Since the Great Financial Crisis in 2008-09, the income portion of portfolios has been almost an afterthought. Your checking and savings accounts earned less than 30bps; so too did the cash sitting in your brokerage account. Equities did well, averaging ~14% during the 2010s, but Bonds, not so much.

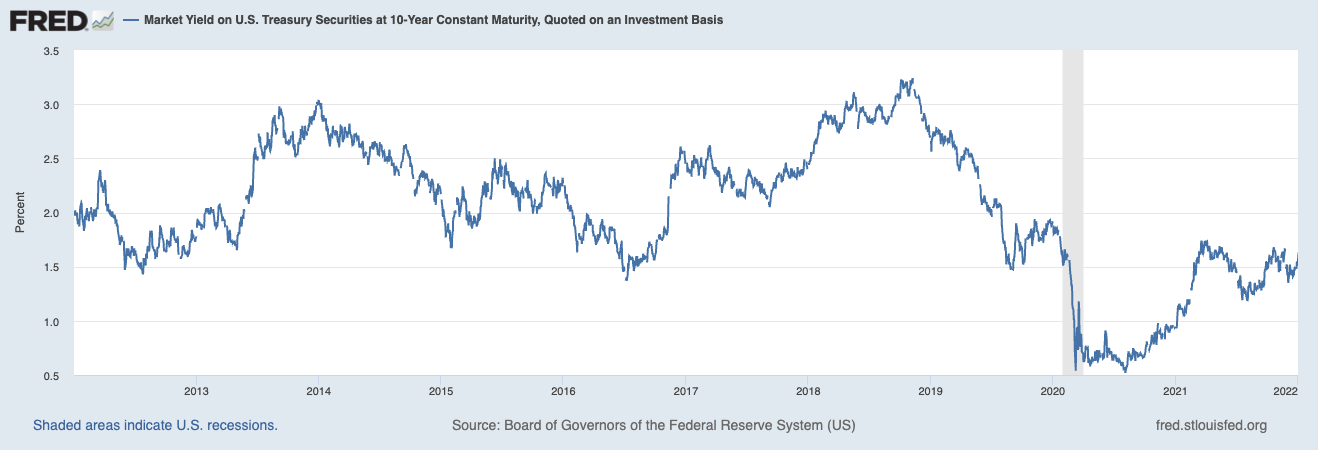

For the decade1 from 2012 to 2022, 10-year Treasuries yielded less than 3% and averaged closer to 2%. Investment grade Corporates gave you a little more, between ~3-4% at somewhat higher risk levels with minimal default rates. Muni bonds were yielding 2-3%, a tax equivalent (depending on the state you lived in and your tax bracket) of ~4-5%. And this was before the 2022-23 rate hiking cycle. That rate-hiking cycle all but guarantees the next decade of equity returns will look nothing like the last decade.

But what the right-hand of higher rates taketh away from equities, the left-hand giveth to fixed income.

As the equity portion of your portfolio moderates — I suggest you lower your return expectations for equities2 to ~5-7% — much of those reduced returns are being made up in fixed income.

Of course, you should never let fear and greed drive your portfolio decisions. How many times have we discussed people increasing stock market exposure late in a bull market or selling stocks as a bear market bottoms? But that is not how things operate on the bond portion of your investments.

Making changes in fixed income is a matter of simple arithmetic, or if you prefer a risk/reward analysis. Are you getting paid a sufficient yield relative to quality (credit risk) and how long (duration risk) you need to tie up that capital? The change in monetary policy has shifted the math dramatically. What was once a mediocre risk — long-duration, high-quality bonds that yielded little — is now much more attractive.

Our investment committee made changes in our fixed-income portfolios to take advantage of higher rates; our advisors have been having conversations with clients about much more attractive options they now have in fixed-income today versus last decade (yes, we like to think in decades when it comes to fixed investing). These conversations should always be ongoing, and relative to your financial plan.

If you have not been thinking about cash management and the yield opportunities the new rate regime has brought, it’s not too late!

In the first week of November, Ritholtz Wealth Management is bringing a big crew to our offices in North Carolina. We are going to be meeting clients, advisors, and other folk we don’t get to see in person all that often. We will be hosting a live event at the Nascar Hall of Fame (I’ll be doing a few hot laps), and broadcasting a live Compound and Friends from Charlotte to raise money for “No Kid Hungry.”

In addition to equities, we will be discussing everything from bespoke municipal bond portfolios to how to assemble a set of fixed-income holdings.

Interested in speaking to us? We will be in town November 5th-8th. There are only a few slots left on the calendar; Send an email to info@ritholtzwealth.com with the subject line “Charlotte”

See you in the Tarheel State!

See also:

Michael Batnick: If You’re Looking for a Change (October 23, 2023)

Josh Brown: There are four million households in North Carolina (October 24, 2023)

Me: RWM is Coming to Charlotte! October 11, 2023

Previously:

Understanding Investing Regime Change (October 25, 2023)

Dollars Are For Spending & Investing, Not Saving (October 20, 2023)

Farewell, TINA (September 28, 2022)

__________

1. I purposefully chose the 10 years prior to the FOMC 500 BPS rate-raising regime.

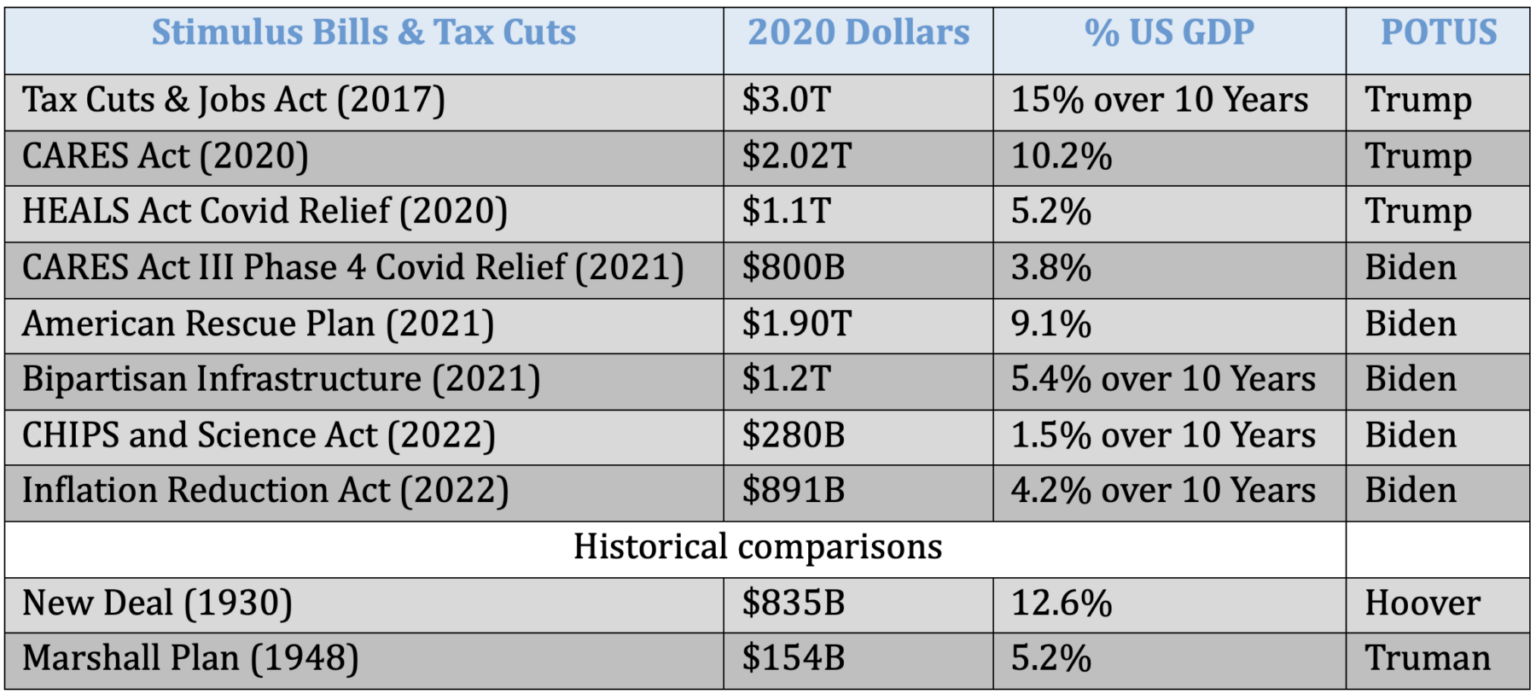

2. As discussed earlier this week, there has been a regime change in the dominant form of government stimulus, shifting from Monetary to Fiscal.

The key takeaways were this fiscal spending will stimulate the economy, but higher interest rates will eventually pressure household spending and corporate earnings, and that is why you should lower your return expectations for equities.