Big Tech Drives the Stock Market Without Much U.S. Help

The Fang stocks get lots of their sales from countries that are doing better at managing the pandemic and reopening.

Bloomberg, July 13, 2020

Frustrated investors sometimes forget Mr. Market is occasionally irrational. A surprise 42% rally while the nation remains in the throes of a pandemic shows no signs of abating has them confused; so does unemployment at levels not experienced since the Great Depression and GDP off as much as 40%. Worse still, after a lengthy lockdown, the economic re-opening of the country seems to have been bungled.

The average American is experiencing an economy that is very negative.

Despite this, and a long host of woes, the market seems unstoppable. Yesterday, the Nasdaq hit new all-time highs. The S&P 500 is not too far behind. Both seem to be ignoring new record highs in coronavirus infections and myriad re-opening stumbles.

Attempts at explanations have included the Federal Reserve’s liquidity injections, the Congressional stimulus, an imminent Covid-19 treatment and/or vaccine. Perhaps the markets are looking to another trillion in stimulus this summer; maybe investors are looking past 2020 to 2021 or beyond. Or some combination of all of the above.

Another explanation is less glib: The most important stocks in the S&P500 are giant technology firms that derive a majority of their revenues from outside of the United States. On a relative basis, and for the first time in a decade, much of the world’s wealthy industrialized countries are doing better (and in some cases, much better) than the United States. Nations like Japan, South Korea, and Germany not only have managed to wrestle the pandemic into submission, their economies are far ahead of ours into their re-openings.

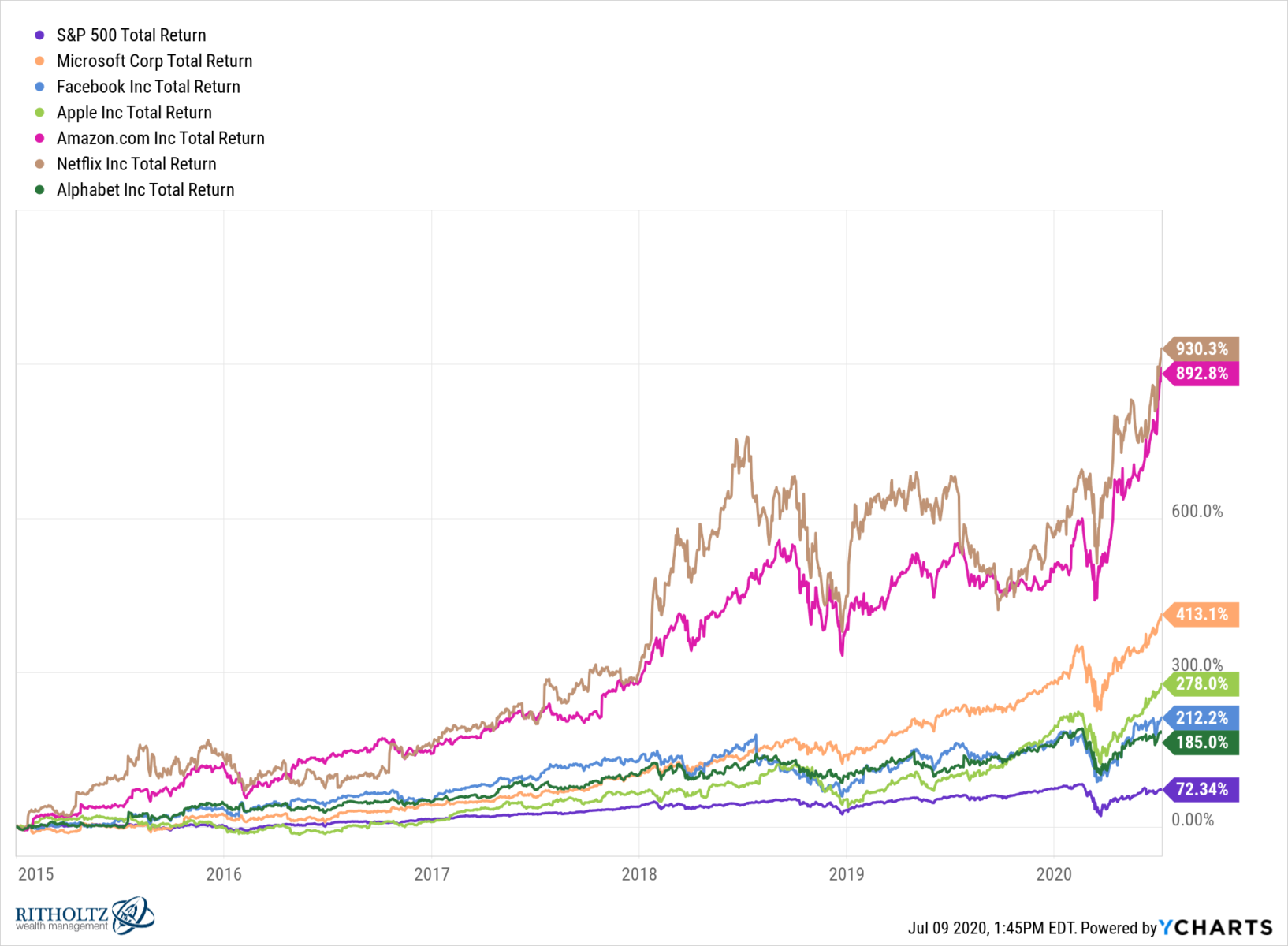

For the past 5 years, the group of stocks known as “FAANMG” have had an outsized influence on U.S. markets. “Since the start of 2015, the market capitalization of the S&P 500 has increased by $6 trillion. Of this, $4 trillion has come from the big six tech names: Microsoft, Apple, Amazon, Facebook, Alphabet (the owner of Google) and Netflix,” according to The Times of London.1 Two thirds of the gains in the S&P500 have been driven by just six U.S. companies.

See full column here (Paywall free mirror here)

_______

1. For the 5-year period since 2015 inclusive, the index gained 56.5%. Since the March 23rd lows this year, the index is up 42.1%, about three quarters of the gains of the prior 5 years.

~~~

I originally published this at Bloomberg, July 13, 2020. All of my Bloomberg columns can be found here and here.