The single most asked question that I have heard since January 20th is:

“How will this new administration affect my stock, bond and real estate holdings?”

I keep hearing variations of that question from clients, advisors, and the media. The general question reflects a concern about the new Trump 2.0 administration’s flurry of activities, especially DOGE, Elon Musk, layoffs, and other issues.

My advice is to tune out the noise, turn off the TV, and avoid the trolling, wild gesticulations, and chaos. Instead, focus on what is truly happening.

I admit the general demeanor feels weird because there’s been a whole lot more getting said than done; far fewer actions than the pronouncements (or stated intentions to perform actions) all of which may or may not happen.

How many of the 3 million federal civil service workers (not counting military or postal service employees) are really going to be laid off? Does the executive branch have the authority to cancel spending allocated by Congress? What can Elon Musk do?

I don’t know; I doubt most of the pundits you hear opining all day long on TV know either. The outcome of these issues will not be litigated on television; rather, it will be litigated in the federal court system, where it is supposed to happen.

***

It is difficult to remember this when you are overwhelmed by Steve Bannon’s “Flood the Zone ” strategy. A perfect example is the U.S. military activity abroad. Is Canada about to become the 51st state? Will we retake the Panama Canal by force? Will Denmark knuckle under and sell us Greenland?

That was last week—it feels like months ago. I don’t know if any of those territorial ambitions will come to fruition (color me doubtful). But I do see that the noise of these issues has wholly overwhelmed any boots-on-the-ground activity. My advice is that investors (mostly) ignore these comments.

Flood the Zone is very good at exhausting you politically, but don’t let it exhaust your discipline as an investor.

Another example: 47 (the same guy as 45, but a different administration) announced today that he is “canceling Manhattan’s congestion pricing.” The MTA yawned at the proclamation. Despite all the sturm und drang, the MTA is still collecting congestion pricing and says it will continue to do so until it is ordered by a lawful court to stop.

What about all those Tariffs? Canada and Mexico? (Nothing done)

Have there been mass layoffs? (No)

China Tariffs? (Nope)

Has Pentagon spending been cut yet? (No)

Ukraine and Russia? (Nyet)

47 is a savvier executive than 45; he is experienced, has his own people in place, seems to have a thought-out plan, and his team is executing that plan. But my focus is on what actually gets put into place and not the noise the media dutifully repeats as if it’s Gospel.

***

Recall the era of Trump 1.0, especially the period between election day and the inauguration. During that interregnum, 45 began tweeting at company executives, cajoling, threatening, and otherwise causing general mischief. For the first few weeks, markets punished companies that received 45’s ire. But soon after, it became clear this was mostly bluster, with little or no actual-world consequences. Market (over)reaction faded.

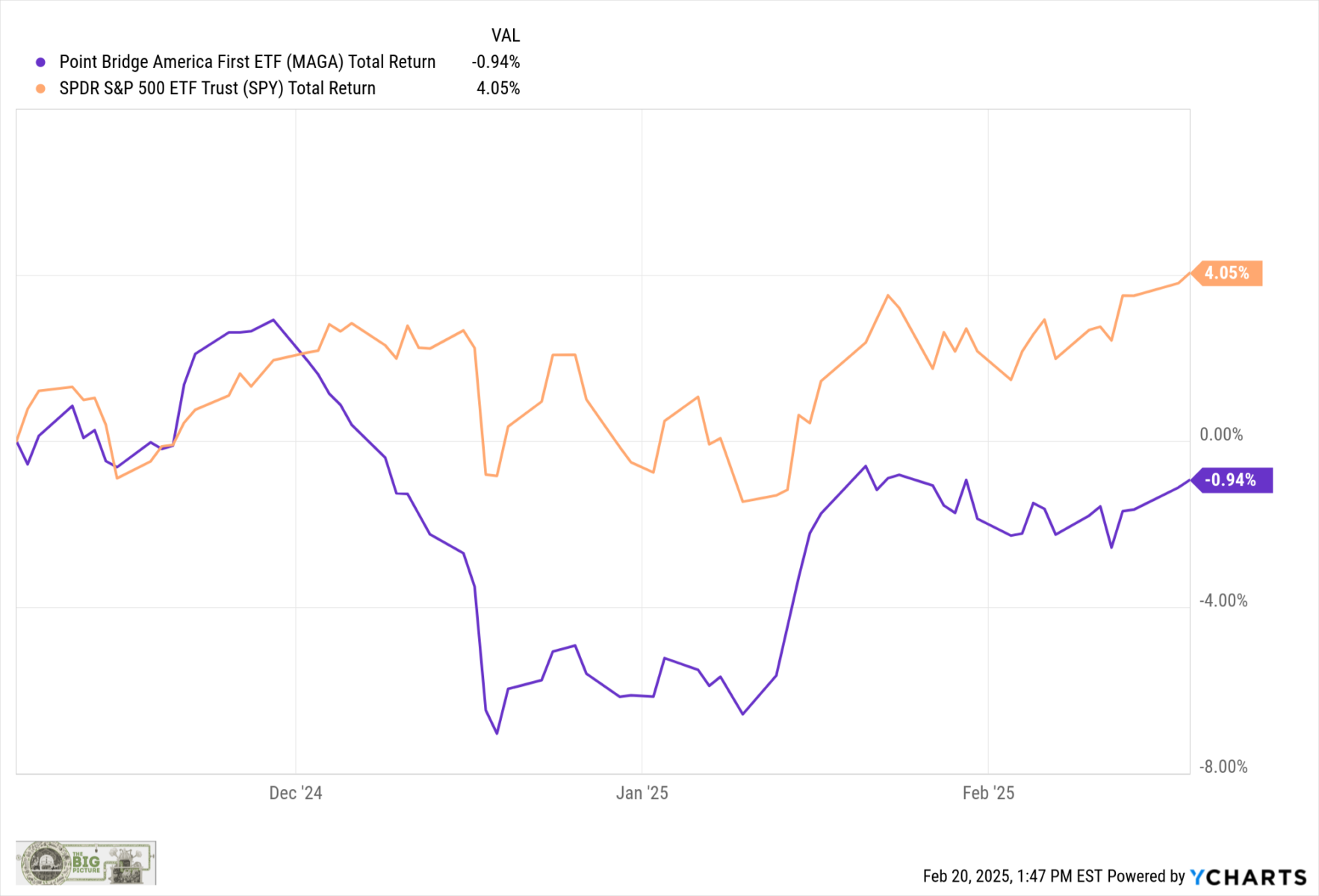

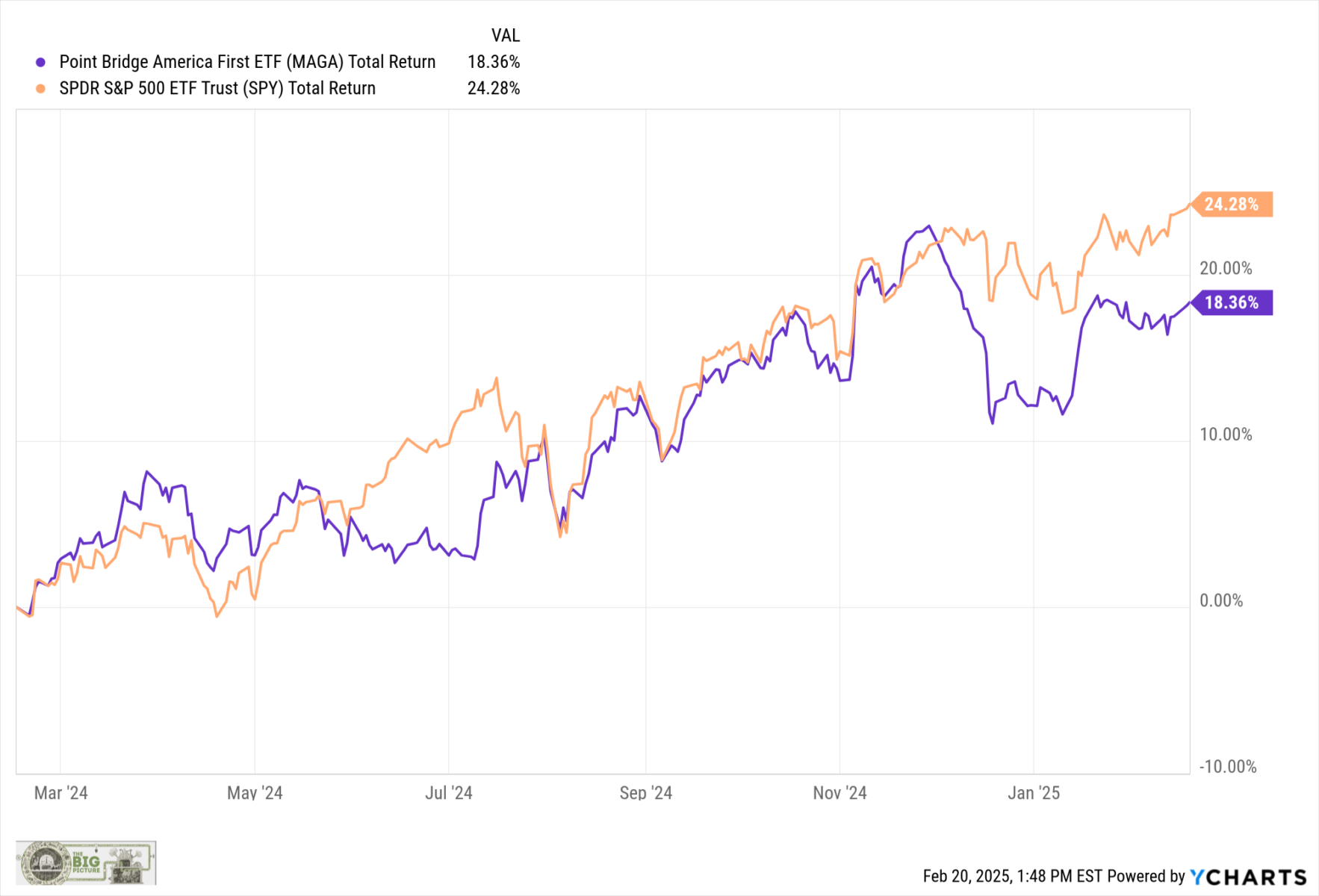

After November 5, 2024, the Russell 2000 Index gained on hopes that the stated Trump policy would benefit smaller cap companies. That has mostly faded, and RUT is now more or less back to where it was before November 5th. Even the MAGA ETF (after a post-election pop) is again lagging the S&P 500 (above since election; below, trailing 12 month chart).

To me, the political noise is just that – a distraction. I suggest you ignore most of what gets said, and focus on all the things that actually get accomplished. These are likely to include large tax cuts (TCJA gets extended 5+ years) and a much M&A-friendlier FTC…

***

More importantly, pay attention to the broader context of where we are today. Back-to-back years of greater than 20% in equities strongly suggest we lower expectations for the following 12-24 months.

Context matters much more than noise.

UPDATE February 21, 2025

As a counterpoint (and consistent with what Callie wrote), here is a very different take from Connor Sen:

Previously:

Why Politics and Investing Don’t Mix (February 13, 2011)

How Much is the Rule of Law Worth to Markets? (August 2, 2021)

Archive: Politics & Investing

See also:

Governments are people, my friend (Optimistic Callie, February 18, 2025)

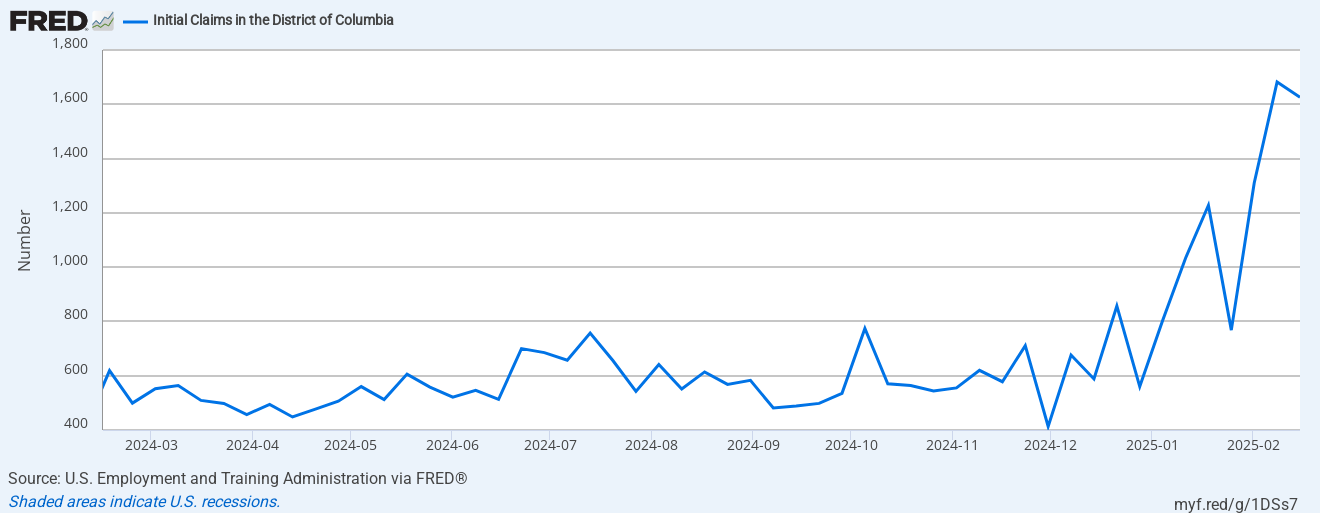

Jobless Claims for the DC Area (Daily Spark, February 18, 2025)