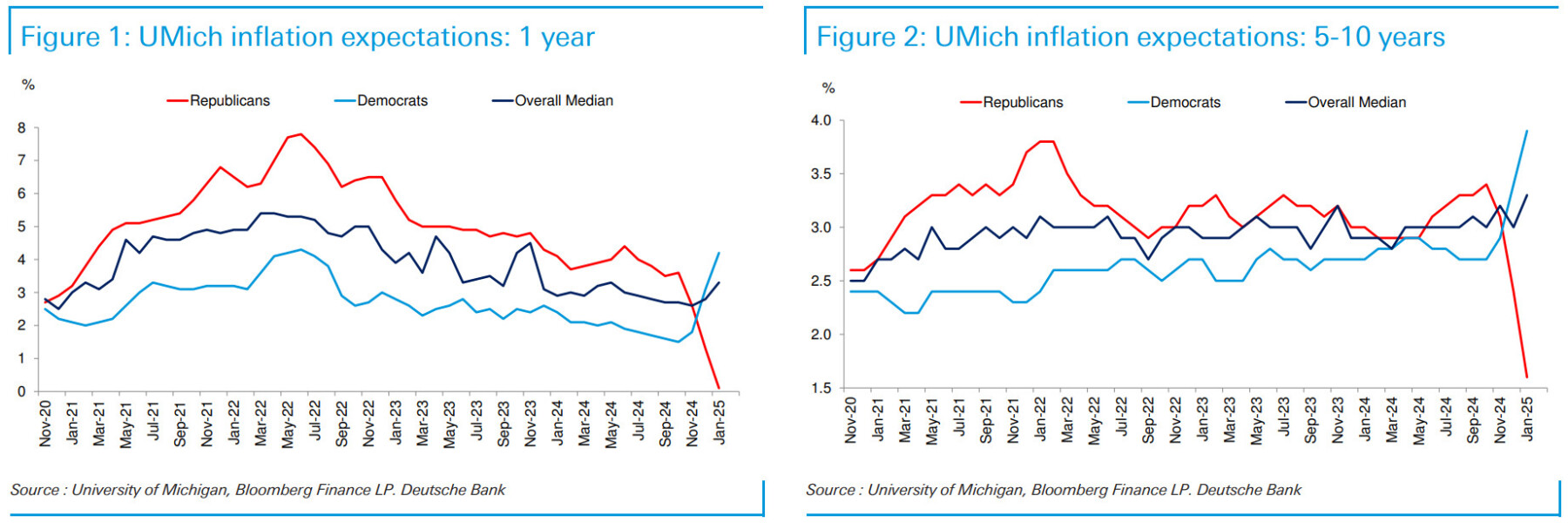

Even something as basic as SENTIMENT is impacted by your priors, tribal affiliation, and flawed cognition. You see what your brain wants/expects you to see, not what is there. This chart has become the classic example:

Your goal, challenging though it may be, is to avoid letting whatever partisan preferences you may have interfere with your portfolio preferences. As the chart above shows, partisanship leads to expensive errors, as an investor is an expensive hobby…

~~~

Let’s jump into the non-partisan fray to see what we can deduce. Note: These bullet points and charts come from my Q1 conference call for clients (week of January 6th) and pre-date the latest news by several weeks.

Economy: For the second time, President Trump inherited a robust economy from his predecessor. Despite economists predicting a recession for the past two years (Wrong!), we have enjoyed a resilient, surprisingly strong economy characterized by full employment, strong wages, and robust spending.

-Full-year GDP is close to 3%;

-Unemployment Rate: 4.1% (full employment);

-Inflation is at a near normal. 2.7% (headline CPI);

-Wages are higher;

-Markets are (were) at record highs.

The U.S. has a ~$28 trillion economy, 4% of the world’s population, >20% of the globe’s GDP, and >55% of the global market cap. Economically speaking, America is already great.

Except for the US, the developed world is doing only OK; Europe has structural problems, and China is doing worse(!). In the U.S., sentiment has been weak for years. But to paraphrase Ralph Waldo Emerson:

“I can’t hear what you’re saying because what you’re doing speaks so loudly.”

From Thanksgiving Day to Cyber Monday, online spending was $41B—that is a monstrous number! Home prices are up, demand for automobiles is robust, and consumer spending on travel, entertainment, and discretionary items is substantial. People may complain about the prices of Eggs, but their actions are pure expansionary boom behavior.

The bottom 50% is undoubtedly struggling: There are not enough starter homes (and they are pricey), credit card rates are very high, and car financing ain’t cheap. While wages are up for everybody, they are much higher for the top half, quartile, and decile.

The bottom line economically is that we rolled into 2025 with a strong, positive economic footprint, with households in good shape, strong wage growth, reasonable saving rates, and corporate profits at record highs.

Footnote: For an incumbent party to lose the White House with this sort of economic data is political malpractice.

~~~

Risks & Opportunities from the new 2025 administration

Risks:

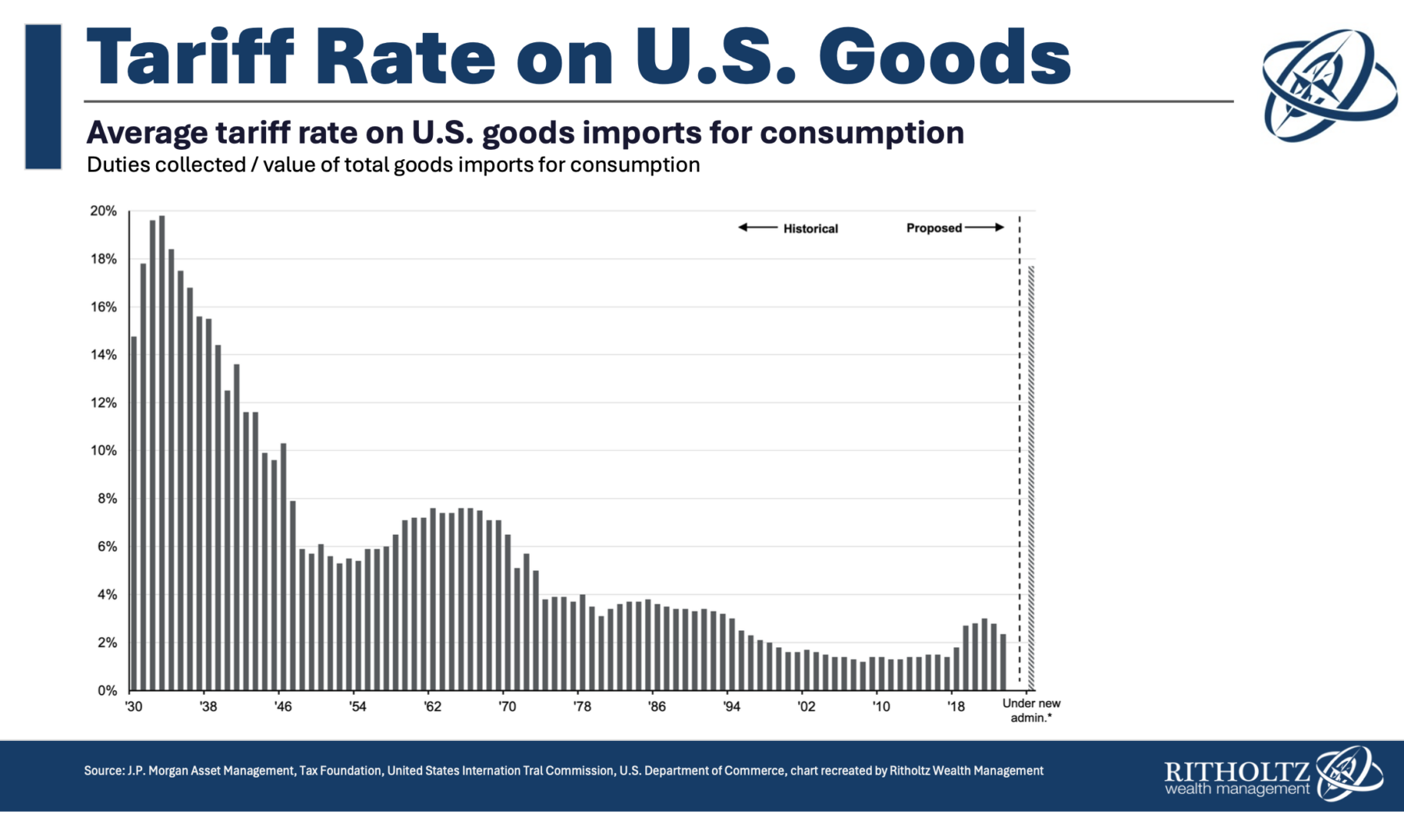

1. Tariffs: Smoot-Hartley tariffs were partly blamed for the Great Depression (or at least for worsening it). 25% tariff levels will have a very significant impact on the global economy and the U. S. economy. I don’t know what to make of 20% tariffs on specific countries and 10% tariffs on the rest of the world. My wishful thinking is this is hopefully a negotiating tactic (but who knows?). Yes, there should be some parity/fairness for Tariffs. This is especially true for US Agricultural products (farmers) and oil and natural gas (energy producers).

Tariffs are an inflationary tax ultimately paid by consumers. If we’re putting tariffs on Toyotas from Japan or oil from Canada, it is the consumer that mostly pays them. (Some tariff costs may be absorbed by the goods producers and resellers).

2. Fiscal spending: Despite what 50 years of BS, excess spending has never been a problem during my lifetime. Net interest payments – what we’re paying in interest on our borrowed money – is now larger than our total defense spending. That does catch my attention.

3. Geopolitics: The Trump admnistration is a wild card here. China? Russia? Middle-East? Risk of war and disruption, are all risks to markets.

Everything on the Risks side comes down to interest rates. All of the policies above are likely if implemented fully, to pressure interest rates higher. (Partial implementation less so). Even immigration policies make labor shortages worse (agriculture, construction, restaurants). Deport 3 million people, much less 13 million people, and it is going to be more difficult to find and hire people to work on farms, and in construction. Everything will cost more.

Opportunities:

The opportunities are less nuanced: What will drive markets higher?

1. Tax cuts This is Simple and straightforward: Lower tax rates for Corporate America and especially manufacturing are supportive of higher stock prices.

2. Deregulation will be helpful to specific sectors (Energy, tech, Healthcare). Increased investment in domestic energy production could provide growth opportunities in related sectors. Note: Energy & Materials were among the weaker sectors in 2024

3. Mergers: A defanged FTC will allow more M&A activity, supportive of higher market prices.

4. IPOS and Secondaries tend to do better in that environment, and that is also supportive of higher prices.

5. Stock buybacks will increase (Ditto)

The consistent theme in the opportunities section are simply very market friendly policies…

~~~

What made the Trump 1.0 so challenging is that most observers suffered a failure of imagination as to a full implementation of MAGA policies. There were lots of social policy changes — SCOTUS, Abortion policies, child separation, etc. — but other than the TCHA of 2017 tax cuts, there were fewer radical economic policies implemented.

Trump 2.0 presents very different set of potential outcomes. It is very challenging to guess which will have a bigger impact, as we have no idea as to what will get fully, partially or not at all implemnented.

Strap yourself in, Volatility may begin to move higher…

Previously:

Why Politics and Investing Don’t Mix (February 13, 2011)

Is Partisanship Driving Consumer Sentiment? (August 9, 2022)

Archive: Politics & Investing

See also:

The Trump trade war begins Fine, let’s talk about tariffs (Callie Cox, February 03, 2025)

Tariff Nation: Explaining to your fifth grader why tariffs hurt everyone (Roger Lowenstein, Feb 03, 2025)

Trump Will Take the Stock Market on a Bumpy, if Prosperous, Ride. What to Do Now. Barron’s January 26, 2025

It Was a Very Good Year, Liz Ann Sonders, Kevin Gordon (Schwab, January 6, 2025)