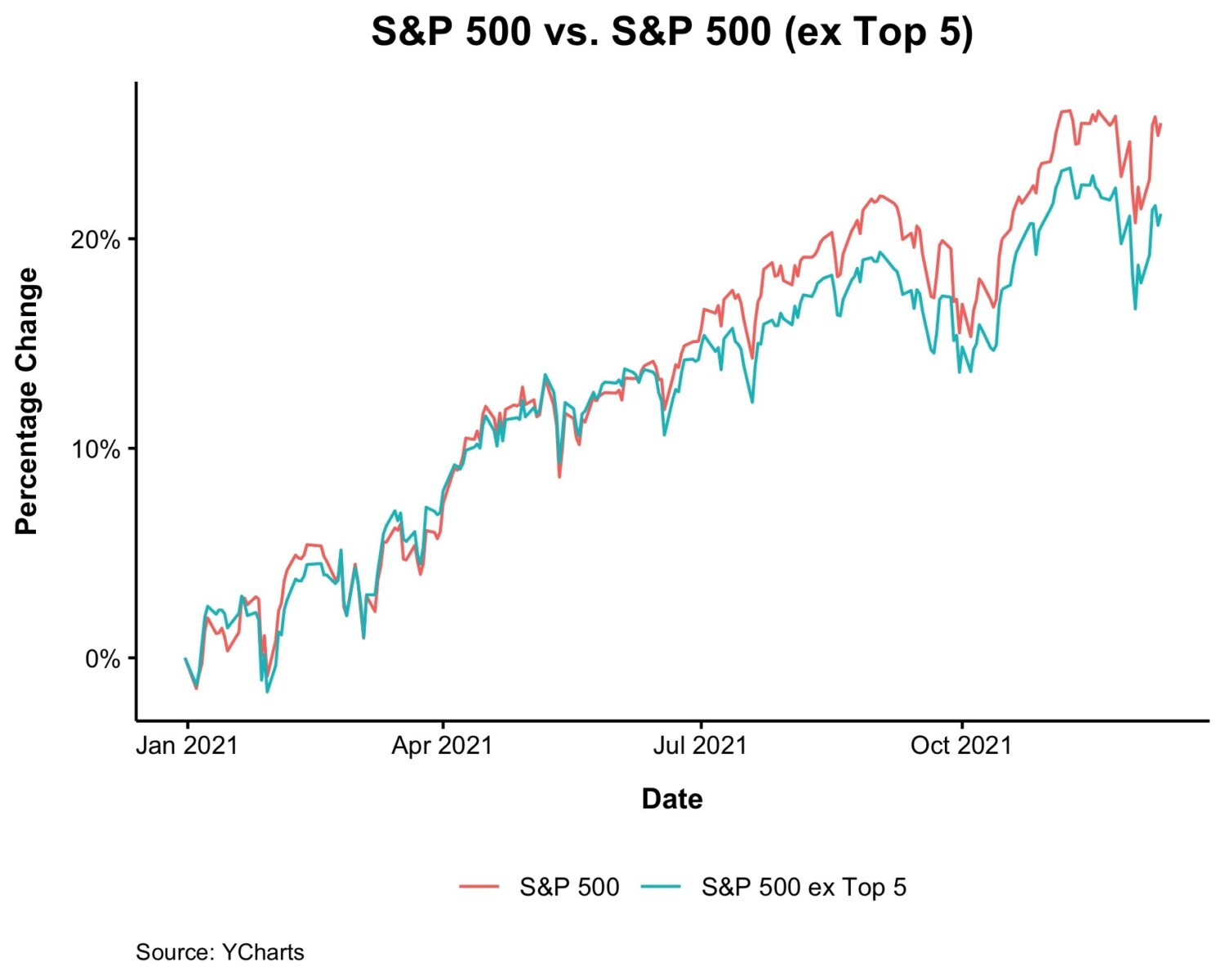

You have no doubt seen variations of this chart floating around the internet. It shows the 5 (or 10) largest companies in the S&P500, with a note pointing out how much they are up (20-25%) over the past few quarters.

And the remaining 490 companies? They are barely positive at all, up maybe 5% at best. There is a longer qualitative argument here (coming soon). For now, let’s focus on the quantitative side.

This is not atypical behavior. We know from academic studies that only a small percentage of stocks tend to drive market gains: Only one in 25 companies are responsible for all stock market gains. The other 24 of 25 stocks — that’s 96% — are essentially worthless ballast. Hendrik Bessembinder observed: “About 30 stocks account for 30% of the net wealth generated by stocks since 1926, and 50 stocks account for 40% of the net wealth.”

This has not stopped the critiques that “only a few companies” are driving markets. We have been hearing these complaints for about 5 years now, but it has yet to really have much resonance among traders and investors.

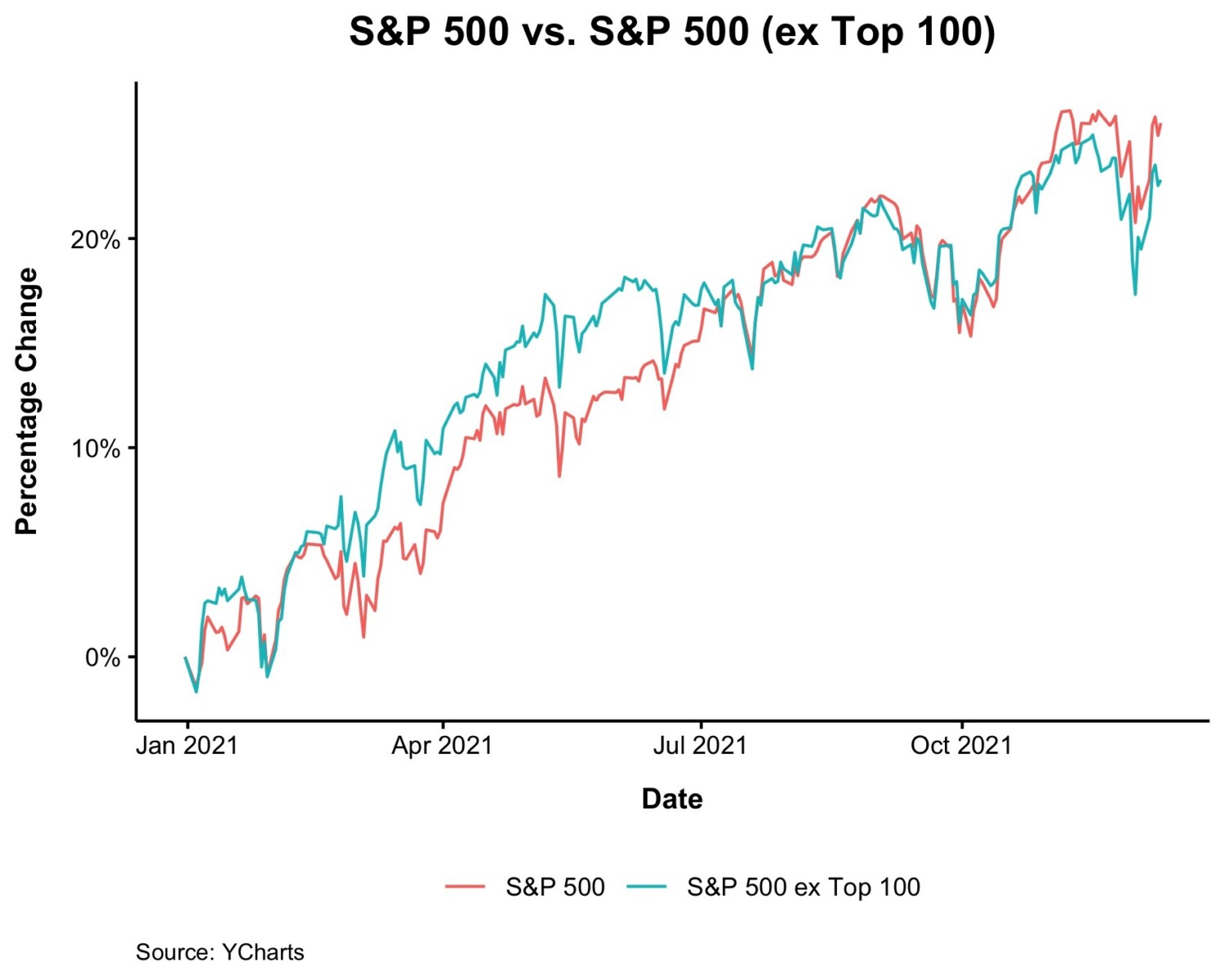

Consider what happens if instead of looking at only the top 5 stocks versus the remaining 495 SPX names, what if we look at 10, 25, 50, or 100 stocks versus the balance of the SPX? Nick whipped a few charts up for me.

As it turns out, it hardly changes the charts:

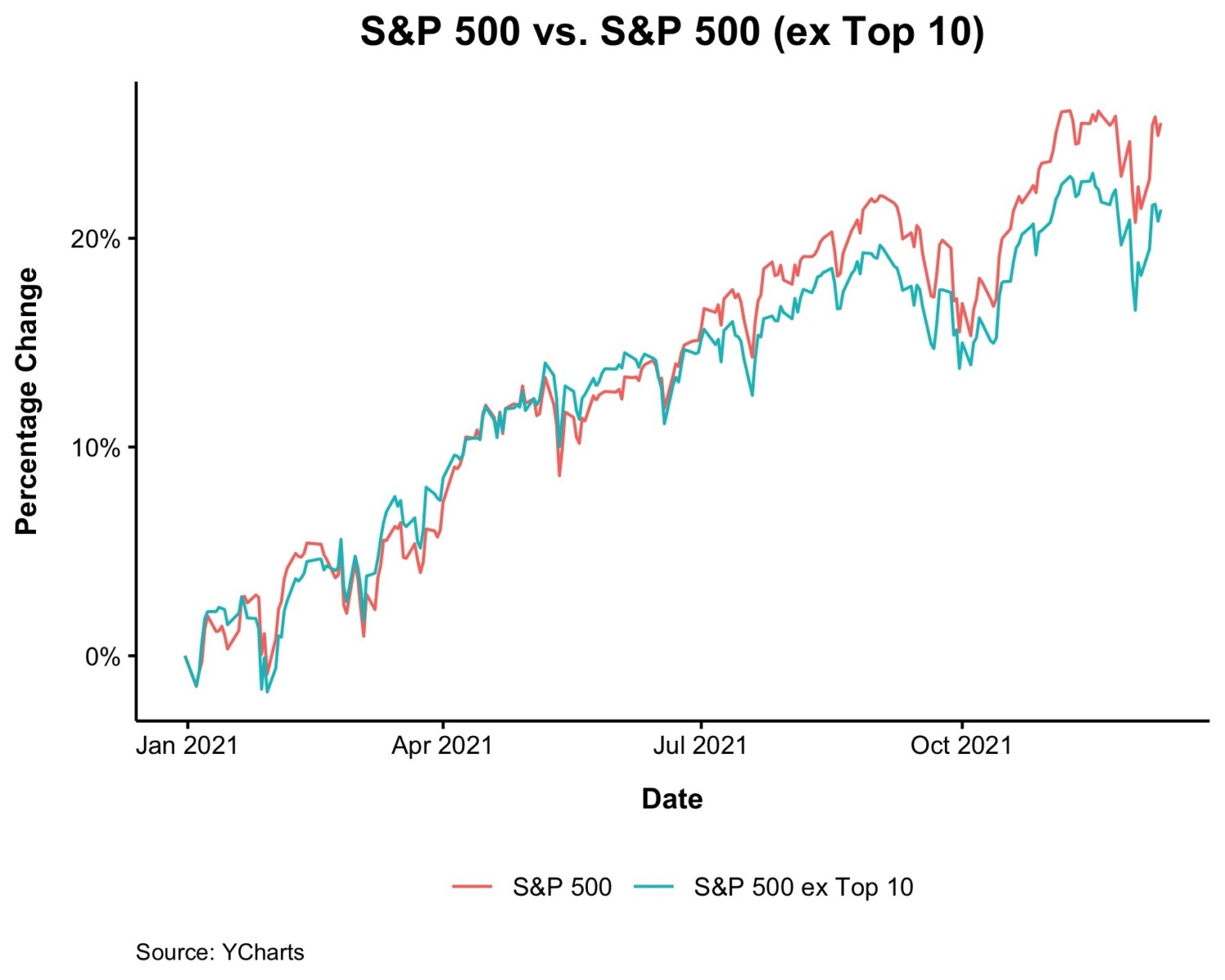

The Top 10 looks a lot like the Top 5, but that should not be much of a surprise — they are both large-cap tech, highly concentrated holdings:

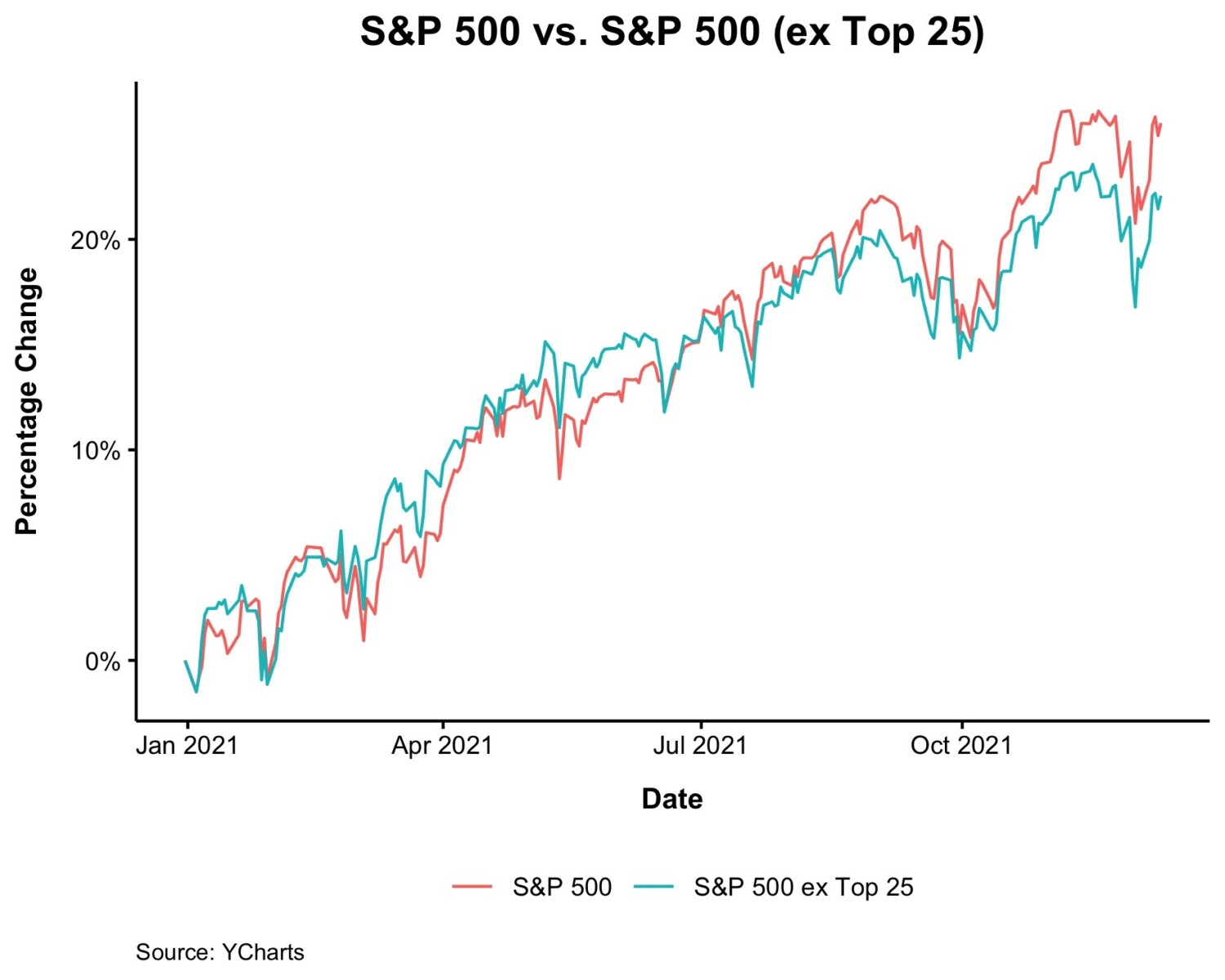

The Top 25 still looks a lot like the Top 5, with somewhat weaker performance, but not all that much.

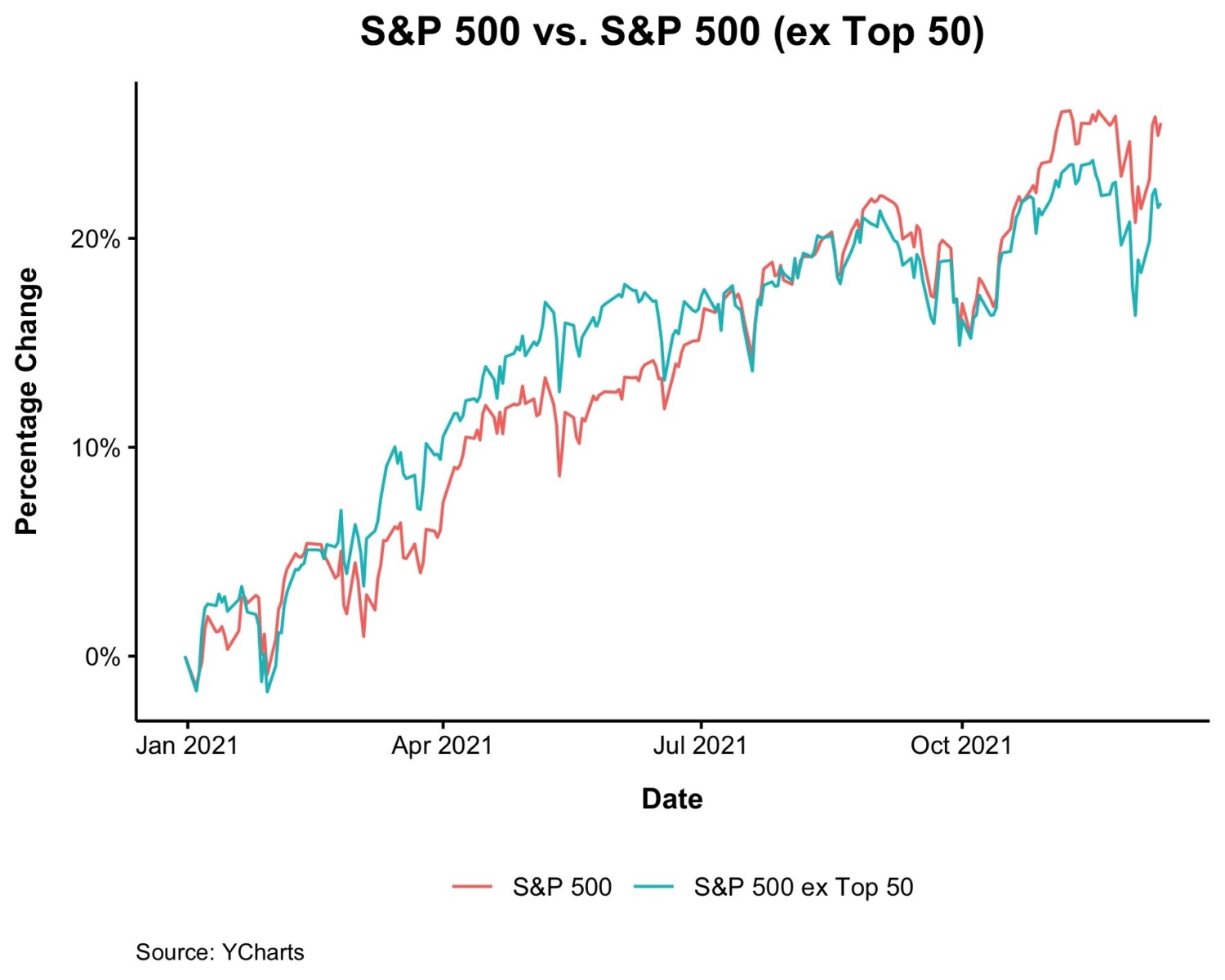

Surprisingly, the Top 50 still looks similar:

It is not until we get to the SPX 100 versus the next 400 names where the big cap tech stock advantage disappears. These two groups essentially perform quite similarly — they are each large indices.

The largest stocks account for most of the gains in the market. This is both fairly typical, but also a causation issue: Most of the biggest winners got that way for a reason. (I’ll discuss this next time out)

Previously:

How to Mislead with Data, Large Company Edition (November 12, 2021)

Criticism of Concentrated Index Risk Are Off Base (August 21, 2020)

So Few Market Winners, So Much Dead Weight (September 26, 2017)

Analysis: Most Stocks Aren’t Good Investments. (September 25, 2017)

Are Too Few Stocks Driving S&P 500? (June 20, 2017)